Global Market Commentary – June

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 19 June 2024.

Politics Takes Centre Stage

- The global stock market (MSCI World Index) has gained 13.5% in 2024

- The bond market (Bloomberg Global Aggregate Index) has declined by 2.4%

- Election activity has drawn attention, at a time in the year when financial markets are usually quiet

Key Themes

2024 always promised to be a busy year for elections, with one half of the world’s population heading to the polls.1 As far as financial markets are concerned, political surprises have now bubbled up in several countries within a short period of time. With much still to be decided by voters, there is greater uncertainty in the short-term investment outlook. However, inflation remains on a declining path in the UK, US and Europe, while economic growth appears strong.

UK

British stocks performed well during the spring, especially the FTSE SmallCap Index which returned 13.9% in the three months to 31 May. Some say “Sell in May and return on St. Leger’s Day” as the summer months often prove languid from a returns perspective, and UK stocks are indeed down a touch so far in June. Rishi Sunak surprised the markets on 22 May by calling an early general election and this may have put a pause on domestic stocks gaining further ground for now, until the makeup of the new parliament is known. Other than political change, the economic backdrop is arguably turning in the most favourable way since 2021, with real GDP improving, inflation moderating, interest rate cuts on the horizon and the manufacturing sector returning to growth for the first time in two years.2,3

United States

The US faces its presidential election on 5 November with an increasing belief that Donald Trump may regain the Oval Office. Investors perceive the difference between the Democrats and Republicans to be fairly narrow as far as public finances are concerned, with neither Biden nor Trump expected to take significant steps to address the nation’s wide fiscal deficit or ballooning national debt.4,5 Deficit spending has stimulated the US economy into strong growth over the past 18 months, but some prominent investors are airing concerns about the sustainability of the nation’s $34trillion national debt pile – equal to 123% of GDP 6 – in a higher interest rate environment. By comparison, the UK has a narrower deficit with a debt-to-GDP ratio of roughly 100%.7

Such concerns are not bothering US stocks, with the Nasdaq 100 technology index rising by 7% in the past month and the broader S&P 500 index up 3.5%. The market is being carried by companies involved with artificial intelligence – Nvidia in particular. The computer chip maker has gained $1trillion in market value this year and accounts for more than a third of the S&P 500’s returns over that period, while overtaking Microsoft as the most valuable company in the world.8,9 However, narrow leadership can sometimes signal a market built on weak foundations: the Dow Jones Industrial Average and Russell 2000 Index of smaller companies are both down since mid-May.

Europe

A political surprise has also arrived in Europe, with President Macron calling a snap election in France after the far right made gains in European Parliament elections. This led to significant declines in French government bonds, French stocks and even the Euro,10 causing the French stock market to lose its position as Europe’s largest – back to the UK, which formerly held that status.11 The Euro Stoxx 50 index is down 3% in the past month, although there is brighter news economically as the European Central Bank reduced interest rates to 3.75% on 6 June. Financial markets currently expect that the Bank of England and US Federal Reserve will follow suit in September.

Asia & Emerging Markets

The Indian stock market has surged higher in recent years, but it experienced some major turbulence this month when pro-business Prime Minister Narendra Modi unexpectedly lost his majority in the national election. Indian stocks first hit record highs upon initial reports of a sweeping victory, before declining 6% on news of a tighter result than expected – their worst daily drop in four years.12 They have moved to new highs once again upon Modi’s return to office. The MSCI India stock market index has gained 40% in the past year.

Elsewhere, China’s stock market has resumed its decline as its ailing property market shows no signs of recovery: new home prices fell at the fastest rate in ten years last month,13 with millions of new build properties standing empty following years of over-construction.14 The Shanghai Composite has lost 7% in the past year, which lags well behind most other stock markets.

Bonds

Government bonds have fared quite well in recent weeks, with the annualised yield-to-maturity on 10-year gilts reducing from 4.40% to 4.10%. When yields decline like this, it produces a mark-to-market capital gain on the bond’s underlying price. Short-term yields remain higher than long-term yields by approximately 1 percentage point, suggesting investors believe that central bank interest rates need to reduce from their current levels.

Points of Interest

Takeover Activity continues unabated with more UK stocks being snapped up by foreign buyers. Royal Mail’s parent company, International Distribution Services, is being bought by a Czech billionaire16 – although by most accounts he is attracted by the more profitable German arm of the business. The UK’s largest retail investment platform, Hargreaves Lansdown, is also primed to accept a bid from a consortium of overseas private equity investors.17

Meanwhile, Trade Tariffs from the European Union and United States are seeking to prevent a flood of cheap Chinese electric vehicles (EVs) from entering local markets.18 Chinese EV maker BYD sells a similar number of cars to Tesla globally,19 but price tariffs of up to 38% from the EU and 100% from the US aim to protect western carmakers from further Chinese advances.

Summary

The summer months can sometimes be quiet for investors, with most of the stock market’s gains historically coming during the winter and spring periods.20 Whether you believe in seasonal effects or not, it is certainly the season for elections. The markets hope that little will change regardless, and they are left to continue higher on the back of strong profit growth and lower interest rates.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online at Sources-List-19-June-2024.pdf or provided on request

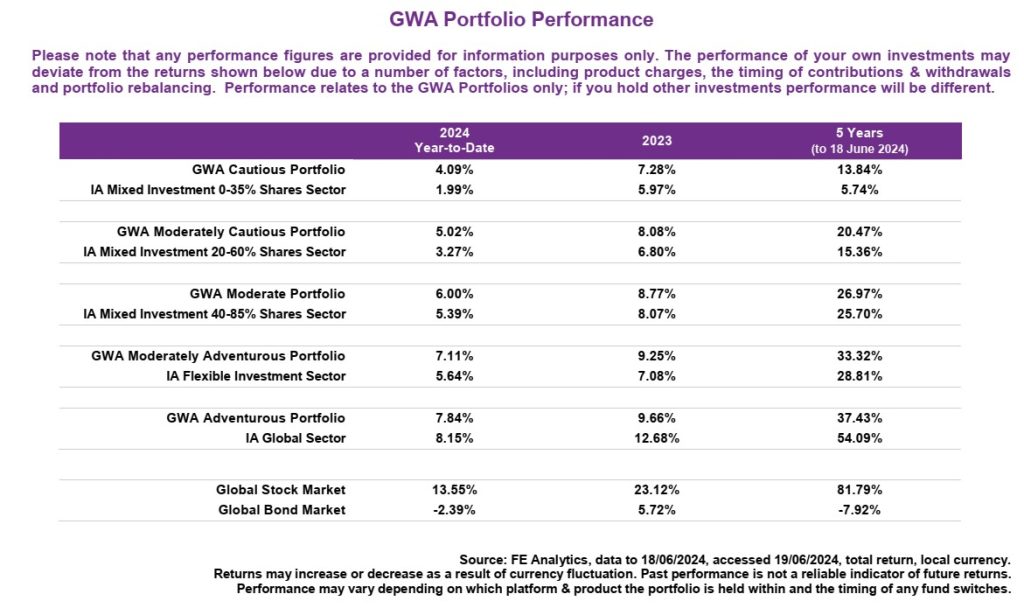

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.