Global Markets Performance Update – 2021 Quarter 2

Overall, the last quarter was pleasing for investors and the economic picture remained rosy. Successful vaccination roll-outs in many parts of the world saw restrictions easing, societies begin to re-open and global industrial production start out on the road to recovery. This drove business and consumer confidence which meant that most markets and sectors made positive gains.

Overview:

- global equity and bond markets posted broad gains in this quarter as economies moved towards a recovery

- developed equity markets outperformed in response to vaccine roll-outs, positive economic data and the easing of Covid-19 restrictions

- 10-year US treasury yields fell back 30bps to 1.45%. This helped growth stocks, which outperformed value stocks over the quarter

- this quarter saw a divergence in sovereign yields globally: falling in the US but steepening in the Eurozone

- commodities gained in response to an increase in demand as the global economy opened up. Surging oil prices saw energy company share prices top sector performance tables

- a strong rebound of economic activity fuelled inflation in some areas. The US saw its consumer prices index increase 5% year-on-year

- although the Fed believes rising inflation to be transitory, its language has become more hawkish, highlighting the possibility of near-term tapering.

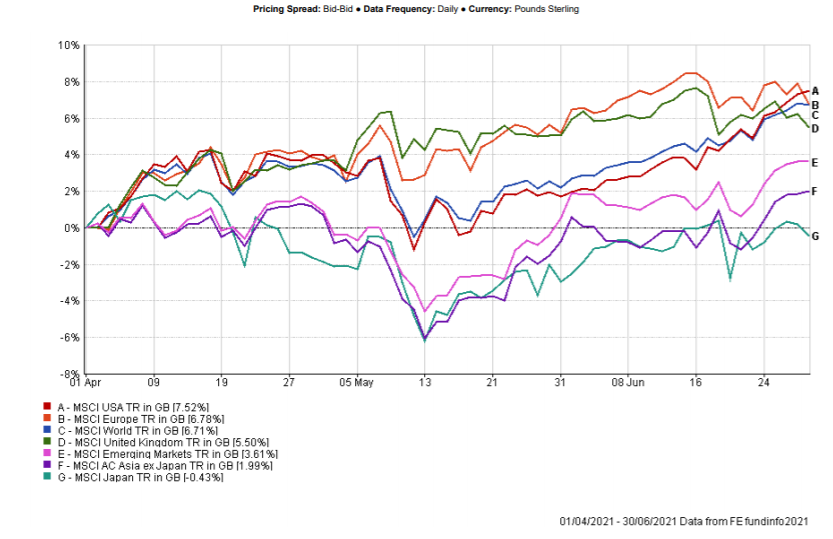

Regional Overview

United States: The US market posted the strongest regional return over the quarter, delivering 7.5% (MSCI USA). The S&P 500 reached all-time highs in June due to the strong rebound in growth stocks and the prospect of further stimulus following the Biden administration’s $1 trillion infrastructure deal.

Q1 GDP grew by 6.4% and industrial activity, as measured by the US Purchasing Manager’s Index (PMI), moved from 59.7 (March) to 63.9 (June – flash reading). Any reading over 50 signals expansion.

Europe: European companies returned 6.8% (MSCI Europe) on the back of strong global goods demand, reopening of relevant economies, improving vaccination numbers and a healthy corporate earnings season. The Eurozone flash Purchasing Managers’ Index (PMI) jumped to 59.2 in June, its highest level since 2006.

Asia: In Asia, Japan returned -0.43% (MSCI Japan), lagging behind other developed markets. Though Covid-19 infection rates remain markedly beneath most other countries, increasing case numbers led to the government delaying the removal of national emergency measures until 20 June. This, coupled with a slow start to the vaccination roll-out, weighed on investor sentiment. However, Japan appears to have overcome any initial logistical problems with its vaccination programme and is now capable of administering over 1 million vaccines per day.

Japan’s industrial output was relatively weak over the quarter. This was attributable to poor automotive manufacturing amidst a continued global shortage of semiconductors. Japan continues to exhibit moderate deflation despite the prevailing theme of positive inflation on a global level.

China posted a modest, positive return over the quarter. Covid-19 case numbers remain low, but policy tightening and regulatory concerns weighed on returns.

UK: Domestically the spread of the Covid-19 Delta variant is of concern. However, increasing infection numbers have not, so far, led to corresponding levels of hospital admissions indicating that the vaccination programme is effective against the variant.

UK companies managed to return 5.5% (MSCI United Kingdom) over the quarter. Underlying the headline figure were mixed performances. Undervalued, economically sensitive companies continued to drive returns in April and May. Defensive large cap companies were favoured in June, aided by sterling weakness against the US dollar. Healthcare and consumer staples proved resilient and energy companies also fared well. However, financials suffered as market interest rates fell, weighing on the share prices of banks and insurers.

Overview of Regional Q2 Performance

Source: FE Analytics (01/04/2021 – 30/06/2021).

Source: FE Analytics (01/04/2021 – 30/06/2021).

Past performance is not a guide of future returns. Figures are quoted in GBP terms.

Bonds

Regarding debt markets, 10-year US treasury yields fell back 30bps to 1.45%. The backdrop to this was a strong rebound in economic activity coupled with annualised inflation rates spiking to levels not seen in the last decade. The US Federal Reserve’s policy meeting in June saw a shift of rhetoric to a more hawkish tone, with the open market policy committee indicating that interest rates are likely to rise sooner than previously anticipated.

European sovereign debt yields steepened as optimism rose around recovery prospects and improving vaccination numbers. The UK 10-year gilt yield fell from 0.85% to 0.72%.

With the high inflation/low sovereign yield backdrop, investors increasingly looked to spread products; credit outperformed sovereign as emerging market debt, US investment grade credit and European high yield debt all garnered interest.

Commodities

An opening up of the global economy meant that Commodities had a strong quarter. Oil prices increased amidst higher demand, as did industrial metals – aluminium, nickel and lead in particular. Precious metals achieved modest but positive returns.

Summary

The last quarter has been one of positive gains in nearly all markets. We are now moving into an area of change with some potentially choppy waters. The global economy is rebounding from the Covid-19 pandemic and there is some worry that recovery, combined with fiscal stimulation, will stoke higher inflation.

Going forward, we believe there is still cause for optimism and there will be plentiful opportunities for investors.

All of our advisers, are contactable on their usual phone numbers and email addresses. If you have any queries or require investment advice, please do not hesitate to get in touch.

GWA Portfolio Returns

Our results are summarised against benchmarks in the following table.

| Investment Association Mixed Investment 0-35% Shares Sector | 6.86% |

| GWA Cautious | 5.58% |

| Investment Association Mixed Investment 20-60% Shares Sector | 12.74% |

| GWA Moderately Cautious | 11.17% |

| Investment Association Mixed Investment 40-85% Shares Sector | 17.29% |

| GWA Balanced | 16.45% |

| Investment Association Flexible Investment Sector | 19.48% |

| GWA Moderately Adventurous | 22.86% |

| Investment Association Global Shares Sector | 25.92% |

| GWA Adventurous | 26.91% |

Source: FE Analytics (30/06/20 – 30/6/2021).

Past performance is not a guide of future returns. Portfolio returns are quoted net of fund management costs but gross of adviser and platform/custody charge. Figures are quoted in GBP terms.

Please note that the content of this review should not be considered investment advice or any form of recommendation.