Global Markets Performance Update – Quarter 3 2020

Overview

- Global equities rallied over the quarter, led by strong returns from the US and emerging Asia. The Eurozone lagged behind.

- We saw the most significant EUR/USD appreciation in several years with the Euro strengthening 4.0% against the dollar.

- In the commodities markets, precious metals and industrials saw gains but oil prices remained in the doldrums.

- Real estate assets saw modest, but positive, returns following sharp falls amidst the peak of the COVID-19 pandemic.

Equities

It is good to see that, as we come to the end of a very turbulent and challenging year, there is more positive news in relation to the markets.

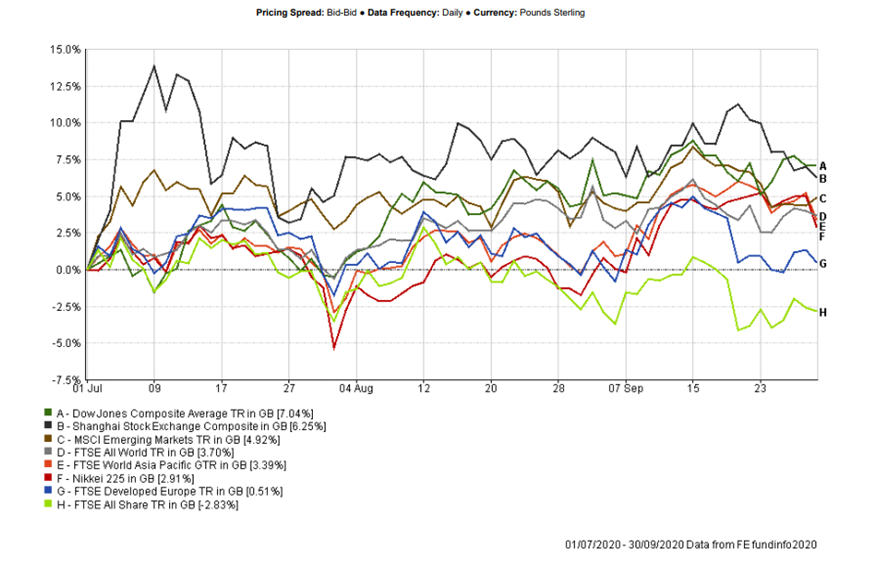

As you will see from the accompanying chart, global equities rebounded over the quarter led by strong returns in the US and Emerging Asia market, in spite of continued COVID-19 pressures. But it is worth noting that all sectors and regions have not seen the same results.

Source: FE Analytics (01/07/2020 – 30/09/2020). Past performance is not a guide of future returns. Figures are quoted in GBP terms.

Firstly, the positive. In the US, the Dow Jones gained +7.0% over the third quarter. Here the focus appears to be on the US’s favourable monetary and fiscal stimulus rather than on the continued tensions with China. In Asia, economies seem to be making an earlier recovery as they encountered the pandemic earlier than the US and Europe. Japan is worth a specific mention with the Nikkei seeing a 2.9% for Q3.

Unfortunately, the same story is not reflected in Europe, where equities across the region were flat. Europe continues to be depressed (aren’t we all) by the looming threat of a no-deal Brexit and this has no doubt affected the 2.8% fall on the FTSE. This was compounded by noticeably weak performances in Spain (the IBEX35 was down 7.1%), Belgium (the BEL 20 was down 2.8%) and France (the CAC40 was down 2.7%).

Emerging markets proved to be a mixed bag: Latin America (MSCI Emerging Markets Latin America USD) was down 4.0%, no doubt influenced by Brazil, the world’s third most COVID-19 affected country. By contrast, Emerging Asia (MSCI EFM Asia USD) reprted an impressive +11.5% return over the quarter. This was heavily influenced by China, the only major economy anticipated to post positive GDP figures for 2020.

Foreign Exchange

A notable mention in the foreign exchange overview for Q3 is that the euro strengthened 4.0% against the dollar, the most significant EUR/USD appreciation in several years. The dollar did begin to regain some of its lost ground in September, fuelled by the second COVID-19 wave in Europe. But with a similar second uptick now apparent in the US, it is likely that this sentiment will work against the dollar in due course.

The Japanese Yen rose by 2.4% against the dollar over the quarter. As a safe-haven currency, the Yen has benefitted from recent uncertainties elsewhere and it is unlikely that there will be any remarkable change of monetary policy in the country even following the appointment of a new Prime Minister.

Commodities

In the commodities space, the oil price remains in the doldrums, still not recovering from the fact that large parts of the world were effectively banned from flying or driving and travel is still severely limited. Brent oil was weak over the three months to 30 September, down -3.2% (-42.7% from the turn of the year) not helped by increased production coupled with oversupply fears.

With further uncertainty ahead there has been greater investment in gold and other so-called defensive stocks and it’s no surprise therefore that ‘safe haven’ precious metals have boomed as a result. A great example is silver, which returned 30.9% in Q3 and also industrial metals benefited by a rebound in Chinese manufacturing, increasing +10.6% over the quarter.

Fixed Interest

Fixed interest securities, also referred to as bonds, generally posted positive returns over the quarter, with corporate bonds outperforming.

US and German government bond yields were little changed and saw just a modest uplift of +0.2% and +0.5% respectively. Corporate bonds enjoyed higher returns, as investor sentiment became more optimistic about the economy and sub-investment grade debt was up +4.6% and +2.6% in the US and Eurozone respectively. As a comparison, investment grade assets (bonds that have little risk of default) returned +1.5% (US) and +2.0% (Eurozone).

Real Estate

Real Estate Investment Trusts (REITs) performances were mixed over the quarter. Whilst rental income is clearly under pressure, most notably in retail, the impact of the pandemic on a price basis seems to be less certain with quite a variation across markets. Japanese REITs were up +3.5% (best), whilst UK REITs fell -2.6% (worst), owed to the dual concerns of both COVID and Brexit.

GWA Portfolio Returns

Our results for the quarter are summarised below:

| Investment Association Mixed Investment 0-35% Shares Sector | 1.05% |

| GWA Cautious | 1.09% (+0.04%) |

| Investment Association Mixed Investment 20-60% Shares Sector | 1.40% |

| GWA Moderately Cautious | 1.84% (+0.44%) |

| Investment Association Mixed Investment 40-85% Shares Sector | 2.12% |

| GWA Balanced | 3.12% (+1.00%) |

| Investment Association Flexible Investment Sector | 2.42% |

| GWA Moderately Adventurous | 3.82% (+1.40%) |

| Investment Association Global Shares Sector | 4.41% |

| GWA Adventurous | 4.33% (-0.08%) |