Global Stock Markets – What’s Happening?

It was not that long ago when Brexit and the uncertainty associated with our departure from the European Union was the primary topic on the mind of UK investors. Although Brexit had a notable impact on domestic stock markets, its effect pales in comparison to that created by the COVID-19 pandemic, which has brought the longest bull-market in history to a dramatic end.

To put this in context, the FTSE All World – which monitors the price movements of some 3,100 companies in 47 countries – has shed in excess of -20% in the period 19 February 2020 to date.

Why Have Stock Markets Fallen so Significantly?

In answering this, it is perhaps useful to consider what stock markets actually reflect – namely investors’ expectations of companies’ future earnings.

When investors are collectively optimistic about company prospects, they bid the price up. When they become nervous, expecting slower or negative growth, demand for the company’s shares lessens and the price falls. When widespread panic ensues, markets may crash.

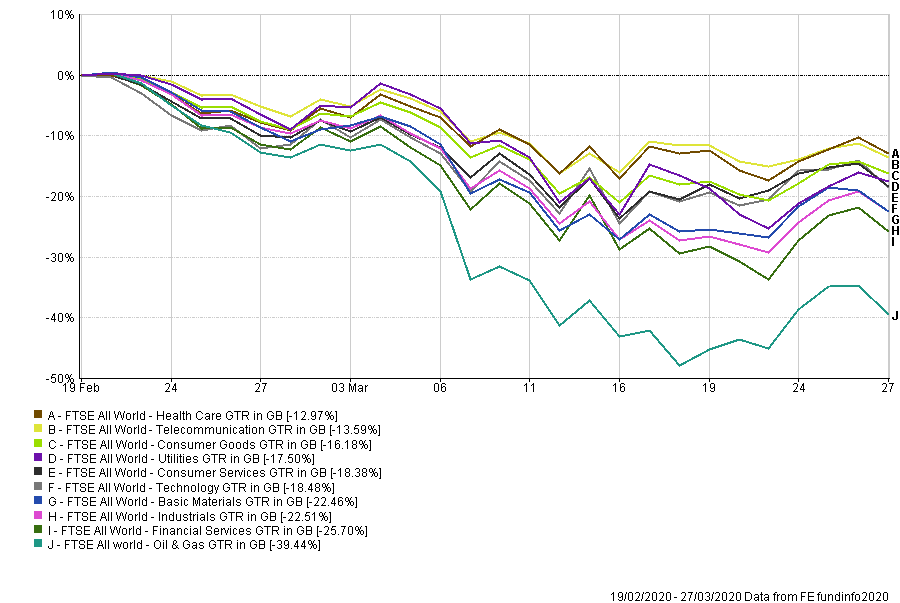

The COVID-19 pandemic and its related quarantine measures are expected to be detrimental for the revenues and profits of many businesses. Whilst travel and leisure companies are the obvious companies at risk, the knock-on effect may be felt across many sectors. Some companies may benefit, but are few and far between.

However, it is not only COVID-19 to blame: oil prices have played their part in recent volatility. A price war between Saudi Arabia and Russia has caused oil prices to plunge in recent weeks, placing significant pressure on major energy companies. As sizeable components of major global markets, any downward trend in the stocks of these companies can make a considerable impact.

Which Market is the Worst?

No major market has escaped volatility since the falls began on 20 February 2020, though some have fared better than others. In light of the very short period being assessed, the following information should be treated with caution and be in no way considered an investment recommendation.

Source: FE Analytics, 19 February 2020 – 27 March 2020. Past performance is not a guide of future returns.

The FTSE All World has fallen by in excess of -20% over one month. The Asia Pacific basin region (including Japan) has been lesser affected. The Chinese market has held up favourably to every other major market. In both of these cases, this may be attributable to more stringent quarantines and travel restrictions, coupled with lower growth expectations prior to the COVID-19 outbreak.

Western markets have borne the brunt of the pandemic thus far, which is represented in the -23% drop in the FTSE Developed Europe market.

Prior to the outbreak, the growth expectations of US companies were significantly above the rest of the world. As these expectations are not likely to now be met, markets responded with an indiscriminate sell-off. This led to the Dow Jones Industrial Average, at its worst point, falling by 28% in the space of a month. However, following the enormous US Government stimulus package, investor interest was reignited to a certain extent. As a result, the Dow Jones has clawed back +5% from its trough (at the time of writing).

The worst affected market so far is the UK, the FTSE All Share having fallen by -27%. Prior to the US stimulus package announcement, the index was off -34%. A major reason for this fall is that companies that form the most sizeable positions within the index are oil and gas companies, which have been amongst the worst performers amidst recent volatility.

Industry Performance

Source: FE Analytics, 19 February 2020 – 27 March 2020. Past performance is not a guide of future returns.

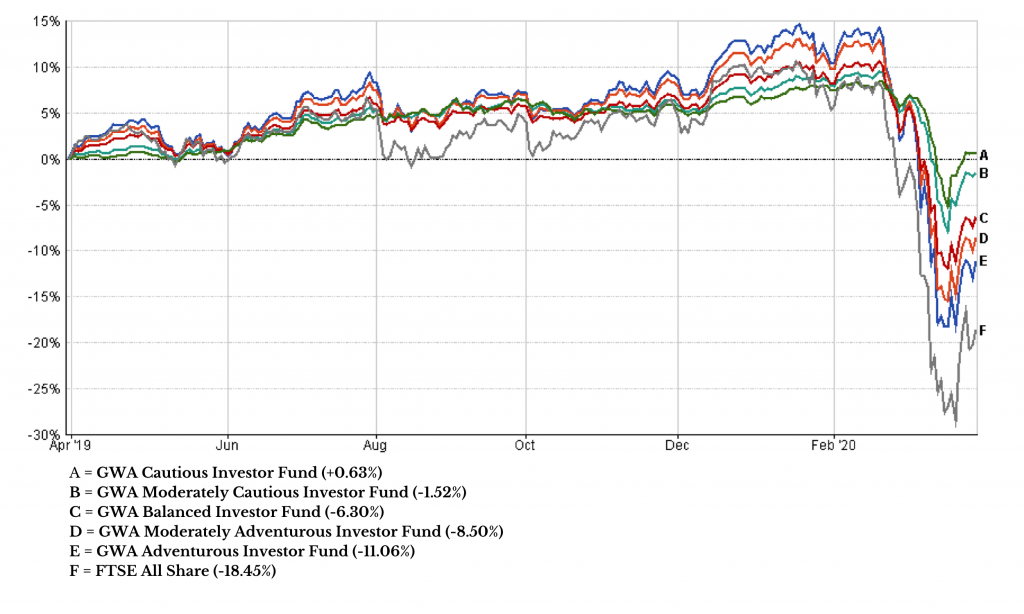

Greaves West & Ayre Portfolios

Finally we just want to share with you the performance of our portfolios over the past year which, as we have noted above, was going well until February 2020.

We manage five stock market-based portfolios in which you can invest, depending on your attitude to risk and appetite for loss. These range from ‘Cautious’ to ‘Adventurous’, the former exposing investors to less risk, whilst the latter exposes investors to potentially larger losses and gains.

The performances of each of the five funds are shown graphically below (A being Cautious – to E being Adventurous). We have also shown the performance of the stock market FTSE All Share Index (which has shown a 20% fall) for the same 12-month period.

Source: FE Analytics, 1 April 2019 2020 – 1 April 2020. Past performance is not a guide of future returns.

Whilst our portfolios have not been immune to the recent turbulence, we are pleased to note that our strategy has protected some of the downside, particularly in the more cautious funds.

We would point out that this past performance is no guide to future performance and that markets can fall as well as rise.

What Should I Do?

Seeing the value of your investments go down is never a pleasant experience. Investing always comes with risk and generally it is important to ensure that your portfolio is adequately diversified. Fortunately, this is something that we place great emphasis on within the GWA portfolio range and our diversity of asset classes has proved advantageous amidst the recent equity market downturn.

A common and frequently misguided approach in poor market conditions is to wholly sell a portfolio to stave the risk of further losses, and await recovery before investing again. In practice this is almost impossible to time, unless you’re particularly lucky, and may well see you miss out on the market upside. It is therefore generally preferable to remain invested.

It is frequently said that stock markets “go up like an escalator but down like an elevator”. With prevailing uncertainty in mind, it is impossible to determine whether we have reached the ground floor. However, you certainly don’t want to miss the ride back up.

Should you require any assistance from GWA’s Wealth Management team or have concerns you would like to discuss with us please get in touch. We are here to help and you can call or email us on our usual office phone number and email addresses.