Global Market Commentary – New Year’s Review

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 5 January 2024.

New Year’s Review

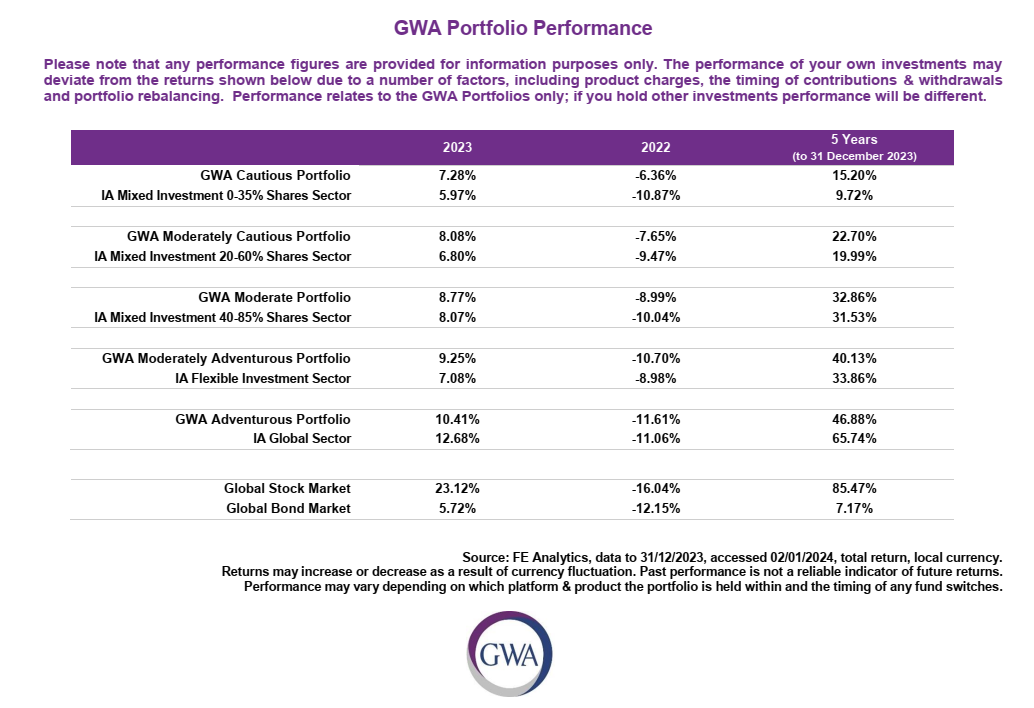

- The global stock market (MSCI World Index) rose 4.2% in December and gained 23.1% in 2023

- The bond market (Bloomberg Global Aggregate Index) also rose in December and gained 5.7% in 2023

- Investors enter 2024 with optimism

Key Themes

Global stocks closed 2023 with their fourth largest annual return of the last twenty years. But those gains mostly came from a narrow group. The seven largest companies in the US – Apple, Microsoft, Google, Amazon, Nvidia, Facebook & Tesla – returned a colossal 111% on average1. The rest of the world was largely left in their wake. As inflation moderates and interest rates potentially decline, many analysts hope that 2024 will see a broadening of the rally with smaller and more cyclical companies benefitting as well.

UK

The FTSE 100 has just celebrated its 40th birthday. Launching at 1,000 on 3 January 1984, it closed 2023 at a level of 7,733. Counting significant dividends along the way, it has produced a total return of 8% per annum2 during that period. It also happened to return 8% in 2023. While this is broadly similar to the average long-term return from global stock markets according to academic literature, it falls far behind the returns achieved elsewhere during the year. An absence of technology companies has hindered its progress.

United States

The United States now makes up 70% of the global stock market by value, having produced excellent returns in 2023.The Nasdaq technology index surged 44% while the broader S&P 500 index gained 25%. With the US Presidential Election taking place in November 2024, hopes are high for another positive year: when an incumbent President has stood for re-election, the S&P 500 has not declined during the election year since 19523 and the average return has been 12%4. With interest rate cuts already widely expected, this creates a favourable backdrop for the year ahead in the eyes of many.

Europe

The Euro Stoxx 50 closed 2023 achieving a 22% return. Italy (33%) and Spain (28%) outperformed, while Germany (11%) lagged. These gains came despite the European economy being undeniably weak. Manufacturing activity has declined for 18 months in a row and current forecasts suggests that Eurozone GDP data due on 30 January will be slightly negative for the second quarter in a row, to confirm a technical recession5. The slowdown appears mild and the stock market is brushing it off, so far. Analysts hope that unemployment will stay stable, allowing growth to resume later in 2024.

Asia & Emerging Markets

Japan was a jewel in the crown with strong performance throughout 2023. Its 28% return placed it second only to the Nasdaq among major markets. As we head into 2024, the Bank of Japan has a new Governor and there are hopes that stock market reforms will drive further gains6. Japanese investors certainly hold the bragging rights over their Chinese counterparts: the Shanghai market was among the worst performers of 2023 with a 4% decline, amidst continued concerns about the unwind of a Chinese property bubble7,8. Elsewhere, India’s ‘Nifty 50’ stock market remains one of the hottest in the world after it became the most populated country in 2023, with an average age of only 29 and fast-expanding GDP per capita9,10.

Bonds

Although bonds ended the year with a positive return, investors had a turbulent ride along the way. In March the MOVE index of bond volatility reached similar levels to the 2008 financial crisis, as regional banks in the US struggled to survive a rapidly changing interest rate environment. Returns only turned positive later in the year, as inflation started to fall. Despite a volatile ride, the best place to invest throughout 2023 was high-yield corporate bonds, which returned an average of 13% in the US and 15% in the UK. Often referred to as ‘junk’ because they are issued by riskier companies, such an outcome is ironic given commentators thought 2023 would be a recessionary year, where risk should be avoided.

Points of Interest

Over the past six months UK CPI has only been 0.6% on an annualised basis11. Core CPI is 2.2% annualised over the same period12, very close to the Bank of England’s long-term target. With other economies experiencing similar declines, inflation may be disappearing as quickly as it arrived.

On the back of falling inflation, the Santa rally of November and December has been so strong that the Fear and Greed Index has reached ‘extreme greed’ levels, having been at ‘extreme fear’ as recently as 27 October13. Used by some as a contrarian indicator, it suggests that investors may have become too buoyant and returns could be limited in the near term.

Summary

A guest on Bloomberg radio recently remarked that we have seen a decade of activity during the past year. There have certainly been many cross-currents and unexpected price movements. Central banks increased interest rates above 5% during the first half, yet stock markets boomed – driven by the technology sector which is supposed to suffer most from higher rates. Growth stocks outperformed value stocks. Yet smaller companies did not react. Oil surged higher in the summer despite the dollar strengthening. There was a major conflict in the Middle East. Oil declined.

Gold flirted with new highs several times despite higher real yields, only to fall back as soon as anyone noticed. Southern Europe outperformed Germany in economic terms for the first time in years14. The stock and bond markets whipsawed based on each consecutive data release, be it inflation, employment or growth related. The data itself was often contradictory. Central banks seemingly had (and have) no idea whether to stick or twist.

After such a year, it is no wonder that investors wish that 2024 will be a more simple bull market. A January pullback would not be unusual following a strong year-end, but let’s hope they are right.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

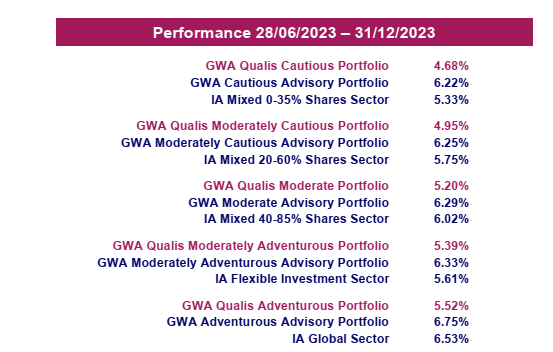

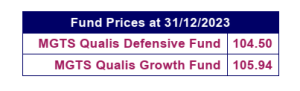

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commodities and alternative assets.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification.

Both funds invested relatively cautiously at outset, before increasing risk levels when markets became less volatile in late 2023.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk

This article was written on: 5 January 2024.

To see sources from this article click here