Global Market Commentary – 7 August 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written 7 August 2025.

Interest Rates Decline

- Stock markets (MSCI World Index) rose in July and have gained 8% so far this year

- Bond markets (Bloomberg Global Aggregate Index) have risen by 6% this year

Key Themes

Risk appetite remained strong last month with the US and UK stock markets achieving new record highs. The first days of August have been a little more muted, with economic data proving mixed, but interest rates are on a declining path once again and may provide a lift. Overall, conditions remain bullish for now in the absence of any unexpected shocks.

UK

The FTSE 100 has had a strong month, up 4% and rising through the 9,000 level for the first time ever. Large companies are very much leading the way this year, with old staples such as tobacco, telecoms and banks among the leading sectors. The banks received a further boost this week, when the supreme court was seen to side with them on the car finance scandal.1 Such are the stakes, Lloyds rose 9% on the day, adding £4bn to its valuation.

The stock market might be doing well, but the economy is showing signs of weakness. Unemployment has risen to the highest level since June 2021 and recent GDP growth has been weaker than expected.2 Therefore, the Bank of England has cut interest rates to 4% today and may cut again before Christmas, despite inflation remaining above target at 3.6%. Pressure is also beginning to build on the Autumn Budget, to make further savings.

United States

The US has seen a similar deterioration in its employment data, which threatens to end a positive streak of monthly jobs growth that stretches back to January 2021 – the second-longest expansion in history.3,4 Some investors suggest the Federal Reserve has made another policy mistake, by leaving interest rates too high and allowing the economy to weaken. Jerome Powell’s 8-year stint as Fed Chair ends next May and he has shown a degree of intransigence against Trump’s demands for rate cuts. The latest data appears to be forcing his hand, however, with the Fed now likely to reduce rates in September. This should help stocks, although the likes of Microsoft and NVIDIA have powered to new highs already on the back of AI excitement

Europe

European stocks have performed well this year, with the Spanish, German and Italian indices gaining more than 20%. However, Adidas shares have declined 30% due to weak sales and the impact of US trade tariffs on its manufacturing hubs in Vietnam and Indonesia.5 This is simply the latest blow to the traditional sportswear giants. Adidas & Nike have both seen their share prices cut in half since their pandemic-era peaks in 2021, while Puma has lost 80% of its value over the same period. Analysts cite a lack of innovation to core products and increased competition from newer brands such as Lululemon, Hoka and On.6,7

Asia & Emerging Markets

Trade tariffs haven’t stopped Vietnam’s stock market from experiencing a sudden boom. The FTSE Vietnam index has surged 40% since May on the back of strong foreign investment, as the country takes measures to improve its status from a frontier market to an emerging market. The rise has been so sharp that the local regulator issued a formal warning today about the dangers of a speculative bubble.8 Elsewhere, Chinese stocks continue to drift higher, while India struggles to recapture its past momentum.

Bonds

Investors are enjoying the higher coupons that are now available from both government and corporate bonds, with yields much higher than they were during the 2010-2021 period. This provides a much firmer underpinning for the traditional 60:40 portfolio and should improve long-term return expectations. The yield on a 10-year UK Gilt stands at 4.5% and has remained relatively unchanged for several months, regardless of interest rate cuts.

Points of Interest

Lower base rates would certainly help to unlock the US housing market, which has suffered from very low transaction volumes since 2022. While the Americans lead the world in innovation across many fields, their mortgages aren’t portable and typically have a 30-year fixed rate. Many homeowners are therefore unable to move without giving up the low 30-year rates they locked in several years ago. Such is the effect, transactions are currently at similar levels to the 2008 financial crisis, with academics estimating that higher rates have reduced home sales by some 57%.9,10

Summary

Stocks have had a good run this year, after a sustained recovery from the April sell-off. As we enter the second half of the year, August is traditionally one of the trickier months, with low trading volumes during the peak holiday season. We should not be surprised if markets experience a dip, especially after a period of strong gains. However, with rate cuts providing stimulus and stock valuations remaining attractive in many regions, the outlook remains positive for the remainder of the year.

Sources may be found online HERE, or provided on request

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

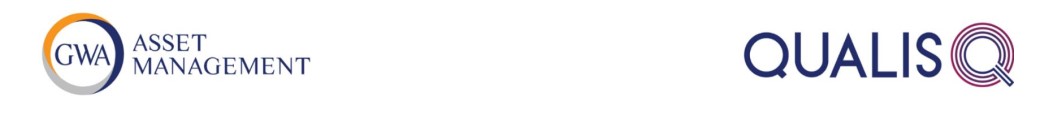

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

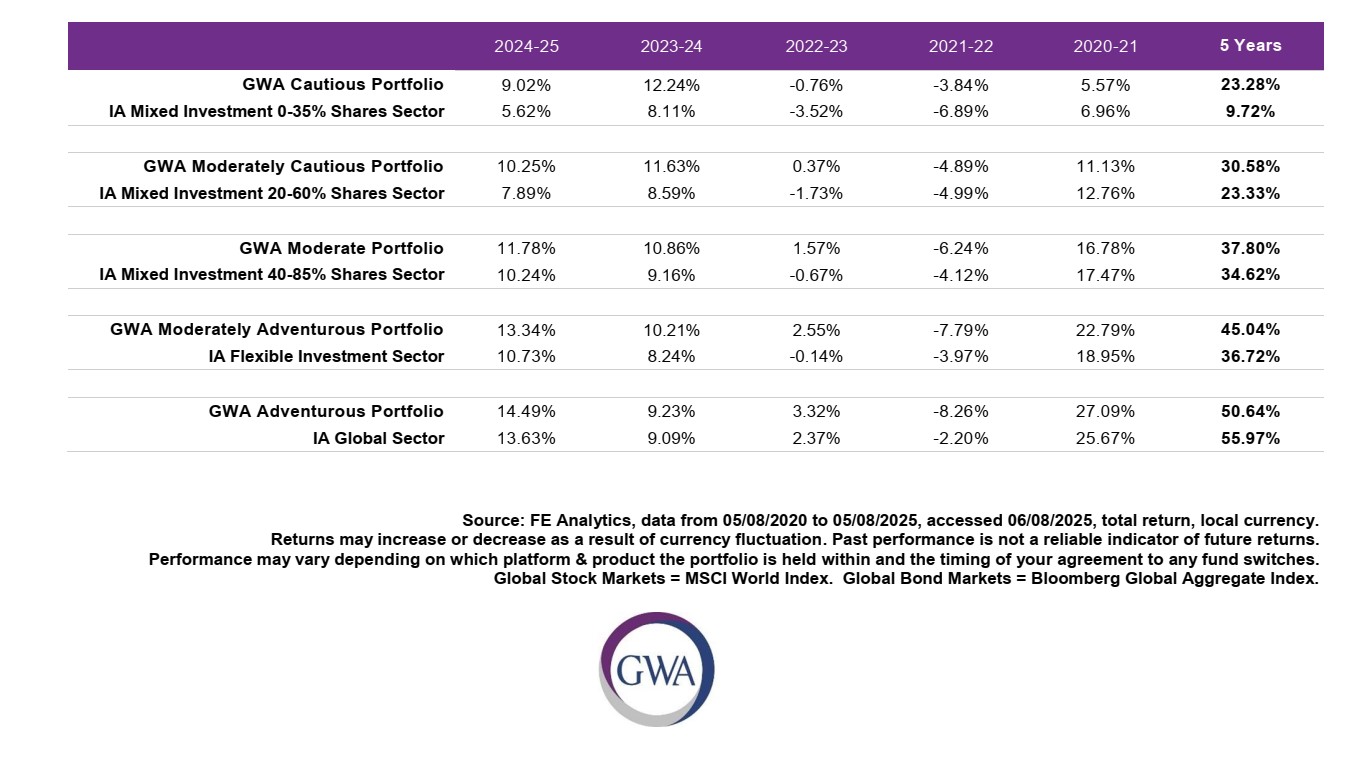

MGTS QUALIS FUNDS

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd

Fund Positioning

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk