Planning for Care in Later Life

Many of us take steps to prepare for retirement – setting aside savings, managing our Inheritance Tax position, or making Wills. Yet one crucial area often gets overlooked: planning for future care needs.

As a society we are living longer. Our families and support networks are more widely dispersed. Navigating the world of care homes, Local Authorities and financial assessments is not only complex, but is becoming increasingly likely to be part of our future.

Understanding Types of Care

- Domiciliary Care: Support provided in your own home, helping with daily tasks and personal care.

- Residential Care: Long-term care provided in a residential care setting. Typically for those who need significant help with everyday activities.

What Does Care Cost?

The cost of care can vary depending on several factors, such as your location*. The cost is not insignificant and typically, ‘basic’ care (without specialist nursing or dementia care needs) will cost £1160, per week, on average. Domiciliary care is similarly priced. This means we can expect to face care costs of over £60,000 per annum in later life, if we have care needs which cannot be met by family or friends.

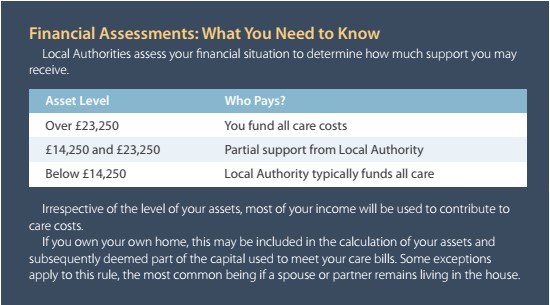

Financial Assessments: What You Need to Know

Local Authorities assess your financial situation to determine how much support you may receive.

What Happened to the Care Cost Cap?

In 2021, the Government proposed a lifetime cap of £86,000 on care costs, potentially protecting individuals from excessive bills. However, due to budget constraints, the plan was scrapped in 2024.

Planning for care can make a significant difference – not just financially, but emotionally too. If you would like to explore your options or understand how this might affect you or your loved ones, we are here to help.

As financial advisers we provide support and guidance to those facing care costs. By removing unnecessary jargon, explaining how the care system operates and outlining practical solutions, we help our clients to make informed decisions. If you or a family member would benefit from further information in this area, please contact Corryn Wild. Corryn is one of the Directors at our sister organisation Three Counties Ltd. She specialises in later life advice and is a Society of Later Life (SOLLA) accredited adviser.

Disclaimer

This is a potentially complex area and you should consult a suitably qualified adviser. Government support and regulation can change.

*In Scotland, the costs of personal care and nursing care are usually fully funded, irrespective of your assets.