Global Market Commentary – April 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Relief Rally: All-Clear or Market Myopia?

- Stock markets (MSCI World Index) dropped 10% in April, before recovering strongly to end broadly flat

- Bond markets (Bloomberg Global Aggregate Index) rose and have now gained 5% this year

- Trump’s tariff concessions have led to optimism, but economic data could still weaken from here

Key Themes

April 2025 was a historic month for stock markets, which declined rapidly upon President Trump’s announcement of huge international trade tariffs, then rose almost as quickly when he reined back on them. The Federal Reserve is reluctant to cut interest rates with the inflation outlook so uncertain, although the Bank of England did cut yesterday and is expected to do so again in coming months. The question now is whether the real economy has been damaged by tariffs, both in the US and globally, and how persistent that damage may be.

UK

UK stocks have outperformed their US counterparts this year, and April ended with the FTSE 100 rising for fifteen days in a row to mark its longest ever winning streak.1 However, it remains slightly below its all-time high from 3rd March. The FTSE 250 and Small Cap indices are roughly 15% below their previous highs, set back in 2021, but have also shown strong momentum in recent weeks.

In stock-specific news, the Competition and Markets Authority gave an update on its investigation into the cost of veterinary services. Investors assessed the content to be fairly benign and unlikely to impact future profitability.2 Shares in vets group CVS rose 14% on the day and Pets at Home also gained, with almost half of its profits coming from its veterinary group.3 Elsewhere, Deliveroo was snapped up by its more highly-valued US rival, DoorDash.4

United States

Trump’s first 100 days has passed with the worst stock market performance of any presidential term since Gerald Ford in 1974.5 His “Liberation Day” trade tariffs caused US stocks to decline more than 10% in two days at the start of April – something only witnessed during the 2008 Financial Crisis and March 2020 covid shutdown, since the millennium.6

The market may have staged a nice recovery after tariff rates were reduced – helped by strong earnings from Microsoft and Facebook8 – but a number of forward-looking indicators would warn against complacency. The odds of a 2025 recession remain elevated and there is speculation that empty shelves may be seen in US stores, with Chinese container bookings down 50% and threatening to cause layoffs across the transportation and supply chain.9,10

Europe

European stocks have been a relative bright spot this year, with the STOXX 50 index rising 11% in sterling terms. The German government has approved a massive spending plan focused on defence, national infrastructure and climate initiatives. The German DAX index has gained 19% this year as a result, with the IMF forecasting a long-term boost to economic growth.11

Asia & Emerging Markets

The Japanese stock market remains fairly subdued: down very slightly this year, despite ongoing attempts to make improvements in the corporate governance and capital structure of major firms, which has led to record levels of share buybacks.12

Emerging markets have had positive returns, led by Mexico, Hong Kong and Brazil. Mexico currently has the benefit of avoiding tariffs on exports covered by the United States-Mexico-Canada Agreement which Trump established in his first term.13

Bonds

The Bank of England (BOE) may have reduced its base rate from 5.25% to 4.25% since last July, but government bond yields have actually risen slightly during that time. 10-year gilts currently yield 4.65% and have remained close to that level for six months. Therefore, there appears to be no guarantee that mortgage rates will drop to the same extent as short-term savings rates, if the BOE makes further rate cuts. The bond market is focused on long-term growth and inflation expectations and both are highly uncertain, given the current state of international affairs and government finances.

Points of Interest

Oil has experienced its largest monthly decline since 2021, with a barrel of brent crude currently trading at $62 compared to $82 in January (-24%). The US-China trade war and higher OPEC+ production have both had an effect.14 However, the difference doesn’t appear to have been reflected on petrol station forecourts, just yet.

The US dollar has not recovered in the same way as the stock market in recent weeks. The Dollar Index has declined 9% in three months and many institutions are expecting further weakness, to make US exports more competitive and support Trump’s pro-manufacturing agenda.

Summary

Financial markets are said to hate uncertainty, but April may have shown that plain old bad news (high tariffs) is much worse than a wide range of possible outcomes (messy negotiations). The relief rally of the past few weeks has approached record proportions. Looking forward, there are valid arguments to be made by both optimists and pessimists. However, we should remember that true stock market crashes are only caused by very large problems and are infrequent in nature (2000, 2008, 2020). For the rest of the time, stocks tend to reward those who remain steadfast amidst the noise.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online HERE, or provided on request

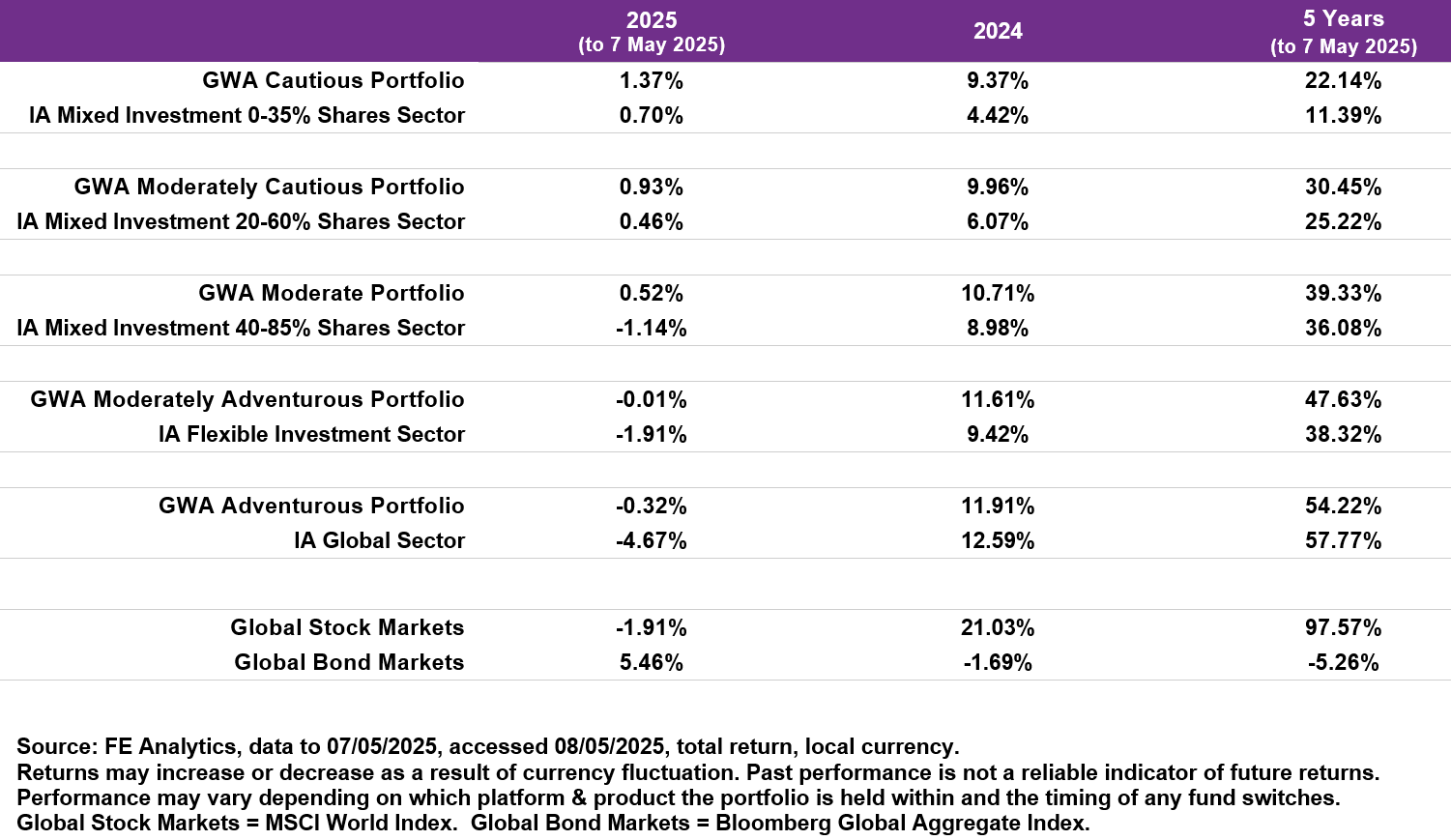

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

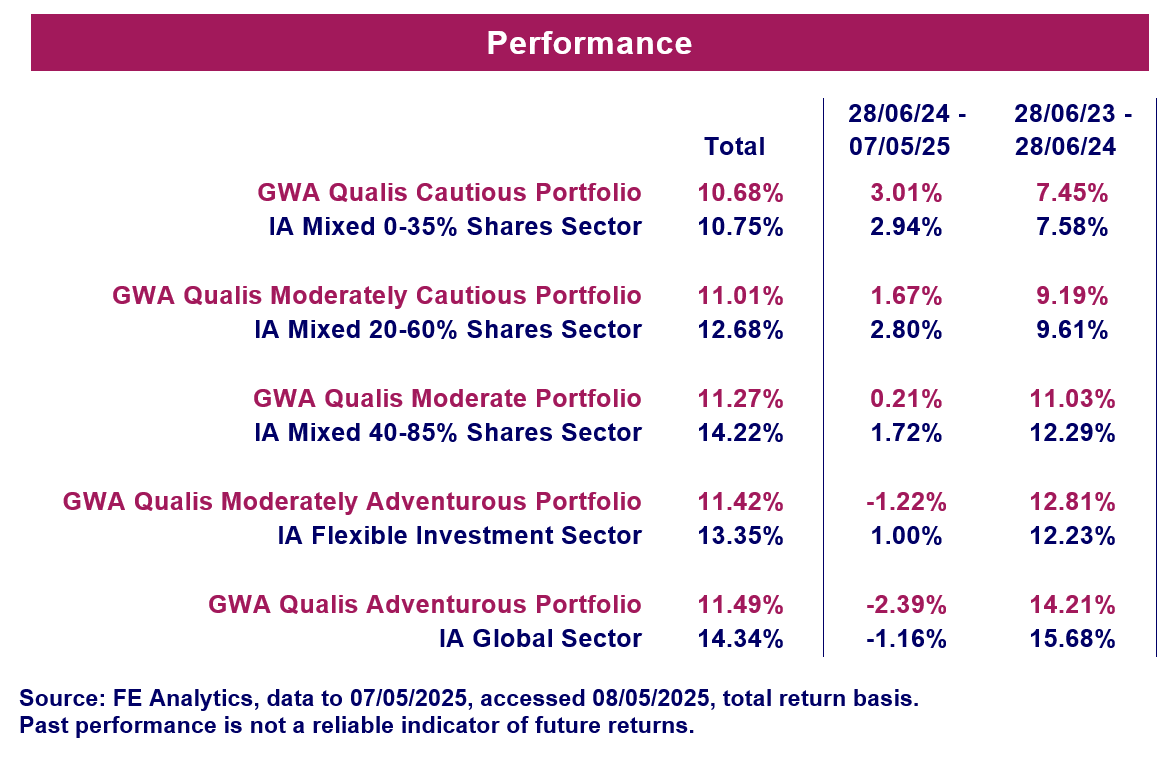

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk