MGTS Qualis Defensive: A Strong Start to 2026 as Volatility Returns

Data to 23 January 2026

Bond markets have started 2026 in a way that total return investors will recognise: income has been supportive, but price moves have been choppy, driven by shifting rate expectations and periodic risk-on/risk-off swings. After a strong year for many risk assets in 2025, markets have entered the New Year with a greater sensitivity to inflation surprises, central bank messaging, and changes in expected timing of rate cuts.

Bond price action: duration remains the key driver

In the opening weeks of the year, yields have edged higher across major markets, which has mechanically translated into lower bond prices, particularly in longer-duration parts of the curve. This has been most visible in the US, where the 10-year Treasury yield has traded around the mid-4% area and briefly spiked to roughly 4.29% during a sharp sell-off in January. Moves like this reinforce a simple reality for bond investors: duration remains the dominant source of volatility.

The UK has seen a similar dynamic. Ten-year gilt yields have risen back towards 4.5%, and the intra-month swings have been a reminder that even modest changes in rate expectations can create meaningful price moves, especially when markets reassess how quickly inflation will fall and how much policy easing can be delivered.

Overall, the Bloomberg Global Aggregate Bond Index is down 0.70% in the early weeks of 2026. This highlights that, once again, simply “owning duration” isn’t automatically the consensus trade it can appear to be, particularly when rate volatility remains elevated.

MGTS Qualis Defensive: delivering resilient total returns

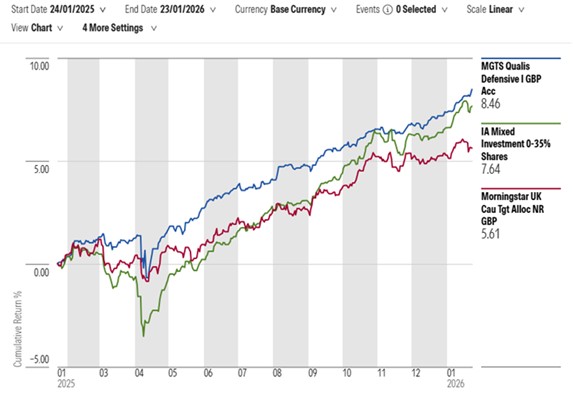

Against this backdrop, MGTS Qualis Defensive has begun 2026 positively, returning 1.04%, and outperforming the IA Mixed Investment 0–35% Shares sector benchmark by 0.05%. Crucially, this outcome has been achieved with the lowest drawdown in the sector at just 0.06%, ensuring investors have experienced a return profile that remains consistent with the strategy’s defensive objectives.

Source: Morningstar – https://www.morningstar.com/

This is exactly the environment the fund is designed for: markets can move quickly, correlations can shift, and bond price action can become unsettled, but the goal remains the same: deliver steady progress while keeping volatility and drawdowns tightly controlled.

What’s driving performance so far in 2026?

Performance year-to-date has been generated through a carefully curated portfolio of diverse active managers, selected to complement one another and deliver both capital growth and minimal volatility, without requiring investors to take on long equity risk.

Within the bond allocation, the standout contributor has been Man Global Credit Value, the newest addition to the fund (October 2025), delivering 0.91% year-to-date.

The most significant returns have come from the alternatives allocation. YFS Argonaut Absolute Return has delivered 4.65%, while YFS Kernow Equity Navigator has returned 4.81%, reinforcing the role that diversifying return sources can play when traditional asset classes experience periods of unsettled pricing.

Looking ahead: constructive, with volatility likely to persist

We remain constructive on the outlook for the year ahead, but we also expect higher volatility as markets continue to absorb evolving growth expectations, changing central-bank narratives, and geopolitical uncertainty.

Our focus remains unchanged: maintain meaningful diversification, back high-conviction active managers, and retain the flexibility to respond as risks and opportunities evolve.

Past performance is not a guide to future returns. The value of investments can fall as well as rise, and investors may not get back the amount invested.

Disclaimer –

This article does not constitute investment advice or an offer to sell or a solicitation of an offer to buy the products described within. You should consult your financial adviser before making any decisions.

Please note that any performance figures are provided for information purposes only and are not to a guide to future returns. The performance of your own investments may deviate due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing.

Important information –

As always with investments, your capital is at risk. The value of investments is not guaranteed and the income from them can fall as well as rise. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole consideration when selecting a product. The basis of taxation may also change from time to time. We have not considered the suitability of these investments against your individual objectives and risk tolerance. This article is intended for information purposes only.

The MGTS Qualis funds are operated by Margetts Fund Management Ltd (MGTS) the Authorised Corporate Director. GWA Asset Management Ltd (GWAAM) has been appointed as the Investment Manager, a wholly owned Greaves West & Ayre Group business. GWAAM is authorised and regulated by the Financial Conduct authority and is entered on the Financial Services Register https://register.fca.org.uk/ under FRN 960226

Margetts have full responsibility for the management and operation of the funds as the Authorised Corporate Director.

Margetts Fund Management Ltd is authorised and regulated by the Financial Conduct Authority no. 208565. More information about MGTS can be found by visiting their website – MGTS (mgtsfunds.com).