Global Market Commentary – November 2023

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 6 December 2023.

Goldilocks Awakes

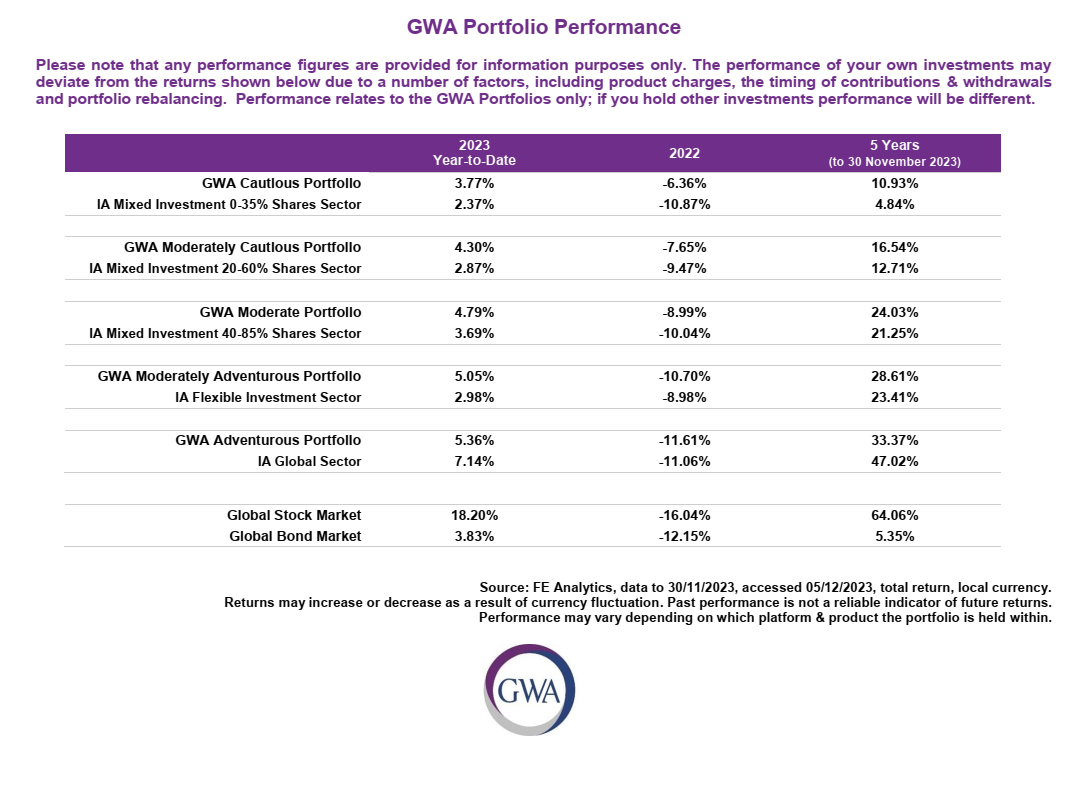

- The global stock market (MSCI World Index) rose 8.3% in November and has gained 18.2% this year

- The bond market (Bloomberg Global Aggregate Index) rose 3.4% in November and is up 3.8% this year

- Gains have stemmed from lower inflation and reduced interest rate expectations

Key Themes

Last month we said ‘the key economic indicators could prove not too hot, nor too cold, but just about right for investors to feel comfortable’. There can certainly be no doubt about the stock market’s favourite fairy tale after November’s gains: Goldilocks wins, hands down. With inflation cooling rapidly and GDP and employment figures remaining stable on both sides of the Atlantic, the stock market has shaken off the bears and moved markedly higher.

UK

The FTSE 250 index of mid cap stocks rose 7.1% during November, with AIM (5.3%) and the FTSE Small Cap Index (4.0%) following behind. On 14 & 15 November the US and UK inflation reports both surprised to the downside1, providing a boost to housebuilders and businesses focused on the domestic economy. The pound also strengthened versus most other currencies, gaining 3.8% versus the dollar.

It isn’t all good news, however. The headline FTSE 100 index only moved 2.3% in November, taking year-to-date returns to a paltry 3.9% – far behind the global stock market average and almost all other developed market indices, on a local currency basis. For British investors, it can feel like an endless wait for the tide to turn. Despite a strong month, mid and small caps remain broadly flat for the year.

United States

Last month we reported the S&P 500 had experienced its biggest decline in over a year. In November, it came bouncing back with a return of 9.1%. It has now risen 20% this year, with the Nasdaq technology index soaring 37% on the back of an Artificial Intelligence investment boom. In the US, mid and small cap stocks remain sleepy in comparison to their larger counterparts. The Russell 2000 is performing similarly to the UK and is up 3.8% in 2023.

Europe

The Euro Stoxx 50 index gained 8.0% in November with the Spanish IBEX (+11.6%) and German DAX (9.5%) leading the way. Financial markets firmly expect the European Central Bank to start cutting interest rates in the spring2 after eurozone inflation fell to 2.4% in November3. Despite a slowdown which sees it on the brink of recession4, the German DAX is now close to an all-time high, in a reminder that the stock market is not the economy. Liquidity and financial conditions may matter most and those are deeply impacted by interest rates, both actual and forward-looking.

Asia & Emerging Markets

China is the largest component of Emerging Market indices with a 30% weighting5, but it has lagged far behind other markets this year. The Shanghai and Hong Kong stock markets have declined 9% and 13% respectively during 2023, in sterling terms. The combination of a global manufacturing recession6, a domestic property market crisis and underwhelming government stimulus measures has meant investors have been disappointed, after predicting a strong post-lockdown bounce from Chinese stocks when we entered 2023. While other Emerging Markets are up strongly, Chinese stocks failed to rally even in November.

Japan, in contrast, has seen a very strong 28% return from its Topix stock market index in 2023. Currency weakness has been an issue, meaning unhedged sterling returns would ‘only’ be 9%, but the yen has strengthened slightly in recent weeks.

Bonds

The yen has been helped by a reduction in US Treasury Bond yields. With the headline 10-year yield declining from 5.02% on 23 October to 4.33% on 30 November, the difference in interest rates between Japan and the US has narrowed considerably. The drop in bond yields was again driven by lower inflation and interest rate expectations. This resulted in the best monthly return since May 1995 for the Bloomberg Aggregate Index, excluding currency fluctuations. The 10-year UK Gilt yield stands at 4.17%, while corporate bonds have experienced a strong rally.

Points of Interest

Gold has been in the headlines, rising from $1,810/oz on 6 October to briefly hit an all-time high of $2,135 on 4 December. Its digital cousin, Bitcoin, stormed higher by 55% over the same period and has now risen 150% in 2023. This follows talk that a Bitcoin ETF will be launched in the United States sometime next year7. At $42,000 per coin, it remains 40% below its all-time high of $69,000 set in November 2021.

UK house prices have risen for three months in a row for the first time since October 2022, according to Nationwide8. The services sector also showed signs of growth with positive data for November9. With mortgage rates dropping slightly and expectation that the Bank of England will reduce its base rate next year, could the worst now be over for the property market? Commercial Property REITs – which typically own warehouses, offices and retail units – have bounced higher but continue to trade on wide discounts to Net Asset Value10.

Summary

In our previous update we mentioned that November and December have provided the strongest average returns of any two-month period in recent years11. November certainly held up its side of the bargain and looking towards Christmas, investors see few hurdles in the way of a traditional ‘Santa rally’. However, there are still murmurs about a possible ‘hard landing’ for the economy in 2024. The market is now switching its focus towards employment figures. Will unemployment rise from its historically low level12,13, or will layoffs be avoided? Where the labour market goes, the stock market will likely follow.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

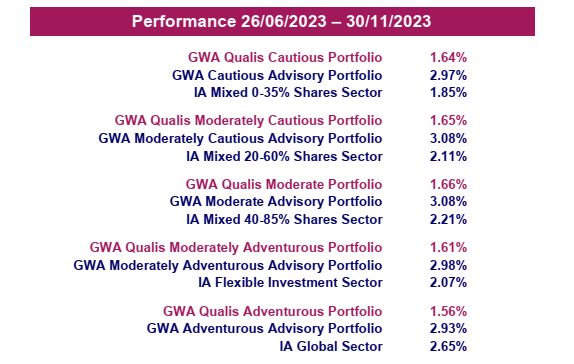

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commodities and alternative assets. The fund does not hold any equities. The fund recently increased its allocation to corporate bonds.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has an overweight position in Japan. The fund recently reduced its Emerging Markets exposure and invested in the Defence sector and broader US indices.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk

This article was written on: 6 December 2023.

To see sources from this article click here