Global Markets Performance Update First Half 2022

The year so far has been tough, certainly one that will have tested the stamina of many investors. Markets encountered a shopping list of problems. More COVID-19 lockdowns, the ongoing Russia/Ukraine war, cuts in oil and gas imports pushing up energy costs, continued inflationary pressures and central-bank tightening. After a period of stable growth we’re now acclimatising for volatility. After living with low inflation for years we’re now seeing inflation at a 40-year high.

Because of this volatility we’re departing from our usual quarterly update and are looking at the first half of 2022.

Following two years dominated by concerns around the COVID-19 pandemic, many investors entered 2022 with expectation of heightened volatility. However, no-one could reasonably have predicted what transpired: one of the most turbulent first six months in markets on record. In this report we will try to explain some of the background to some of these unfamiliar trends.

Overview:

- the first six months of 2022 have been amongst the most intense on record for investors

- developed market equities posted the worst first half returns seen in over 50 years, the MSCI World, a broad measure of global markets, – shedding -18.7% in local currency terms

- for the multi-asset investor, holding traditionally low-risk government bonds failed to cushion equity losses amidst a heavy sell-off in fixed interest markets

- commodity prices reached all-time highs steering inflation to a 40-year record and causing major central banks to hike interest rates at a pace not seen in decades

- for UK investors, a greatly weakened pound provided some offset to losses in US stocks and global indices dominated by US companies. The MSCI USA lost -21.7% in USD terms but was off by -13.4% in GBP.

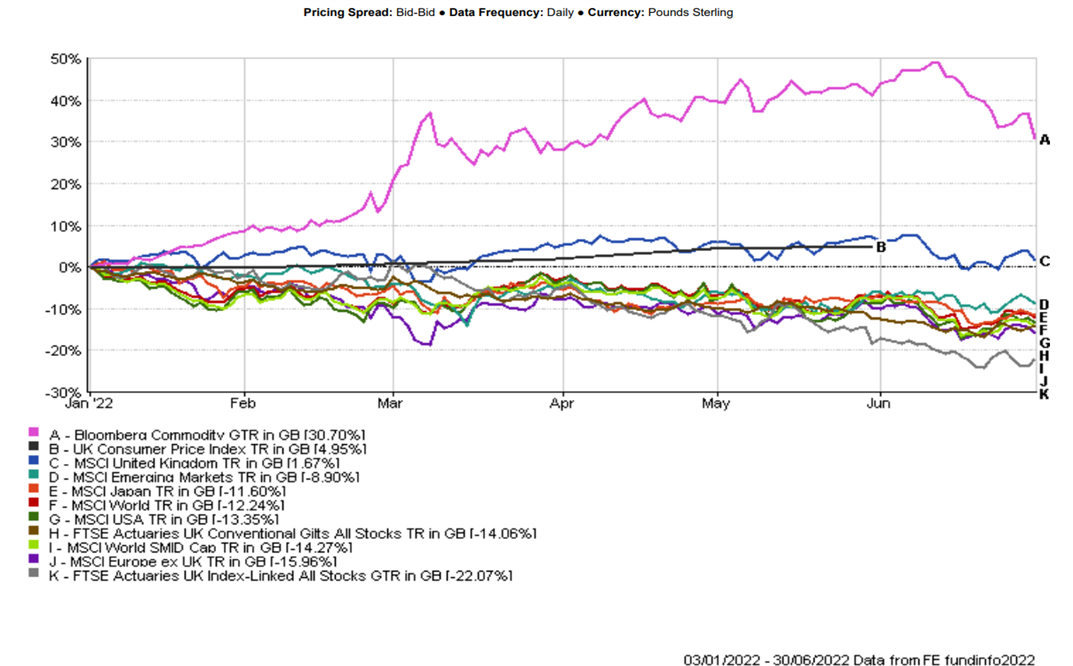

A summary of H1 2022 performance from major regions/asset classes is provided below:

Source: FE Analytics (03 January 2022 – 30 June 2022).

Past performance is not a guide of future returns. Figures quoted in GBP terms.

Inflation’s impact on Equities and Bonds

A key factor in the gravity of this turmoil, has been the positive correlation between equity and government bond prices. For the past twenty years or so, returns from equities and bonds have been negatively correlated ie. when one goes up, the other goes down. In the first six months of 2022 the MSCI World Index saw its biggest ever first half drop. At the same time the 10-year US treasury bond, traditionally a ‘safe haven’ asset, also had its worst first six months since 1788. For many investors, the appeal of government bonds is that performance has been uncorrelated with global equity markets. But so far, 2022 has bucked these historic norms. Risk assets (equities) and defensive assets (government bonds) falling in tandem, leaving investors with few safe places to hide.

The reason for this centres on one key issue: inflation. Rising inflation was already apparent prior to Russia’s invasion of Ukraine. The conflict however, significantly compounded the issue. The UK Consumer Prices Index climbed 9% in the 12 months to April whilst the USA saw inflation reach a 40-year high of 8.6% for the 12 months to May. As a result, major central banks raised interest rates in an attempt to quell rising prices.

Most government bonds are conventional, meaning they will pay a ‘coupon’ (fixed rate of interest) through the life of the loan and repay principal at maturity, both in nominal terms ie. before taking inflation into account. Consequently, spikes in inflation and/or interest rates causes the price of conventional bonds to fall, increasing the running yield (effective annual interest) to a more risk-appropriate level. For that reason, in a backdrop dominated by rising inflation and climbing interest rates, government bonds have not provided the ‘safe haven’ investors would ordinarily expect.

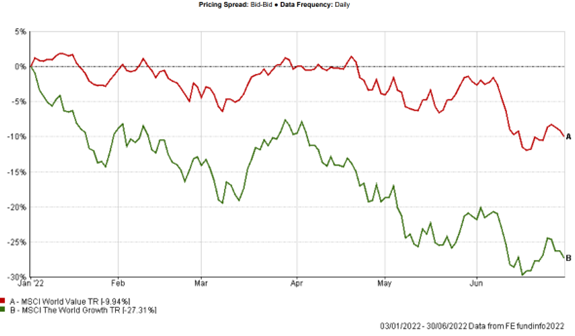

High inflation and rising interest rates also create an inhospitable environment for the growth stocks that represent some of the largest companies in the world. Value stocks suffered far less, as shown in the graph below:

Source: FE Analytics (03 January 2022 – 30 June 2022).

Past performance is not a guide of future returns. Figures quoted in local currency terms.

Growth Stocks vs Value Stocks

Generally, growth stocks perform best when interest rates are low. This is because the value placed on these companies by the market reflects expectation of future output – ‘jam tomorrow’. Rising inflation and interest rates force investors to re-consider the value of a company’s future output, demonstrated by a sell-off. The extent to which global investors have favoured growth companies in a decade characterised by low inflation, low interest rates and loose monetary policy is such that recent economic changes have led to a sharp reduction of some lofty valuations. Many equity investors have felt this sell-off to some degree, due to the dominant position of these companies in major global indices. For the UK investor, a good example would be the massively popular Scottish Mortgage Investment Trust, which is unapologetically growth orientated and is off around -46% (GBP) in H1.

Value shares have, by and large, benefitted from the reversal of economic conditions as investors look for companies with attractive valuations and the potential to provide positive returns in an inflationary environment. The typical old-world economy sectors that value investors have looked to include oil majors, utilities and financials, some of which have generated significant profits from massive commodity gains. Value investment’s favour is reflected in the relatively strong performance of the MSCI United Kingdom index, which is heavily comprised of ‘old world economy’ sectors.

Notably, the only traditional ‘safe haven’ asset that lived up to its reputation was the US dollar. This gained around 9% against a basket of hard currencies and over 15% against the Japanese Yen. The weakness of the British Pound against the US Dollar also greatly cushioned the worst of the downside experienced in US shares for UK investors.

Looking Ahead

Looking forward, there are reasons for positivity.

Global inflation has been fuelled in no small part by commodity markets. 50% and 60% hikes in oil and gas prices respectively have massively increased costs for households and companies alike. The other primary contributor has been supply chain shortfalls. This was led by Russia’s growing isolation and the shortage of exports from a zero-Covid policy China. That being said, sourcing suitable replacements for Russia’s energy exports is a priority for Western nations. And, it is expected that heavy restrictions in China will be alleviated in the near future, following positive update on their domestic COVID issues.

Whilst recession angst remains, analysts are expecting growth in company profits for 2022 and 2023. In addition, the breadth of the equity market sell off has left most regions, save for the US, with valuations beneath long-term averages. Furthermore, if investors envisage heightened recessionary risks moving forward, it would not be surprising to see the correlation between equity and government bond prices revert to the negative.

So with some market data signalling inflation could be reaching its peak, and potential long-term value emerging amid the volatility, there may be relatively calmer times ahead.

So if your stamina has been tested, focussing on the long term with a well-balanced, diversified portfolio, is key to successful investing. We know this is easier said than done, and although history shows a recovery will come, we don’t know when that will be. But those investors who are able to stay the course, with a well thought-out financial plan can withstand periods of market volatility.

Please note that the content of this review should not be considered investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.