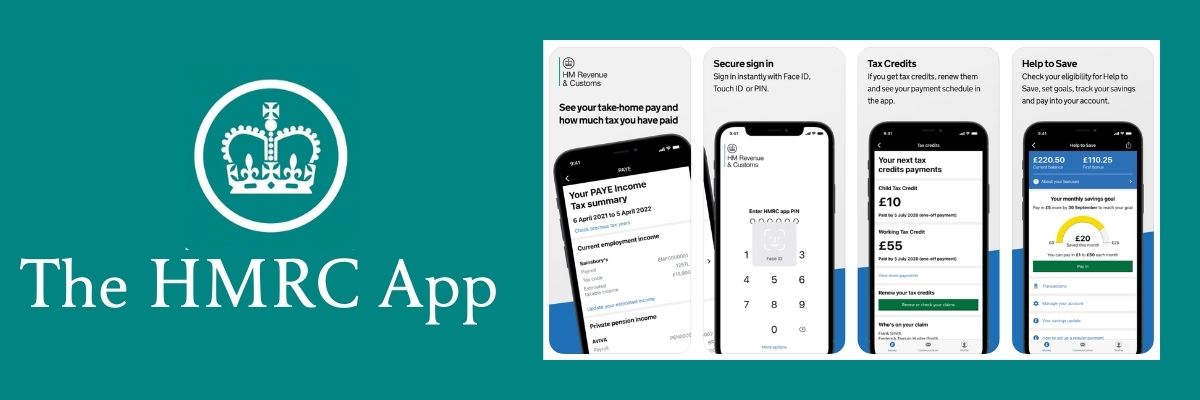

The HMRC App

Did you know that there is a HMRC app which provides you with a quick and easy way to access your personal tax information using a mobile device such as a smartphone or tablet?

You can use the app to view your tax code, National Insurance (NI) number and Unique Taxpayer Reference (UTR) for Self-assessment on the move. You can also use it to estimate how much tax you will have to pay, manage your tax credits and access your Help to Save account.

The app also enables you to perform tasks such as tracking forms and letters you’ve sent, updating personal details such as your postal address and using the HMRC’s calculator to work out your take home pay after tax and NI.

Previously this would have required logging on to a computer, if not a lengthy phone call to HMRC.

The app is free to download from either the App Store for iOS or the Google Play Store for Android. Users will need their Government Gateway User ID and password when signing in for the first time. If you don’t have these already, you will need to go to the Government Gateway website and register as an individual.

Full details can be found at gov.uk/government/publications/the-official-hmrc-app