Global Markets Performance Update – Quarter 4 2020

Overview

- Global equity markets continued to rally

- Value stocks had their best quarter since 2009

- The impact of vaccine announcements overshadowed those of further lockdown measures

- Low returns on government bonds expected to continue.

Equities

Following last quarter’s rebound, equity markets continued to rally in the fourth quarter of 2020.

In spite of government action across the world to re-introduce further lockdown measures to try and contain rising COVID-19 infection rates, as far as the markets were concerned, November’s positive news from Pfizer/BioNTech and AztraZeneca/Oxford in relation to their respective vaccines had a much greater effect.

In fact, looking across the year as a whole, these announcements contributed to one of the most dramatic reversals of share price direction ever recorded. The sharp fall we saw in Q1 2020 was one of the deepest and quickest in history – the UK FTSE 100 dropped 32% and the US S&P 500 dropped 24% from 23 February 2020 to 23 March 2020* and has since been followed by similarly extraordinary recovery. The UK FTSE 100 has risen 27% and the US S&P 500 is up almost 42% from the 23rd March 2020 to the end of the year*.

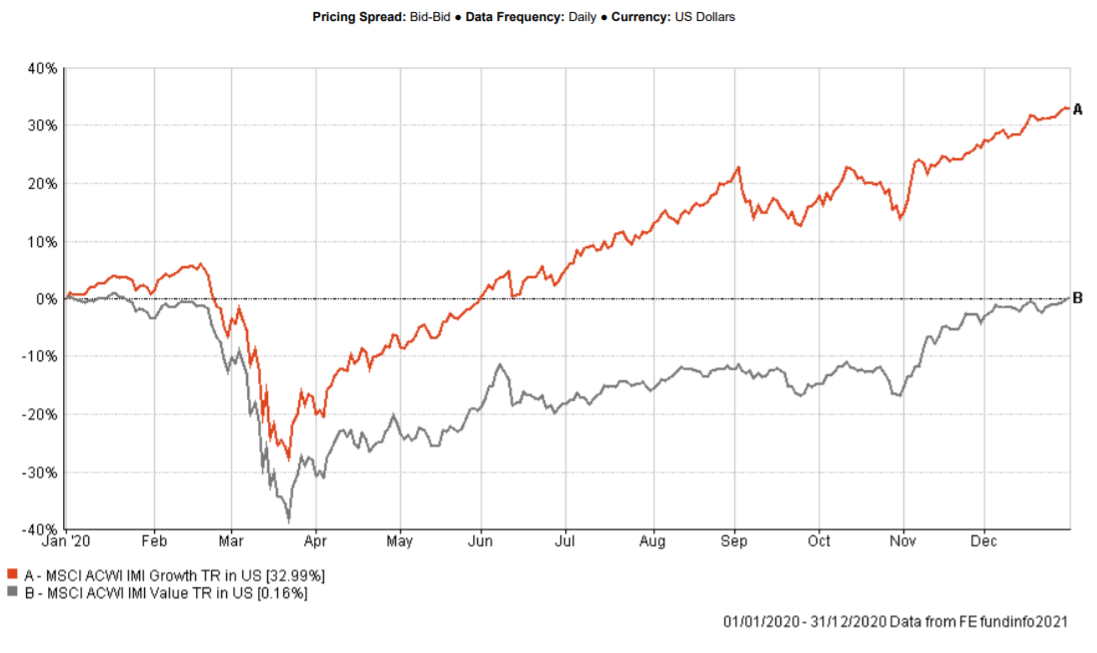

The divergence between those companies who could continue to deliver their products and services during the “working from home” scenario (e.g. Amazon, Netflix, Microsoft and Peloton) and the more traditional industries and value stocks (such as banks and oil majors) have been considerable over the 12 months. The former all increased their share price over and above expectations, whereas the latter have struggled to recover from the market falls earlier in the year.

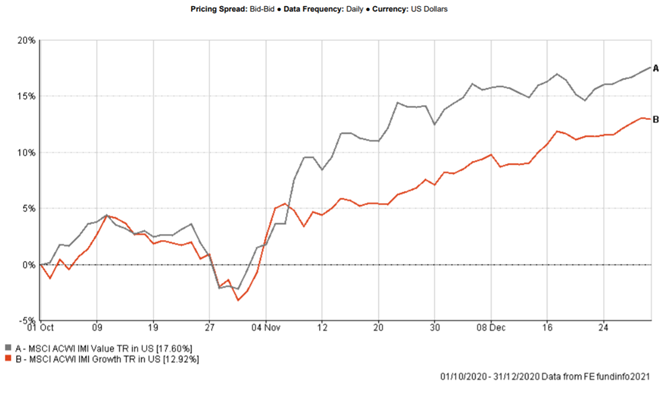

In Q4 however, spurred on by the positive news surrounding COVID-19 vaccinations and the US election result, those value equities (shown by the grey line in the charts below) grew 17.6% in USD terms, which proved to be their strongest quarter since 2009.

By comparison, growth shares – those often issued by newer companies without long track records (shown by the red line in the charts) – relatively underperformed over the quarter, returning only 12.9% in USD terms. However, they still outperformed over the year by a comfortable margin.

Value share vs. Growth shares – Q4 2020

Source: FE Analytics (01/10/2020 – 31/12/2020).

Past performance is not a guide of future returns. Figures are quoted in USD terms.

Value share vs. Growth shares – Jan-Dec 2020

Source: FE Analytics (01/10/2020 – 31/12/2020).

Past performance is not a guide of future returns. Figures are quoted in USD terms.

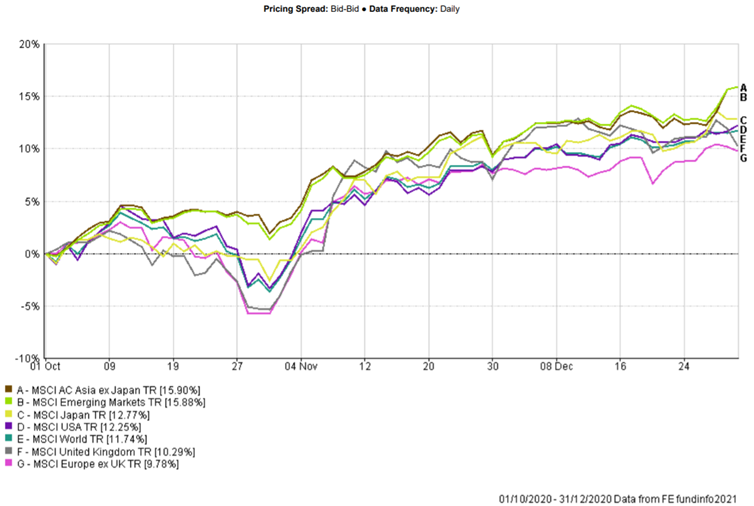

The earlier recovery in Asian markets, that we mentioned in our Quarter 3 2020 update,continues. The region outperformed again this quarter, inspired by a weakened US dollar and an uptick in trade activity. Increasing global trade activity saw China and South Korea’s exports benefitting from the considerable demand for medical supplies and technology products. This also reflects an international trend with manufacturing proving to be considerably more resilient than service-based sectors.

In the US, performance also continues an upward trend. Although we saw the official US presidency result take days to be declared, the markets remained relatively calm. When the news of Biden’s success was officially announced, it was welcomed with a 12.25% increase (USD terms) over the quarter. The potential for a less controversial presidency, coupled with a split Congress that could curtail the risk of tax hikes and tightened legislation, was clearly viewed favourably.

*Source – Morningstar

Overview of Q4 Performance

Past performance is not a guide of future returns. Figures are quoted in local currency terms.

Central Banks

Regarding monetary policy, central banks in the US, European Union and United Kingdom all pledged to maintain asset purchasing programmes, often referred to as quantitative easing.

The US Federal Reserve has stated its commitment to purchase 80 billion (USD) per month of treasuries and mortgage-backed bonds until “substantial further progress” has been made towards its inflation and employment goals. The Bank of England announced increased facility for a further 150 billion (GBP) of asset purchases, whilst the European Central Bank created capacity for a further 1,350 billion (EUR) of debt purchase.

The net effect is likely to be continued low yields for those holding investments in government bonds, even with hopes of an economic recovery.

Domestic Economy

As far as our UK domestic economy is concerned, residential property prices and retail spending increased year-on-year, in spite of lockdown restrictions. After four years, we finally reached a Brexit agreement just before, albeit only just before, the end of the year, which saw sterling jump 5%. GDP levels still remain lacklustre, however with an aggressive roll-out of vaccinations along with the impact of the Brexit agreement being better understood we can look forward to more positive signs of a recovery.

The start of a new year provides an opportunity to look ahead and there is no doubt that 2021 will continue to be challenging for many. In the first quarter in 2021, continued restrictions related to COVID-19 are likely to limit economic activity across much of the Western world. So far, the positive vaccine news has overshadowed weak GDP figures, but any setbacks could rattle nerves, particularly in market sectors with already stretched valuations.

That being said, we believe that we are moving into 2021 from a very positive position. Having access to a vaccine means we have a much greater chance of containing the COVID-19 virus than we could have expected a couple of months ago. The markets have also rallied well after last year’s March falls.

It is always worth reminding ourselves that a successful investment plan is one that is focused on the longer term and is able to stay the course. As a result, we will continue to manage our portfolios and be prepared to make changes if we believe that the volatility and risk conditions change.

GWA Portfolio Returns

Our results for the quarter are summarised below:

| Investment Association Mixed Investment 0-35% Shares Sector | 4.03% |

| GWA Cautious | 2.55% (-1.48%) |

| Investment Association Mixed Investment 20-60% Shares Sector | 1.40% |

| GWA Moderately Cautious | 4.85% (+3.45%) |

| Investment Association Mixed Investment 40-85% Shares Sector | 7.59% |

| GWA Balanced | 6.91% (-0.68%) |

| Investment Association Flexible Investment Sector | 8.19% |

| GWA Moderately Adventurous | 9.40% (+1.21%) |

| Investment Association Global Shares Sector | 8.67% |

| GWA Adventurous | 10.92% (+2.25%) |

Source: FE Analytics (01/10/2020 – 31/12/2020).

Past performance is not a guide of future returns. Portfolio returns are quoted net of fund management costs but gross of adviser and platform/custody charge. Figures are quoted in GBP terms.

All of our advisers are contactable on our usual phone numbers and email addresses. If you have any queries or concerns, please do not hesitate to get in touch.