Global Markets Performance Update – 2021 Quarter 1

During a year like no other, we are feeling quite buoyed by how we managed our operations during 2020. The saying “change is the only constant in life” has certainly been proved time and time again over the past 12 months. As we write our latest quarterly update, the sense of optimism feels greater than it has done for some time. However we must never become complacent and the rollout of vaccines across the globe in 2021, although positive news, will continue to change the outlook for markets and economies alike.

Overview

- equities gained over the quarter, supported by the continued roll-out of COVID-19 vaccinations and the news of Biden’s US fiscal stimulus package

- value shares outperformed growth shares with smaller companies also faring well

- government bond prices fell causing yields to steepen following inflationary expectations

- increasing demand, led by energy and industrial metals, resulted in gains in the commodities market

- there is growing positive sentiment around expectations for global growth

Equities

Although stock markets have lost some momentum in the past three months, they have still made a great recovery from the doldrums of last March. The MSCI World, often used as a common benchmark for ‘world’ or ‘global’ stock funds, has returned 4.9% over the first quarter of 2021 and 38.4% over the last twelve months. Meaning, not only have its losses been recouped since the market bottomed out in March 2020, but also this index has added a further 10% when compared to pre-COVID highs.

The optimism surrounding a sustainable reopening of economies has been boosted by the continued momentum of vaccination rollouts in both the UK and US. This allows us to both look ahead with more confidence, but we should also consider the impact this could have on investments.

One trend we are seeing is a ‘rotation’ from growth stocks, that have in recent years generated strong returns for investors, to more traditional, value stocks.

Growth stocks that shone during the pandemic are now looking decidedly sombre, with the MSCI IMI World Growth Index returning just 0.03% in GBP terms. In contrast, the formerly ‘unloved’ value sectors, such as such as travel, hospitality and banking, have continued to gain, with the MSCI IMI World Value Index up 9.1% in GBP terms. This increase was boosted by rising commodity prices, with oil up 23% (Bloomberg West Texas Intermediate Crude – USD) and copper up 13% (S&P GCSI Copper Spot Price – USD).

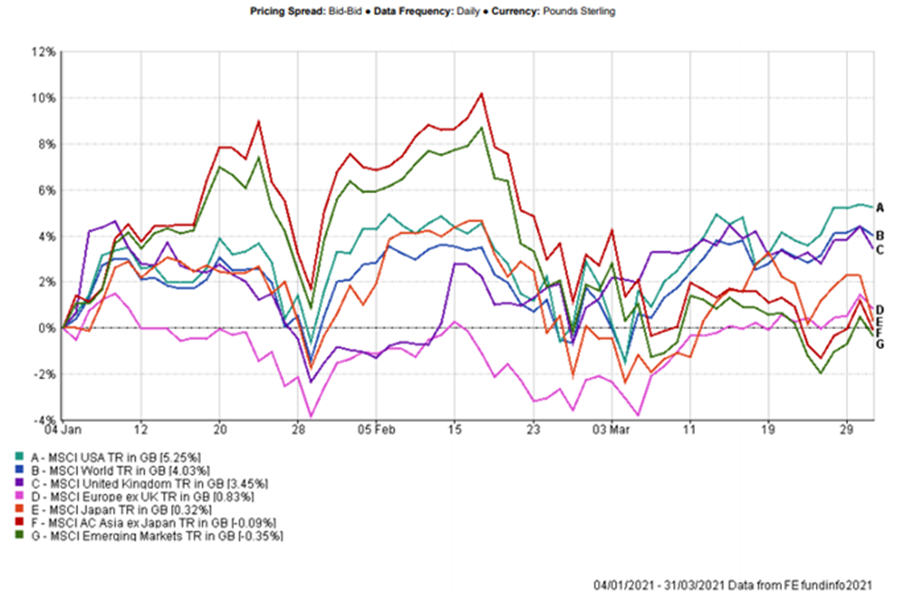

Overview of Regional Q1 Performance

Source: FE Analytics (04/01/2021 – 31/03/2021).

Past performance is not a guide of future returns. Figures are quoted in GBP terms.

Regional Overview

Although US equities started this year on an uneven footing, they finished the quarter strongly. The rally was driven by the vaccine rollout, the confirmation of President Biden’s $1.9 trillion stimulus package and his promise of a further $2 trillion of expenditure on national infrastructure. In summary, big tech lagged, whilst energy and industrials gained.

UK equities also performed strongly, with ‘undervalued’ companies in sectors sensitive to the economy’s performance continuing to recover. Better than expected results and steepening bond yields meant that banks and financials performed notably well. Forward looking data for the UK manufacturing sector look positive and there looks to be the healthiest expectation of growth for quite some time.

We have all seen that the vaccination rollout in Europe has been challenging but, despite this Eurozone equities also gained over the quarter. Mirroring rises in the US and UK, energy and financials outperformed the market as a whole. Consumer discretionary stocks also performed well, most notably the automotive sector. Sectors that underperformed included those less influenced by an economic recovery, such as utilities. Expectations of further economic growth remain high on the back of positive business surveys conducted in March. However, the continued rising COVID infection rates, combined with the reintroduction of restrictions, could curtail this enthusiasm, with the tourism sector particularly at risk.

Emerging markets, in spite of having a more difficult start to the year, finished the quarter up a little over 2% in USD terms. The influence of COVID, with slower vaccination rollouts and an increase of daily infection rates in select regions most notably India, played a part in constraining confidence. That and the strengthening US dollar and substantial increase of US treasury yields resulted in a rather lack lustre performance.

Chile was the best performing region in the emerging markets sector, courtesy of not only their vaccination efforts, but also the rising copper price; Turkey’s markets fell sharply as a result of the unexpected decision to sack their central bank governor, Naci Abgal, and we saw the Lira fall by over 15% against the dollar on market opening. It has since regained some ground, but understandably formerly strong foreign investor sentiment has waned.

Bonds

The 10-year US treasury yield rose from 0.91% to 1.74%, representing the worst quarter for US treasuries since 1980, proving that the US stimulus package is not all good news. Investors were concerned about the potential inflationary impact of the package alongside pent-up savings and expectation of demand for select goods and services when economies reopen.

Other markets also saw significant moves. However, the 10-year UK gilt yield steepened by a lesser 0.65%, to 0.88%. Investment grade debt was in negative territory over the quarter, but non-investment grade loan stock (those highest quality bonds as determined by a credit rating agency) generated modest positive total returns amidst rising risk appetite and lower default concerns.

Summary

To sum up, the first quarter of 2021 proved good for equity investors, particularly those with a bias towards value shares, but not so good for fixed interest investors.

However, in light of the gains we have seen in equity markets to date, we expect future returns to be less random. Provided that the vaccination programme proves to be effective it is not unreasonable to expect substantial growth as economies reopen. With this considered, we continue to favour equities relative to fixed interest.

Hopefully the UK and the rest of the world’s recovery against COVID-19 will continue at pace and as we move look towards the end of 2021, we can anticipate other factors playing a larger role for global investors.

GWA Portfolio Returns

It has been a challenging quarter in terms of performance. Our results are summarised against benchmarks in the following table.

| Investment Association Mixed Investment 0-35% Shares Sector | -1.00% |

| GWA Cautious | -0.92% |

| Investment Association Mixed Investment 20-60% Shares Sector | 0.62% |

| GWA Moderately Cautious | 0.02% |

| Investment Association Mixed Investment 40-85% Shares Sector | 1.24% |

| GWA Balanced | 0.49% |

| Investment Association Flexible Investment Sector | 1.82% |

| GWA Moderately Adventurous | 1.57% |

| Investment Association Global Shares Sector | 2.59% |

| GWA Adventurous | 1.98% |

Source: FE Analytics (04/01/2021 – 31/03/2021).

Past performance is not a guide of future returns. Portfolio returns are quoted net of fund management costs but gross of adviser and platform/custody charge. Figures are quoted in GBP terms.

Please note that the content of this review should not be considered investment advice or any form of recommendation.

All of our advisers are contactable on our usual phone numbers and email addresses. If you have any queries or concerns, please do not hesitate to get in touch.