MGTS Qualis Growth: 2025 Performance Review — Why Positioning Mattered

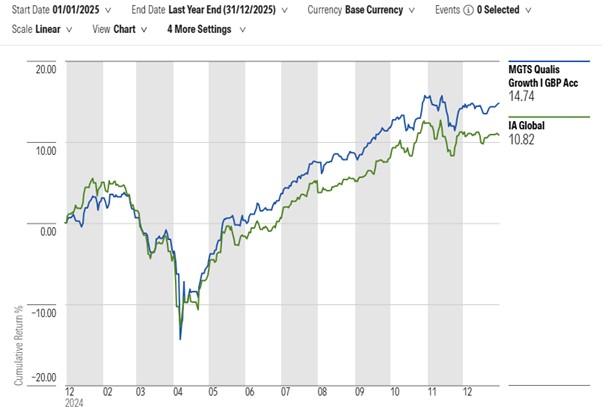

2025 was a strong year for global equities, but it was also a year when where you were invested mattered just as much as being invested. Against that backdrop, MGTS Qualis Growth delivered a return of +14.74% in 2025, outperforming the IA Global sector by +3.92%.

source: Morningstar – https://www.morningstar.com/

This outperformance was driven by a combination of deliberate positioning and disciplined portfolio construction. In short: we sought to avoid overpaying for the most crowded parts of the market and instead focused on regions where the opportunity set looked more attractive.

1) US equity underweight: managing valuation and concentration risk

One of the defining features of global markets in recent years has been the dominance of US equities within major indices. The US remains home to many exceptional companies, but in 2025 it also began the year with elevated valuations and high expectations already embedded in prices.

Our underweight to US equities reflected a view that, while the long-term quality of many US businesses is unquestionable, the starting valuation matters, particularly when index performance can become highly concentrated in a relatively small number of stocks. During 2025, as market performance broadened out beyond the most crowded areas of the market, this positioning supported relative returns.

2) US dollar underweight: reducing FX drag for sterling-based investors

Currency was another important contributor. For sterling-based investors, returns from overseas equities are influenced not only by share price movements, but also by exchange rates. In 2025, the US dollar was not the consistent tailwind it has been in some previous years, meaning unhedged exposure could reduce returns when measured back in sterling.

We maintained a US dollar underweight versus sterling, and importantly, much of our US equity exposure was accessed through sterling-hedged share classes. This is designed to reduce the risk that currency volatility dominates the investor experience. In 2025, it helped protect returns versus strategies with greater unhedged dollar exposure.

3) Overweights to Emerging Markets, China, Europe and Japan: benefitting from a wider opportunity set

While the US remains an important component of global equity portfolios, 2025 also demonstrated that attractive opportunities can emerge outside the most heavily-owned parts of the market.

Our overweight to Emerging Markets, including China, contributed positively. After an extended period of subdued sentiment and weak performance, parts of Emerging Markets offered more compelling valuations and improving fundamentals. In that environment, even modest improvements in expectations can translate into meaningful returns.

We were also overweight Europe, where valuations have typically been more modest than in the US, and where companies can benefit when markets rotate toward sectors and styles that are less dominant in US indices.

Finally, our overweight to Japan was an important contributor. Japan continued to demonstrate improving corporate fundamentals, with increased focus on shareholder returns, corporate governance and capital efficiency. Alongside this, investor interest in Japan has grown as the region has re-emerged as a credible source of diversified equity returns rather than simply a cyclical trade. In 2025, this helped support performance.

Looking ahead

The key lesson from 2025 is a familiar one: global equity investing is not only about market direction, but also about portfolio structure, valuation discipline, and currency-aware implementation. Our goal remains to deliver long-term growth while avoiding unintended concentration risks and ensuring the portfolio remains diversified across regions and opportunities.

Past performance is not a guide to future returns. The value of investments can fall as well as rise, and investors may not get back the amount invested.

Disclaimer –

This article does not constitute investment advice or an offer to sell or a solicitation of an offer to buy the products described within. You should consult your financial adviser before making any decisions.

Please note that any performance figures are provided for information purposes only and are not to a guide to future returns. The performance of your own investments may deviate due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing.

Important information –

As always with investments, your capital is at risk. The value of investments is not guaranteed and the income from them can fall as well as rise. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole consideration when selecting a product. The basis of taxation may also change from time to time. We have not considered the suitability of these investments against your individual objectives and risk tolerance. This article is intended for information purposes only.

The MGTS Qualis funds are operated by Margetts Fund Management Ltd (MGTS) the Authorised Corporate Director. GWA Asset Management Ltd (GWAAM) has been appointed as the Investment Manager, a wholly owned Greaves West & Ayre Group business. GWAAM is authorised and regulated by the Financial Conduct authority and is entered on the Financial Services Register https://register.fca.org.uk/ under FRN 960226

Margetts have full responsibility for the management and operation of the funds as the Authorised Corporate Director.

Margetts Fund Management Ltd is authorised and regulated by the Financial Conduct Authority no. 208565. More information about MGTS can be found by visiting their website – MGTS (mgtsfunds.com).