Global Market Commentary – March 2024

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 11 March 2024.

Stocks Begin to Motor –

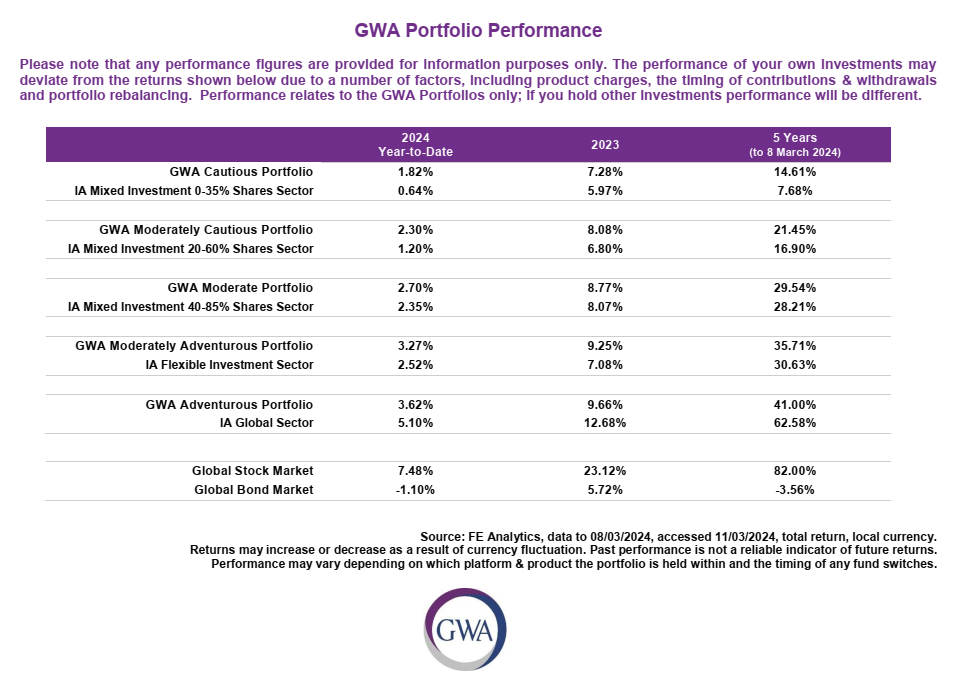

- The global stock market (MSCI World Index) rose 4.6% in February and is up 7.5% since New Year

- The bond market (Bloomberg Global Aggregate Index) declined 1.5% in February and has lost 1.1% in 2024

- Many markets have made new all-time highs, confirming ‘bull market’ conditions

Key Themes

In June 2023 we asked whether a new bull market had begun. Nine months later, we have our answer. The MSCI World index moved to new all-time highs in February. The US and Japanese stock markets have led the way, while others are yet to catch up – including the UK’s. But with strengthening GDP forecasts, moderating inflation and high levels of financial market liquidity, there is no doubt that ‘risk-on’ sentiment is currently in ascendance.

UK

The opinion among many domestic investors is that UK companies are being valued too cheaply by the stock market at present, especially in comparison to their international peers. These complaints have been supported by a flurry of takeover activity in recent weeks. Retailer Currys rejected a US bid which offered a 42% premium to its previous share price.1 Haulage company Wincanton (107% premium) and telecoms firm Spirent Communications (61% premium) have already agreed to be snapped up by US buyers.2,3

Meanwhile, the Virgin Money UK bank is being bought by Nationwide Building Society at a 38% premium4 and the UK’s largest housebuilder by sales value, Barratt Developments, is buying the seventh-largest, Redrow, in an all-share deal.5 Such vulturous activity suggests bargains are on offer and the public market needs to either value firms more aggressively through higher share prices, or risk losing them to acquirers. The FTSE All-Share Index remains in its slumber for now, down 0.2% year-to-date.

United States

‘American exceptionalism’ appears to be ever-strengthening, as the country’s technology giants threaten to expand their global dominance on the back of artificial intelligence (AI) technology. Some even argue there is a bubble in AI semiconductor firm Nvidia, as its share price has risen 710% since October 2022. They sometimes fail to mention its quarterly profits have risen 1,270% year-on-year.6,7 It is now the third most valuable company in the world.8

The S&P 500 Index sits 6% above its previous all-time high from January 2022 and has risen in 16 of the last 18 weeks, which ties a record last achieved in 1971.9 This has been driven by expectations of very strong corporate earnings growth and GDP growth for the remainder of 2024.10

Europe

The Italian stock market is doing well, having gained 10% in 2024 with Ferrari (+24%) among the best performers. The stock gained 12% in one day alone, after seven-time world champion, Lewis Hamilton, was announced as the team’s new F1 driver for the 2025 season.11 With the company currently valued at a 48x forecast price-to-earnings ratio, the shares are almost as expensive as the cars themselves.

Asia & Emerging Markets

Japanese stocks have performed best among major developed markets this year, with the Nikkei and Topix indices up 12.5% and 9.4% respectively. This is despite the country flirting with a recession, based on the most recent GDP data.12 It perhaps helps that stock markets are priced on a nominal basis and nominal GDP growth has been high due to inflation.13 The Nikkei is currently making headlines for surpassing its all-time high set in 1989 during a Japanese asset bubble, with investors becoming more bullish on Japanese stocks than they have been in years.14

Bonds

It continues to be a sluggish year for government bonds, which are down slightly. We should remember that this is normal in a healthy market and is a sign that inflation is now under control, as bonds and stocks tend to move in opposite directions when that is that case.15 Good returns have still been made from riskier and pro-cyclical high yield corporate bonds. The benchmark UK 10-year gilt yield is currently 4.0%.

Points of Interest

Gold has surged past its previous highs and finally broken the $2,100 per ounce barrier, after threatening to do so multiple times since 2020. A breakout following a long period of price consolidation is considered very positive by market technicians. The price currently stands at $2,170 and ‘gold bugs’ hope further gains are to come. Gold miners are yet to join the rally, with the world’s largest Gold Miners ETF still 28% below its previous high.

Cryptocurrencies have had a resurgence and may be entering the mania stage. Bitcoin has gained 69% since 1 January and set a new all-time high above $69,000 on 5 March. It lasted there for 1 minute, lost 13% in 5 hours, then moved to its current price of $71,400. Extreme volatility clearly still exists.

In another sign of bull market conditions, inflows into Equity Funds have reached their highest level in three years.16 The money has mostly gone to US stocks. UK equity funds continue to see outflows and remain as unloved as ever, despite attractive valuations.

Summary

To paraphrase something once said by the hedge fund manager who created the BBC’s Million Dollar Traders series, the trend is up and the surest way to regret is to sell new highs.17 Many markets are moving higher after spending two years below their previous peak. Inflation is under control and economic growth forecasts are increasing across the developed world.18 We finally appear to have a uniformly stable and positive backdrop for investment, for the first time since the Covid pandemic struck in 2020.

Note Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found here, or provided on request.

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

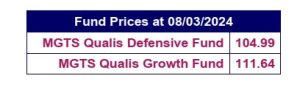

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commodities and alternative assets. Recently, the fund has been focused on opportunities in corporate bonds.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has an overweight position in Japan and has been increasing its allocation to smaller companies in the UK and US.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk

This article was written on: 11 March 2024.

To see sources from this article click here