Global Market Commentary – September

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 7 October 2024

Chinese Stimulus Boosts Stocks

- Stock markets (MSCI World Index) rose in September and have gained 18.7% in 2024

- Bond markets (Bloomberg Global Aggregate Index) have gained almost 2.0% in 2024

Key Themes

Asia remains the centre of attention on the back of a major Chinese stimulus program which has triggered a sharp rally in its stocks. This comes after two months where Japan experienced significant currency volatility and a “flash crash” in its stocks. In the west, the UK remains attractive from a valuation perspective but investors remain wary of committing capital, while the US marches onwards and upwards as usual. Significant geopolitical risk is emerging in the Middle East and beginning to impact markets, but how that develops is impossible to predict.

UK

UK stocks have had good gains this year, led by the FTSE Small Cap index (+15.4%). However, returns have flatlined in recent weeks due to speculation about the Labour party’s first budget announcement on 30 October.1 Investors withdrew £666m from UK equity funds in September, while adding money to other regions, amidst the new government’s warnings about budget black holes and painful tax rises.2 Such economic “doom-mongering” has flipped the previously positive sentiment about UK stocks completely on its head, with both consumer and business confidence turning sharply lower since the election. UK fund managers have expressed hopes that the budget itself will prove less harsh than expected and allow confidence to return.

United States

US stocks make up the majority of the global stock market by valuation and are once again leading the way in performance terms, with the S&P 500 index returning 21.5% so far this year. The Nasdaq technology index had the strongest returns up until July, but that has given way to a more broad-based rally, with other sectors and smaller companies now taking up the baton. The energy sector is up 9% in the past month due to the middle east conflict, with industrials and utilities faring well on the back of improving GDP data and falling interest rates.

The US Federal Reserve is expected to cut interest rates at its 7 November meeting and its 18 December meeting.3 Before then, the October earnings season will see the world’s largest brands, such as Apple and Google, report their Q3 results.

Europe

European stocks have been fairly subdued since the summer. This could be due to a combination of poor economic data and the fact that some of the region’s biggest stocks are taking a breather, having made large gains earlier in the year. Dutch semiconductor equipment maker ASML and French luxury goods firm LVMH (Moët Hennessy Louis Vuitton) are the largest components of the Euro Stoxx 50 index. Both have seen their share prices decline by 25% in recent months, as their lofty valuations have been trimmed back by the market.

Asia & Emerging Markets

A few weeks ago, all focus was on Japan. Now, the attention of global investors is firmly on China. On 24 September the People’s Bank of China announced major stimulus measures designed to prop up its ailing property market and encourage local investors to buy stocks.4 Interest rates were cut and cash incentives promised,5 and the Shanghai Composite stock index swiftly rewarded the authorities with a gain of 21% in five days.

Those gains have also fuelled good returns in Hong Kong and the wider Emerging Markets complex, although some have noted that Indian and Japanese stocks are being sold as investors look to raise cash to follow the Chinese rally. All told, many hope this could mark a major turning point for China, but it remains to be seen whether the stimulus efforts can have a lasting effect.

Bonds

UK and US government bond yields have spiked higher in the last few weeks. This has led to short-term capital losses for investors, as yields move inversely to prices. Investors are beginning to re-evaluate whether interest rate cuts will be as extensive as first imagined, amidst the Bank of England’s reticence and the US economy producing better employment figures than expected. Both nations’ central bankers are keen to normalise interest rates to a “neutral” level lower than the current 5%, but just where that level is remains anyone’s guess, for now. Some speculate 4%, others 3% or even lower.6

Points of Interest

UK House Prices have finally turned a corner. The Nationwide and Halifax housing indices both recorded their strongest growth for two years in September, with Scotland and the North of England leading the South.7,8 Overall, house prices are now very close to their previous high from July 2022. This has created good gains for the shares of housebuilders and construction suppliers in recent months.

Summary

September is cited as the most volatile month of the year for stocks – and the only one which loses money, on average.9 Therefore, by historical standards the market has fared relatively well recently. We can now look forward to the period of the year where stocks are typically strongest, in the run up to Christmas and New Year. Hopefully, those seasonal patterns will be sustained in the face of the upcoming budget and US election. Support should be provided by central banks, who look set to continue lowering interest rates in the months ahead.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found here – https://greaveswestayre.co.uk/wp-content/uploads/2024/10/Sources-List-8-October-2024.pdf

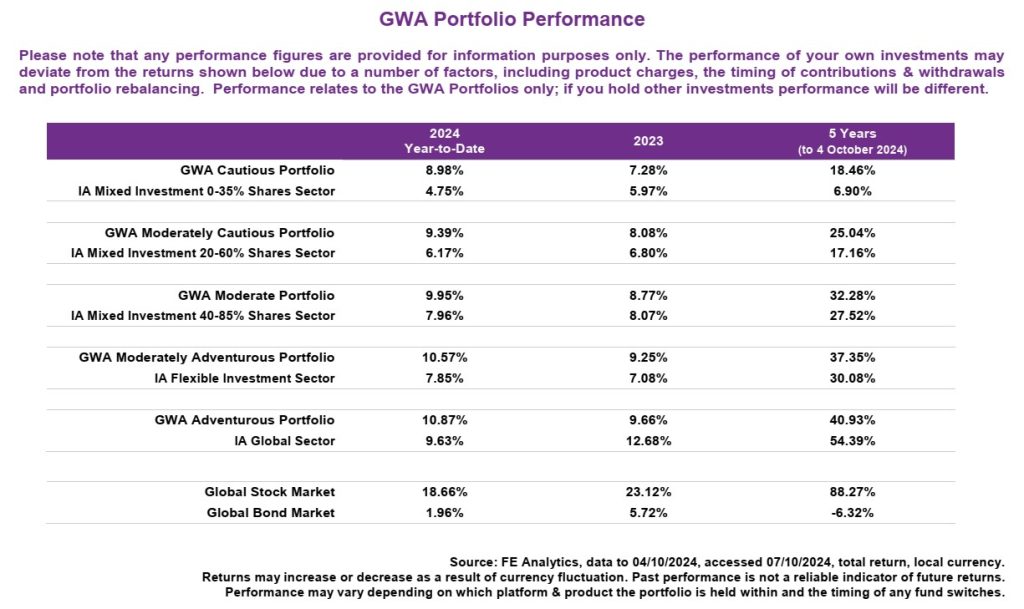

GWA Portfolio Performance

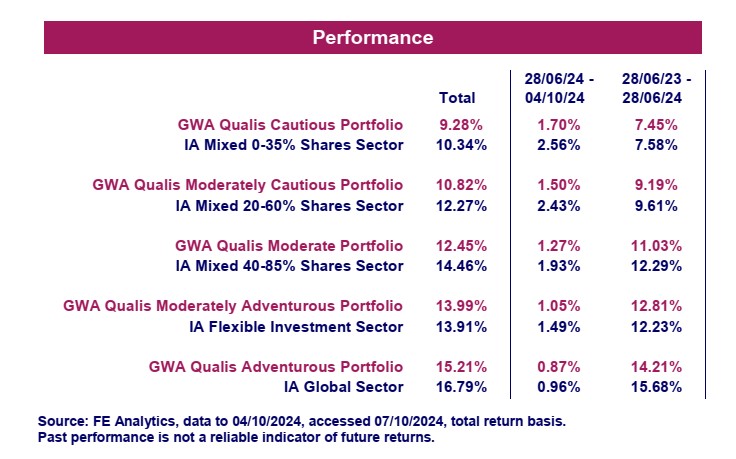

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold

government bonds and corporate bonds. The fund also invests in alternative assets.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund

invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk