Global Market Commentary – July 2023

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

A Strong Summer for Stock Markets

- The global stock market (MSCI World Index) rose 2.9% in July and is now up 18.5% this year

- The bond market (Bloomberg Global Aggregate Index) remained flat in July but has risen 3.0% this year

- This month’s inflation figures were encouraging and have lifted investor sentiment

Key Themes

2023 is doing its best to go down in history as one of the strongest years on record for stock market returns. If global stock markets were to continue at their current pace, they would produce the best annual return of the past 15 years. However, there are still risks heading into the latter part of the year, following very steep interest rate hikes. Markets are currently content that inflation is declining and there will be no major recession, but that can quickly change.

UK

UK stocks received a welcome boost on 19 July when monthly inflation figures came in comfortably lower than expected. The domestically-focused FTSE 250 mid-cap index gained 3.8% for its best single day return in more than eight months, and ended July up 4.1%. Housebuilders had their best daily performance since the 2008 financial crisis by rising 7.0%. However, they have since retreated somewhat as mortgage rates have remained elevated. The Bank of England raised interest rates once again on 3 August, to 5.25%. UK stocks remain attractively valued versus international peers based on many metrics. The headline FTSE 100 index rose 2.4% in July and is up 5.6% for 2023, including dividends.

United States

The S&P 500 rose 3% in July, taking year-to-date gains to 20% for the broadest US stock market index. The tech-focused Nasdaq index has gained a bumper 37% in 2023. Analysts are questioning whether such a strong rally can be maintained, or whether investor sentiment has become too optimistic. The US rally has now extended to smaller companies, with the Russell 2000 index rising 6% for the month, having spent the past year in a sideways range.

Note the pound has strengthened by 23% against the US dollar since September 2022. That makes it a good time for a US holiday, but it would have dampened the GBP returns from any US investments, if currency hedging was not used. The pound has also gained ground against the euro.

Europe

European equities continued a good year with a monthly gain of 2% for the pan-European STOXX 600 index. Most national indices returned 1%-2% on the back of cooling inflation and a better than expected figure of 0.3% Q2 GDP growth. However, the economic backdrop in Europe remains mixed and is not as good as the US. Italian stocks outperformed by rising 5%, taking 2023 gains to 29%. Spanish and French stocks have also done well.

Japan

Japan’s stock market has taken a breather, following strong gains from April to June. The yen halted its relentless decline versus other currencies: the Topix index is up 22.5% for the year, but unhedged UK investors would only have received 7.5% due to currency fluctuations. Major news came from the Bank of Japan on 31 July, as it moved away from a policy to pin its 10-year government bond yield at the lowly figure of 0.5%. Japanese investors are long-used to allocating their money overseas in search of a higher yield. If they can now get that yield at home, it could create a major shift in global investment flows – particularly in bond markets.

Emerging Markets

Asian stocks powered ahead in July, with returns of 9.1%, 7.2% and 6.5% for Vietnam, Hong Kong and China respectively. While many would find it counterintuitive to invest in a stock exchange named after one of the 20th century’s most prominent communist figures, Ho Chi Minh, the Vietnamese public are opening trading accounts in record numbers. Vietnam has returned 90% over the past 10 years in Sterling terms, versus 65% for the MSCI Emerging Markets average. Emerging market equities are threatening to break higher as a group, with positive returns for most markets in July, helped by US dollar weakness. They still have a lot of ground to recover, following a decline of 40% from June 2021 to October 2022.

Bonds

Government bond prices had a quick round-trip during July. Prices moved materially higher (yields lower) at the start of the month, following good US & UK inflation data. Prices fell back again (yields higher) later in the month, due to worries that strong employment data may actually result in sticky inflation. The Bank of Japan’s announcement then caused global bond yields to rise again. The end result: a flat month with UK 10-year gilt yields staying around 4.5% and the US 10-year yield at 4.0%. Corporate bonds remain relatively strong as recession talk dissipates.

Points of Interest

House Prices recorded an annual decline of 3.8% in July, marking the largest downturn since 2009. However, rental prices have gone up, rising by 10% year-on-year for new tenants. Average new rental prices have increased by 33% since 2019, to £1,231 per month. Void periods are also declining.

Inflation figures were good for June with CPIH only rising 0.2% month-on-month, the lowest figure since March 2022. Improving trends in household goods, food and restaurant & hotel prices have helped. The biggest impact by far was declining transport costs due to lower fuel prices. However, brent crude has risen 19.5% since 28 June, from $71 to $85 per barrel. If the oil price continues its ascent that could cause another inflationary pulse.

Summary

Financial markets appear to be moving at breakneck speed since the covid pandemic. Since February 2020, the S&P 500 has declined 35%, risen 120% and declined 28%, before now rising 31% from its October 2022 lows. Interest rates and government bond yields moved to 0% before climbing to 5% in one of the fastest rate-hiking cycles in history.

Economically, the deflationary pulse of 2020 gave rise to a negative oil price at one stage. Massive government stimulus then created a boom in consumption and house prices, followed by double-digit inflation. Oil hit $140 per barrel before halving again. The labour market is currently strong with inflation declining and financial markets rising. Where will markets turn next? Perhaps it is wisest to follow an adage from prominent US investor Shelby Davis: ‘don’t get too greedy and don’t get too scared, invest for the long haul’. Market timing has proven very difficult.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

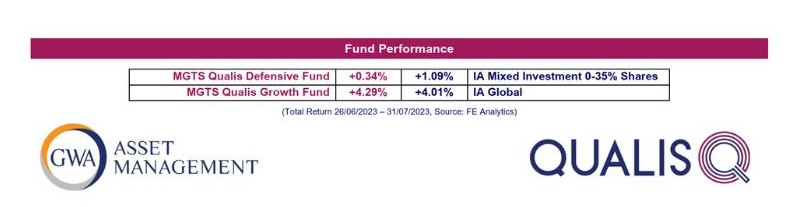

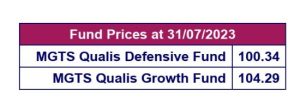

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

We are pleased to report the successful launch of the MGTS Qualis Funds in June 2023. The funds are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and is currently invested mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commercial property, commodities, alternative assets and cash. The fund does not hold any equities. The fund is currently focused on seeking a positive return while managing interest rate risk.