MGTS Qualis Growth: A Strong Start to 2026 as ex-US Markets Lead

Data to 23 January 2026

2026 has begun much as 2025 ended: markets outside the US have taken the lead, supported by improving sentiment, more attractive valuations in select regions, and a rotation in market leadership beyond US mega-cap dominance.

While geopolitical developments remain a key feature of the news cycle, equity markets have generally looked through the headlines so far, delivering a positive start to the year across most regions.

A broad-based start, led by Emerging Markets and Japan

In the opening weeks of January, Emerging Markets and Japan have been stand-out performers. The MSCI Emerging Markets Index returned 6.03%, while Japan’s Nikkei 225 rose 4.45%, reflecting renewed appetite for markets where valuations are often more compelling and earnings expectations remain supportive.

Europe and the UK have also contributed positively. The Euro STOXX 50 has returned 2.60%, while the FTSE 100 rose 2.25%, helped by a more cyclical mix and a market structure that remains less concentrated than the US.

The US has lagged — and UK investors have faced an FX headwind

By contrast, the US has started the year more slowly. For UK-based investors, that relative softness has been amplified by currency moves, with sterling strength and US dollar weakness weighing on returns. In sterling terms, the S&P 500 returned 0.25% over the period.

This is a useful reminder that returns are not just driven by equity market direction, but also by the currency translation effect, particularly when home currency strength moves against overseas exposure.

MGTS Qualis Growth: Outperforming early in 2026

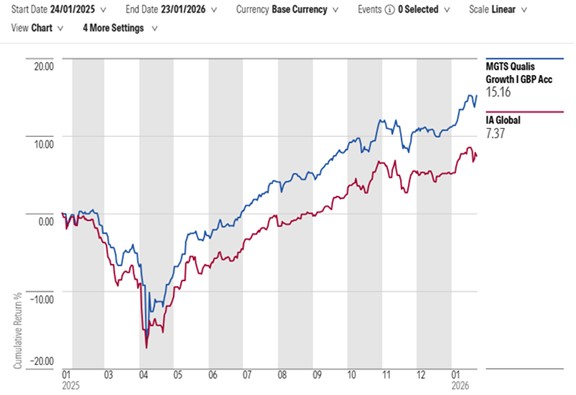

Against this backdrop, MGTS Qualis Growth has delivered a strong start to the year, returning 3.66%, outperforming the IA Global benchmark by 1.27%, and placing the strategy comfortably within the 1st quartile of the peer group both year-to-date and over the past 12 months.

Source: Morningstar – https://www.morningstar.com/

This reflects both market tailwinds in regions that have led early performance and — critically — the portfolio’s positioning. We have maintained our preference for ex-US opportunities over the US, with a meaningful underweight to the US versus the benchmark. In addition, we continue to favour actively managed exposure through managers we believe are best positioned to add value across:

- Emerging Markets

- Japan

- Global equities, with an emphasis on diversification and disciplined risk control

Staying consistent: diversification and active decision-making

Over the past 12 months, MGTS Qualis Growth has returned 15.16%, outperforming the IA Global sector by 7.59%. Importantly, this has not been driven by a single narrow theme, but by maintaining a diversified structure and selecting managers we believe can compound returns through different market environments.

That discipline matters, especially in periods when market leadership rotates quickly and correlations shift.

Looking ahead: constructive, but expect higher volatility

We remain positive on the outlook for the year ahead, but we also expect higher volatility as markets continue to absorb shifting growth expectations, evolving central bank narratives, and geopolitical uncertainty.

Our focus remains unchanged: maintain meaningful diversification, back high-conviction active managers and retain the flexibility to respond as risks and opportunities evolve.

Past performance is not a guide to future returns. The value of investments can fall as well as rise, and investors may not get back the amount invested.

Disclaimer –

This article does not constitute investment advice or an offer to sell or a solicitation of an offer to buy the products described within. You should consult your financial adviser before making any decisions.

Please note that any performance figures are provided for information purposes only and are not to a guide to future returns. The performance of your own investments may deviate due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing.

Important information –

As always with investments, your capital is at risk. The value of investments is not guaranteed and the income from them can fall as well as rise. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole consideration when selecting a product. The basis of taxation may also change from time to time. We have not considered the suitability of these investments against your individual objectives and risk tolerance. This article is intended for information purposes only.

The MGTS Qualis funds are operated by Margetts Fund Management Ltd (MGTS) the Authorised Corporate Director. GWA Asset Management Ltd (GWAAM) has been appointed as the Investment Manager, a wholly owned Greaves West & Ayre Group business. GWAAM is authorised and regulated by the Financial Conduct authority and is entered on the Financial Services Register https://register.fca.org.uk/ under FRN 960226

Margetts have full responsibility for the management and operation of the funds as the Authorised Corporate Director.

Margetts Fund Management Ltd is authorised and regulated by the Financial Conduct Authority no. 208565. More information about MGTS can be found by visiting their website – MGTS (mgtsfunds.com).