Funds raised for the Great North Air Ambulance Service

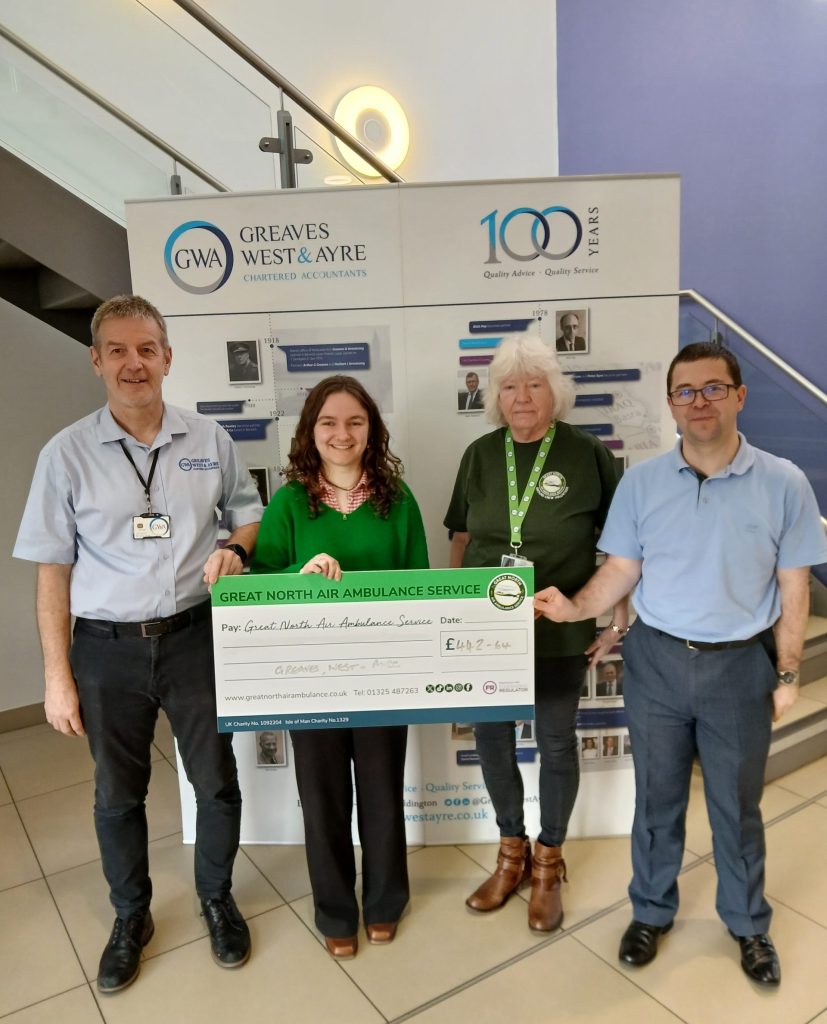

On Monday 14 January 2025 we welcomed Kate Barker from the Great North Air Ambulance Service (GNAAS) to our Berwick upon Tweed office.

Kate was presented with donations by GWA staff. Staff raised £442.64 from their annual Christmas Jumper Day on 20 December 2024. The total ongoing funds raised to date by GWA staff is nearly £4,000

Well done to everyone who has played a part in raising these much needed funds over the years!

You can find out more about the Great North Air Ambulance, the work they do and make a donation on their website: https://www.greatnorthairambulance.co.uk/

Pictured L-R:

David Black, Emma Scott, Kate Barker from GNAAS and Andrew Blair