Global Market Commentary – August 2023

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Most of August felt like a return to 2022, with the US Dollar Index strengthening considerably (+4%) and signaling a risk-off move which has seen stocks and bonds decline together. However, the final few trading days saw material gains as inflation, employment and savings data suggested the overheating US economy may be cooling down. Investors are keen to see the end of interest rate hikes and a return to stable financial conditions.

A Pause for Breath

- The global stock market (MSCI World Index) declined 1.8% in August but has risen 16.4% this year

- The bond market (Bloomberg Global Aggregate Index) declined 0.1% in August but has risen 2.9% this year

- Recent data suggests inflation is moderating and interest rate hikes may be nearing an end

UK

UK stocks declined 2%-3% during the month, with large-cap indices and small-cap indices performing similarly to each other. The UK remains a laggard among developed equity markets year-to-date, with the FTSE All-Share up only 2.7%. AIM remains stuck in the depths of its bear market and is down 9.7% for the year. Despite high inflation and a housing market slowdown, business confidence surveys have turned upwards for the first time in nearly two years and GDP rose 0.2% in Q2.

United States

US technology stocks have led the way in 2023 (+35%) but could not escape this month’s pullback, with the main US equity indices experiencing modest declines of 1.5%-2%. It was a turbulent ride, however, with the Nasdaq down 7% at one point. US small caps reversed most of their July gains as they dropped by 5%. August is typically the quietest month of the year, with very low trading volumes creating a vacuum where prices move quickly on little news. As traders return to their desks following summer breaks, a clearer sense of market direction often becomes evident.

Europe

European equities performed similarly to their UK and US counterparts during the month and the existing trends within Europe also remained intact, with France, Italy and Spain performing markedly better than the traditional economic powerhouse of Germany. Germany reported the deepest contraction in business activity within the Eurozone for the month of August and the European Central Bank is expected to leave interest rates unchanged, as it steps back to assess the impact of its recent rate hikes on the real economy. In a reversal of fortune, analysts are beginning to question whether the Mittelstand manufacturing heartland is losing its edge and whether Germany itself may be the new ‘sick man of Europe’.

Japan

Japan has fared well this year with a return of 24% so far from its Topix stock market index. It also held up best among developed markets in August, declining only 0.4%. The Japanese yen has been declining versus the pound and US dollar since the beginning of 2020 and that decline has done nothing but accelerate in 2023. The Japanese central bank’s efforts to keep interest rates and bond yields at ultra-low levels has taken its toll on the currency, but the local stock market has been appreciative.

Emerging Markets

All eyes have been on China as each passing data point highlights the depths of its economic malaise. Seen as the engine of global economic growth during the previous two decades, that narrative is now shifting. Western investors are currently waiting to see if Chinese officials are able to muster significant economic stimulus in the face of a property bubble collapse and a decline in consumer spending. The yuan has slumped to its lowest level in 16 years and the Shanghai stock market fell 5.4% during August, with Hong Kong down a hefty 8.2%.

Bonds

August proved a mirror image of the previous month in the bond market. Volatility remained elevated as government bond yields marched upwards (prices lower) mid-month, before reversing course and ending the period roughly flat. Investors holding a US 10-Year Treasury Bond experienced significant total return losses in 2021 (-4.4%) and 2022 (-17.8%) and are also slightly underwater so far in 2023. If there were to be three consecutive years of losses, it would be the first time in over 100 years.

Points of Interest

It was earnings season among US mega-caps. Apple produced lacklustre results on 3 August and the stock price slid more than 10% in the days that followed, as revenue declined for the third quarter in a row. Before the announcement, Apple made up 5% of the MSCI World stock market index and traded on 30x forward earnings estimates, following a 55% appreciation in its share price since January. Such sky-high valuations and index concentration carry considerable risks, and this was a reminder. Despite the decline, Apple is still worth more than the entire UK stock market.

On the other hand, chipmaker Nvidia closed the month with stellar results on 24 August. Revenue more than doubled from last year as a result of the Artificial Intelligence investment boom, with half-year profits almost quadrupling. US stocks now account for 70% of the global index – a level that is unprecedented historically – largely due to these 1-trillion-dollar tech titans which include Microsoft, Google and Amazon.

Summary

August ends with the cool breeze of autumn beginning to emerge and the financial markets certainly felt a chill this month. Thankfully, they quickly recovered their composure. Looking forward, September is often the most volatile month of the year but looking further out, seasonality typically favours the winter months – at least according to the old market adage ‘Sell in May and don’t return until St Ledger’s Day’. For those not familiar with the racing calendar, that falls on 16 September this year.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

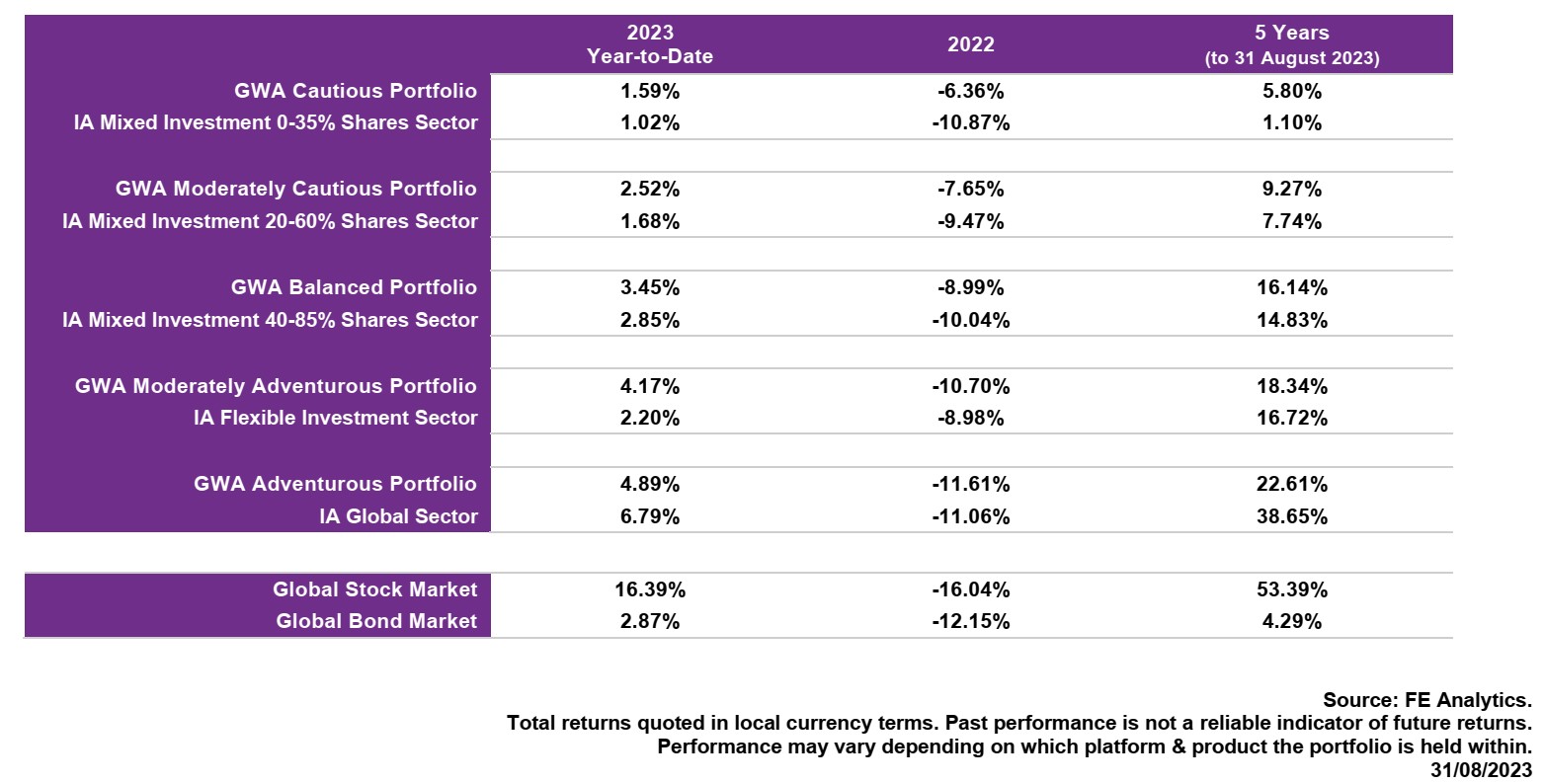

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

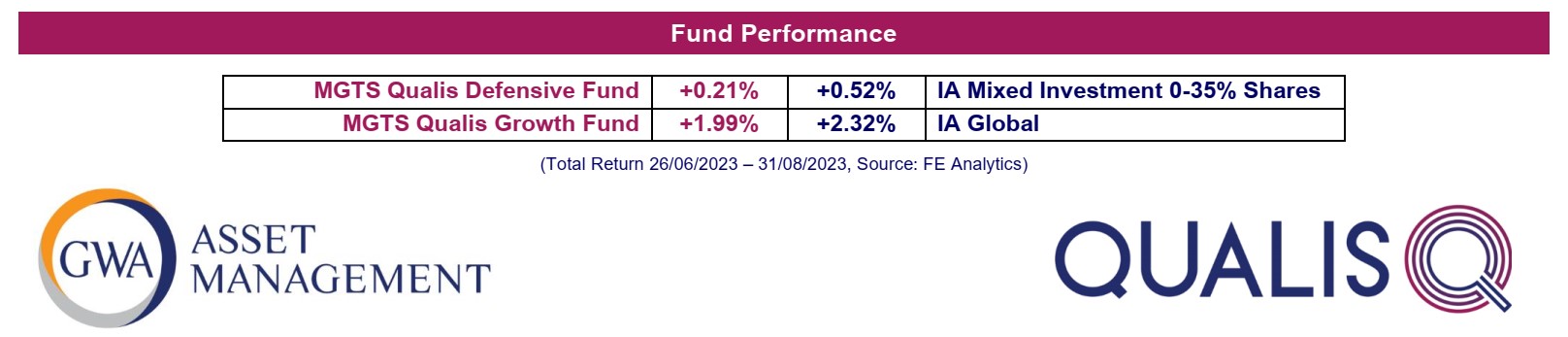

MGTS QUALIS FUNDS

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

We are pleased to report the successful launch of the MGTS Qualis Funds in June 2023.

The funds are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and is currently invested mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commercial property, commodities, alternative assets and cash. The fund does not hold any equities. The fund is currently focused on seeking a positive return while managing interest rate risk.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has an overweight position in Japan. The fund recently reduced its exposure to semiconductor stocks and increased its allocation to smaller companies in the US and UK.