Global Market Commentary – May

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 13 May 2024.

UK Resurgence

- The global stock market (MSCI World Index) has gained 10.1% since New Year

- The bond market (Bloomberg Global Aggregate Index) has declined by 3.3% over the same period

- The UK stock market has pushed higher in the past month, while interest rates look set to fall soon

Key Themes

Recent data has hinted at a divergence between the US and UK/EU economies, with signs of an economic slowdown in the States coinciding with Britain and Europe rebounding from a period of stagnant GDP growth. Having been neglected for several years post-Brexit, there is hope that UK stocks may finally prosper given a more favourable macroeconomic environment. If overseas investors were to show interest in the UK for the first time in years, the market’s valuation discount to global peers may narrow. Investors remain focused on inflation figures which are still slightly elevated on both sides of the Atlantic.

UK

The outlook for UK stocks and the UK economy suddenly looks quite promising. The FTSE 100 has moved to new all-time highs and has risen 6.3% since 1 April. Small cap stocks are also rebounding strongly after experiencing a tough couple of years, with AIM rising during 14 of the past 18 days to cap a gain of 16% since October. It would need to rise a further 66% to recapture its September 2021 peak, so there could still be significant upside to come.

During his 9 May press conference, the Bank of England Governor signalled a clear intention to reduce UK interest rates in the coming months and suggested the cuts could be greater than the current expectation of 0.50 percentage points by year end.1 With the UK economy growing strongly from January to March after almost two years of zero growth2 and levels of private sector business activity ticking up nicely,3 this provides a very positive economic backdrop for UK stocks. Year-to-date, the FTSE 100 is now beating the MSCI World Index and is quickly catching the US indices which led earlier this year.

United States

After eighteen months of very robust growth, the US economy has produced several unexpectedly poor data releases in the space of just a few weeks. Quarterly GDP growth more than halved,4 business activity rose by less than expected amid signs of weakening demand,5 inflation began to rise again6 and initial jobless claims reached their highest level in eight months.7

This led to some turbulence on the stock market, with the S&P 500 declining by more than 5% at one point. As things stand, US stocks are back towards their recent highs, but the market is now very sensitive to forthcoming inflation and economic growth data and the impact this may have on US interest rates.

Europe

The European Central Bank is in a similar position to the Bank of England and is expected to begin cutting Eurozone interest rates in June, from the current level of 4.5%.8 Sweden has already led the way, cutting its base rate for the first time in eight years and acting before the US for the first time this century.9 European stocks are outperforming US stocks so far this year. With divergent interest rate policies and economic conditions, could this finally mark the end of US stock market dominance? It would be long overdue.

Asia & Emerging Markets

Japanese stocks have fared very well since April 2023, but the Nikkei experienced a 10% correction last month. The Bank of Japan had to intervene to prop up the yen once again,10 as it depreciated by almost 10% in 50 days to reach a 34-year low versus the US dollar. The currency is being impacted by very low domestic interest rates in comparison to the west. In a reversal of fortunes, Chinese stocks began to recover from a year-long decline: the Shanghai Composite is up 19.5% since mid-February as the country attempts to move on from the popping of a domestic property bubble. There are rumours that Chinese fast-fashion retailer Shein is considering a London IPO which could value the firm at more than £50billion.11

Bonds

In the face of sticky inflation and surprisingly weak US growth, what are government bond yields to do? Go up, then down, of course. The “risk free” rate is continuing to prove very volatile, more than two years on from the initial spike in inflation following the Covid pandemic. The US 10yr Treasury yield has ranged from 3.85% to 4.75% this year and currently stands at 4.50%. The 10yr UK Gilt yield is 4.20%, with the recent rise in gilt yields causing a marginal uptick in fixed-term mortgage rates.12 Corporate bonds continue to perform well, with the risk of default implied to be low given current economic conditions.

Points of Interest

An independent review found significant deficiencies in the Bank of England’s forecasting systems, including out of date software and shortcomings with its economic modelling.13 This will come as no surprise to those who remember the Bank’s slow response to rising inflation in 2021,14 or its prediction that 2023 would bring the country’s “longest ever recession” leading to a doubling in the unemployment rate.15 Needless to say, last year was tricky, but it wasn’t quite that bad. The Bank has duly promised to implement the review’s 12 recommendations for change.

Brent Crude Oil has declined from $92 to $83 per barrel since 12 April, in a return to its range from earlier this year. With natural gas also well below its 2022-23 levels, there are hopes that energy price inflation may be behind us. Norway’s Equinor now supplies 27% of the UK’s natural gas,16 taking the foremost position which was previously occupied by Russia’s Gazprom prior to the Ukraine war.

Summary

On a global level, a new equity bull market was born in October 2022: the MSCI World Index rising by 44.5% since that low. The FTSE All Share has gained 23% over that period and spent much of the time in a sideways range. However, it was among the best performing indices last month and we may be at a point in the bull market where a rotation in leadership takes place. There are those that think the baton may be passed from US mega-caps such as Microsoft and Amazon, to other markets around the world. Hopefully the UK can continue its momentum and regain its place as a premier international market. The outlook for investment returns remains broadly positive, on the whole.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online at greaveswestayre.co.uk/news-and-events/blog/global-market-commentary-may-2024 or provided on request.

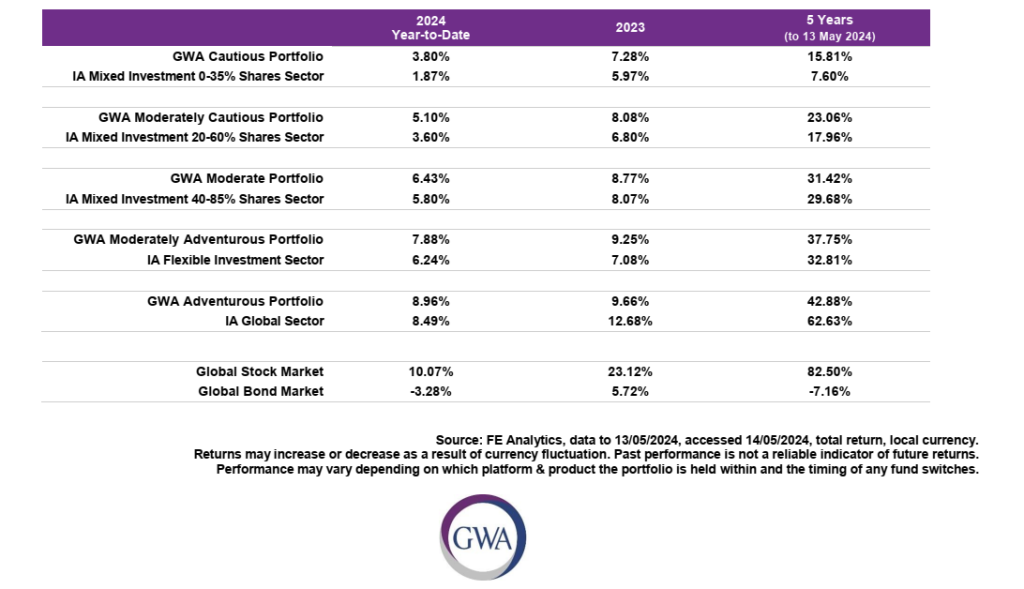

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

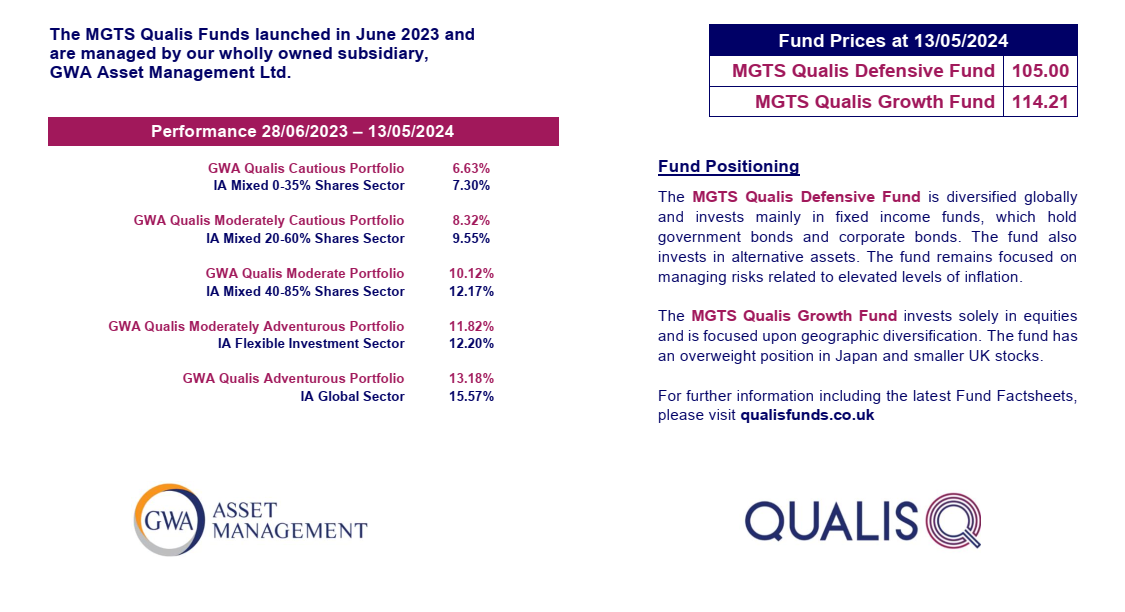

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.