Market Commentary – 5 December 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Bull Market Continues

- Stock markets have risen by 17% this year (MSCI World Index).

- Bond markets have gained almost 8% (Bloomberg Global Aggregate Index).

- UK stocks survived the Autumn Budget and have risen slightly since the Chancellor’s announcements.

Key Themes

Stocks had a small dip in November, before recovering back towards their previous highs. The longest US government shutdown in history had a negative effect, before coming to an abrupt end and allowing stocks to rally.1 Investor sentiment also whipsawed in line with changing interest rate expectations and speculation over the UK budget. Meanwhile, many people have expressed unease over the high valuations and runaway capital expenditure in the Artificial Intelligence (AI) industry. In short, after more than six months of strong gains, market conditions appear to have entered a state of flux.

UK

The current government seems determined to turn the nation’s budget-setting process into an annual exercise of economic fearmongering, with harmful speculation running unchallenged and policies being touted and then dropped within days. For the second year in a row, UK stocks declined on a wave of worry in the weeks before the budget, before steadying themselves after the announcement itself. Banks rose after escaping further levies, while Rank Group gained 12% as bingo duty was abolished.2 All told, markets reacted quite indifferently – as though the measures weren’t worth the level of noise associated with the process.

United States

The likelihood of the US Federal Reserve cutting interest rates at its next meeting on 10 December has swung from a near certainty to very unlikely, and back to a near certainty again.3 Such ambiguity over the “cost of money” tends to increase the volatility of asset prices and was a major factor in the US stock market’s 5% dip and subsequent bounce.

US private sector employment experienced the worst decline since early 2023 last month, but markets are seeing bad news as good news for now, as that simply increases the chances of a rate cut.4 President Trump will soon nominate a new Fed Chairperson, to take over from Jerome Powell when his term ends in May. Many investors are hoping for a candidate who will follow Trump’s desire for drastic rate cuts, to provide a further boost to stocks.

Europe

European defence stocks gave back some of their 2025 gains by declining more than 10% in the past month, as peace talks have intensified in relation to the war in Ukraine.5 Airbus shares were also marked down slightly, as much of its fleet was temporarily grounded to fix a software bug.6 In a wider context the Eurozone appears to have tamed inflation, which now stands at 2.2%, and GDP growth is fairly average at 1.4%. In other words, economic conditions on the continent appear very benign, absent any surprises. The Spanish IBEX index has been a standout performer this year, gaining 48%.

Asia & Emerging Markets

Japan is experiencing a bout of currency devaluation and rising government bond yields. This is usually seen as a concerning combination. It has also caused some commentators to liken the country’s first female Prime Minister to Liz Truss due to her plans to increase deficit spending, when comparisons to Margaret Thatcher were far more common upon her election just six weeks ago.7 The local stock market appears to be navigating the situation quite calmly so far, performing similarly to other developed markets in sterling terms.

Bonds

Japanese Government Bonds have long been renowned for having the lowest yields across the G7 developed economies. As their yields now rise, it places pressure on the government bonds issued by other nations. It also creates chatter about the potential unwinding of global “carry trades”, where institutions have borrowed from Japan at cheap rates to invest in higher yielding opportunities elsewhere.8 The extent to which Japan provides cheap fuel for global markets is often debated, but the sudden selloff of August 2024 provides a warning against complacency – that carry trade unwind caused global stock markets to drop 6.5% in only three trading days.

Points of Interest

Bitcoin has experienced a decline of 33% in little over a month, showing an unusually large divergence from gold and technology stocks which have remained firm. Such a fall has contributed to the emergence of nervous sentiment among investors. The Fear & Greed Index has remained in fear for several weeks, for the first time since the major low in April.9 Some would say this is a positive sign, as it shows there is no sign of “irrational exuberance” in the system.

Summary

Market conditions are fairly normal, and this remains a bull market. It is often said that stocks climb a wall of worry. Such worries are clearly evident right now and have caused stocks to pause for breath, after marching higher for several months. 2025 looks poised to go down in the record books as a good year, whether December is positive or negative. Bonds continue to offer attractive yields, offering some protection against any stock market downturn, if one was to emerge.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online here, or provided on request.

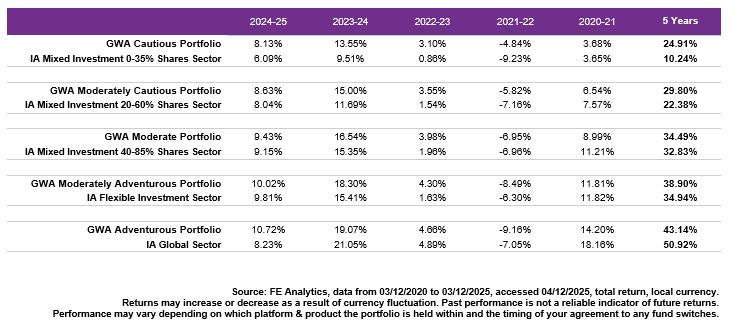

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

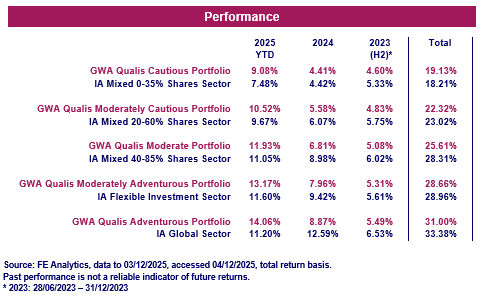

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk.