Global Market Commentary – June 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

The Bulls Take Charge

- Stock markets (MSCI World Index) gained 6.6% in the first half of 2025

- Bond markets (Bloomberg Global Aggregate Index) have risen by 7.3%

- There has been a strong rally since April – can it continue?

Key Themes

The US stock market has reached a new all-time high, with the UK and German markets very close to their own peaks. Investors are now bullish after President Trump softened his trade tariffs, with interest rate cuts and an expansionary US budget coming down the line. Inflation has moderated. Employment has softened, but not too much. Altogether, the environment for stocks appears positive and has led to good gains in recent weeks.

UK

Markets didn’t appreciate signs of frailty within the UK government during the debate on welfare reforms. The FTSE 250 dropped 1.3% on the day, with the pound also down and gilt yields up. However, this is a small blip in an otherwise positive trend. UK stocks have done better than most developed markets this year and there have been plenty of big winners. The defence sector has been particularly strong, with Babcock (+114%), Rolls-Royce (+66%) and BAE Systems (+61%) showing huge six-month gains as European governments promise to ramp-up their military spending.

United States

The US was the poorest performing region from the date of Trump’s inauguration until he was forced to abandon his Liberation Day trade policies in the face of opposition from financial markets. Elon Musk’s Department of Government Efficiency (DOGE) has also failed to cut significant amounts from government spending. Now that tariffs and DOGE are in the rear-view mirror, US stocks are rallying hard with tech firms back in the ascendancy. NVIDIA reached a new high and could soon become the world’s first company to achieve a $4 trillion valuation. For context, that is slightly more than UK GDP.1

Europe

The Euro Stoxx 50 index rose 14% in the first half of 2025, with Santander (+59%) the top performer. Large banks are enjoying a re-rating following the normalisation of interest rates. The “zero interest rate period” of 2009-2021 saw them valued at steep discounts to their book value (assets minus liabilities). With interest rates now higher, profitability has increased markedly and valuations are adjusting fast in order to catch up. UK-listed Lloyds (+28%) and NatWest (+17%) have continued to rise this year, while some smaller lenders have more than doubled.

Asia & Emerging Markets

The Far East has generated few headlines in recent weeks. Japanese and Chinese stocks have moved largely sideways in GBP terms, with little change in economic data or government policies. However, Latin America has come to life this year with the MSCI Brazil and MSCI Mexico indices gaining almost 20% in GBP terms.

Bonds

The annualised yield on a 10-year UK gilt remains relatively stable at 4.57% currently, broadly similar to the 10-year US treasury bond. Meanwhile, higher yielding corporate bonds continue to deliver strong returns, although default rates have edged up slightly. Thames Water recently defaulted on its debt, while Pizza Express and online retailer Very have been added to Fitch’s “concern” list due to their stretched finances.2

Points of Interest

Sharp recoveries in the stock market tend to be very rare, but also very powerful. The S&P 500 has just reached a new 1-year high within 3 months of an 18% decline. This has only happened seven times previously, in the last 100 years. On each of those occasions the market was even higher after 12 months, gaining another 21% on average.3 All told, the recent price action appears to be a very bullish signal indeed.

Oil prices experienced significant turbulence during the conflict between Isreal and Iran. Brent crude started the month at $63 per barrel – close to a four-year low – on oversupply concerns. The threat to middle east production and shipping lanes created an almost 30% price spike to $81, it has now settled in the high-60s following a ceasefire agreement. If the Strait of Hormuz had been closed, some analysts expected oil to trade above $100.4

Summary

2025 is proving to be a case study for those who believe time in the market is more important than timing the market. Successfully navigating the April decline and sharp V-shaped recovery through active trading would have taken exceptional skill and Yoda-like foresight. Those who slept through the whole thing would have checked their portfolio to find fairly normal gains. Stocks are drifting higher, like they usually do. Events can and will happen to divert them from that path, but such diversion is typically temporary. As some traders like to say, “pessimists sound smart, but optimists retire on beaches”. It’s an apt thought as we enter the holiday season.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online HERE, or provided on request

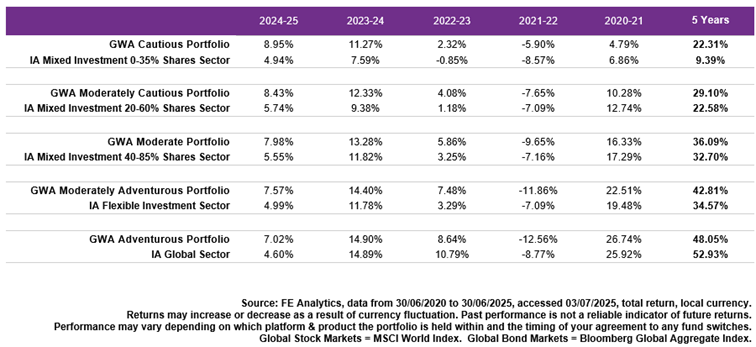

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

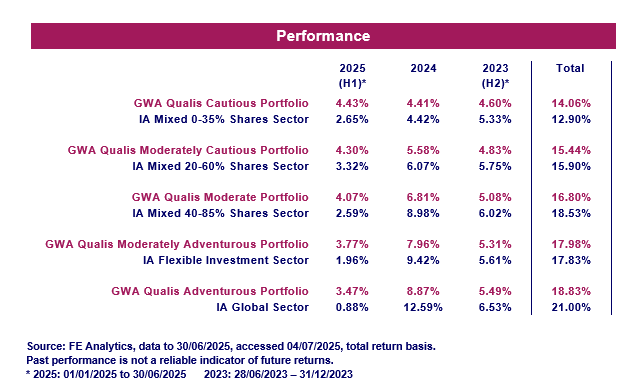

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk