Salary Sacrifice and Childcare Vouchers

Giving up part of your monthly pay might sound a little odd, but it can make financial sense. And likewise, for those businesses who look to improve benefits for their employees, salary sacrifice schemes are an option worth considering.

What is salary sacrifice?

Salary sacrifice schemes allow employers to offer non-cash benefits to employees who relinquish a portion of their salary in exchange.

How much can an employee sacrifice?

There is no limit to the amount of salary which can be sacrificed, provided an employee’s cash pay is not lower than the National Minimum Wage (NMW) or National Living Wage (NLW).

How does it work?

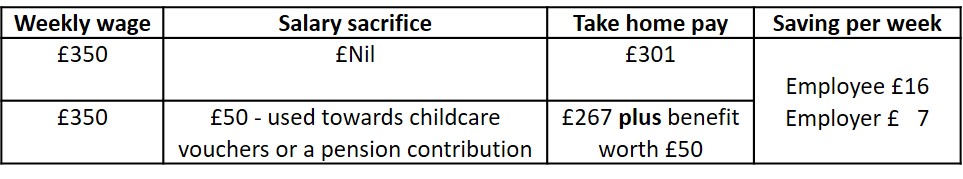

If your business wishes to set up a salary sacrifice scheme, you must provide employees with a contract detailing the agreement and an employee must agree to become part of the scheme. Employees who choose to participate will, as a result, have lower pay and therefore tax and National Insurance (NI) costs (for the employer and the employee) are lower. For example:

Does salary sacrifice affect other income or benefits?

Employees who opt for a salary sacrifice scheme should check that the reduction in income has no adverse effect on, for example, entitlement to maternity pay, workplace pension contributions, State pension or other benefits and any mortgage applications you might make.

What types of benefit are available?

Examples of some of the non-cash benefits available under salary sacrifice schemes include:

• Pension contributions • Cars

• Mobile telephones • Childcare

• Accommodation • School fees

Salary sacrifice has seen a number of changes in relation to the taxation of some of the benefits in recent years. However, pensions, childcare, Cycle to Work schemes and ultra-low emission vehicles are not affected.

Are childcare vouchers still available?

The childcare voucher scheme is now closed to new entrants. However, most people already receiving childcare vouchers will still be able to do so and the Tax Free Childcare (TFC) Scheme has been introduced for anyone else.

What is the Tax Free Childcare Scheme?

For every 80p paid into an HMRC online account to be used for childcare, the government will contribute 20p, up to a total government contribution of £2,000 per child per year up to the age of 12. The new scheme is available to anyone, employed or self-employed, so long as their earnings are at least £120 per week and not more than £100,000 per year. Other family members and employers can also contribute to the account, should they wish.

You can choose to switch to the TFC Scheme, but you will need to stop the original childcare voucher scheme and your employer will need to change your salary sacrifice contract.

As always, it is important to take advice relevant to your specific circumstances before making any changes. Proper planning will clarify if changing childcare schemes is right for you rather than missing out on benefits you currently receive.

If you would like further guidance or information please do not hesitate to get in touch on 01289 306688 or 01620 823211.