Market Commentary: 6 January 2026

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

New Year’s Review

- Stocks in developed markets rose 12.75% during 2025 (MSCI World Index), when converted back to sterling.

- Bonds provided good returns, so long as overseas currency exposure was hedged.

- 2025 was the third straight year of double-digit gains for developed market stocks.

Key Themes

After many years of outperformance, US stocks entered 2025 in a dominant position – representing roughly two-thirds of global indexes and boasting several companies with a $1 trillion market valuation. However, when the year ended it was Asian and European stocks that had achieved the best returns, and the US dollar had also declined. Overall, 2025 will be remembered as a good year for stocks and a decent one for bonds. Market conditions are currently benign and we enter 2026 on a positive footing.

UK

2025 was a great year for the FTSE 100, which produced a strong return of 25%. The last time it gained more than 20% was in 2009 as it bounced back from the depths of the great financial crisis. It has now risen for five years in a row, having been one of the few markets to rise during 2022’s difficult year.

Returns were not spread equally across all UK stocks, however. Around half of FTSE Small Cap and AIM 100 stocks made no gains at all, as large companies did best. There were also big differences between sectors: half returned less than 10%, while miners surged by 250% due to a spike in gold and silver prices. Overall, the UK is still seen as a “value” market with stocks trading cheaply compared to other regions, especially the US.1

United States

The S&P 500 index of US stocks gained a very respectable 17% last year. However, the dollar declined by 7% to reduce the unhedged return to single digits in sterling terms. The technology sector did best as usual, with Google (+66%) and NVIDIA (+36%) benefitting from the Artificial Intelligence (AI) theme that has dominated investors’ attention across the pond. There are some signs of a cooling in that trade, however, with only two Magnificent 7 stocks making gains during the last month of the year and increasing chatter about circular dealmaking within the AI industry.2

The top 10 stocks now make up 40% of the US stock market’s total valuation, compared to an average of only 10-15% from 2000 to 2015.3 The level of concentration risk is close to record levels currently and if the AI trend does lose steam, the whole market will be vulnerable.

Europe

The Euro Stoxx 50 index rose 21% last year and those returns were given a further boost as the euro gained 5.5% versus the pound. This made Europe one of the best performing regions for British investors in 2025. Rising defence budgets created strong gains for defence stocks, while banks also did well – Santander gained 125% to be the top performer in the index, just ahead of BBVA (Banco Bilbao). In many ways the European market mirrors the UK’s, where stocks such as BAE Systems, Lloyds & NatWest have provided great returns.

Asia & Emerging Markets

Emerging Markets did best in the second half of 2025, gaining 18% in only six months, led by China. The market cooled slightly into year-end but has opened strongly in the first trading days of 2026. Some analysts refer to an AI arms race between China and the US, with China having a potential long-term advantage through an abundant energy supply – it already generates more than twice as much energy as the US.4,5

Elsewhere, Japanese stocks have performed well, despite a sharp increase in its government bond yields. However, India struggled, being the only Investment Association Sector to show a negative return for the year, as the Indian rupee lost 12% against the pound.

Bonds

The Japanese 30-year bond yield has now doubled in two years and the Bank of Japan is grudgingly raising interest rates, as inflation has remained stuck around 3% for three years. This modest level of inflation is quite alien to a whole generation of Japanese people, as prices remained completely flat from 1992 to 2022, after the bursting of the country’s asset price bubble.6

UK and US bond yields are trading in a sideways range. The differences between government and corporate bond yields – known as credit spreads – are very narrow, suggesting the bond market is optimistic about economic growth, with default rates expected to be low across the corporate sector.

Points of Interest

Precious metals such as gold (+65%), silver (+140%) and platinum (+120%) experienced huge gains in 2025 and gold mining funds were the best performers of the year.7 However, after such stellar performance last year and with most investors calling for further gains in 2026,8 could this be a contrarian indicator that the best returns have already been achieved? Commodity markets can be difficult to predict and notoriously volatile.

Summary

We enter 2026 with US stocks dominating the global market while trading on expensive valuations. A small number of tech stocks account for a large portion of US returns and they are increasingly tied to the fortunes of the AI industry. These are certainly risks to be aware of. However, 2025 showed that stocks in the UK, Europe and Asia can perform very well in their own right. Therefore, this could be the first period of time since the 2000s where it truly pays to be well diversified across different regions and sectors, with bonds also offering good yields and some protection against market downturns.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online at here, or provided on request.

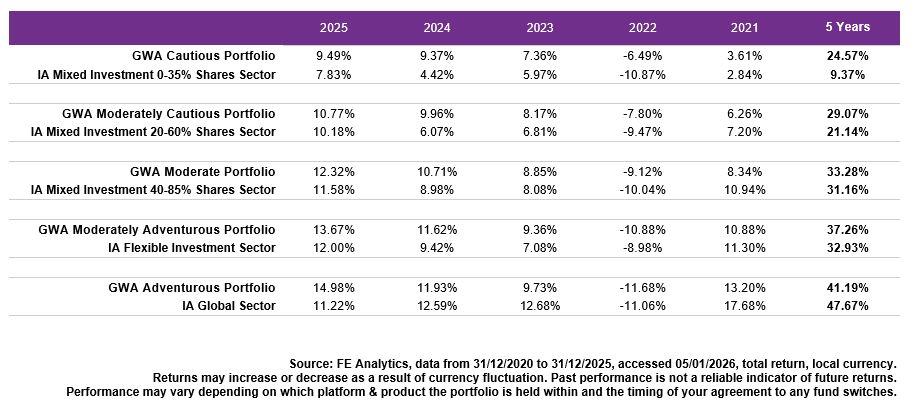

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

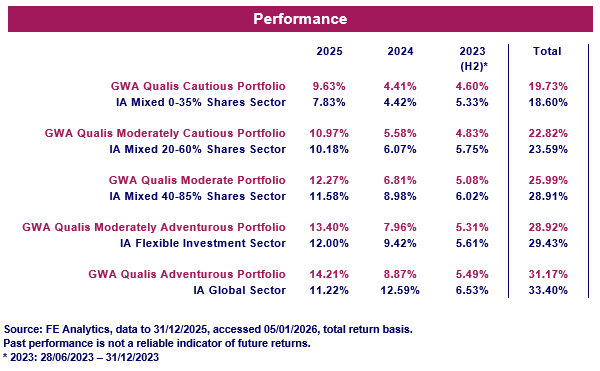

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk.