Global Market Commentary – July

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 25 July 2024.

Winds of Change

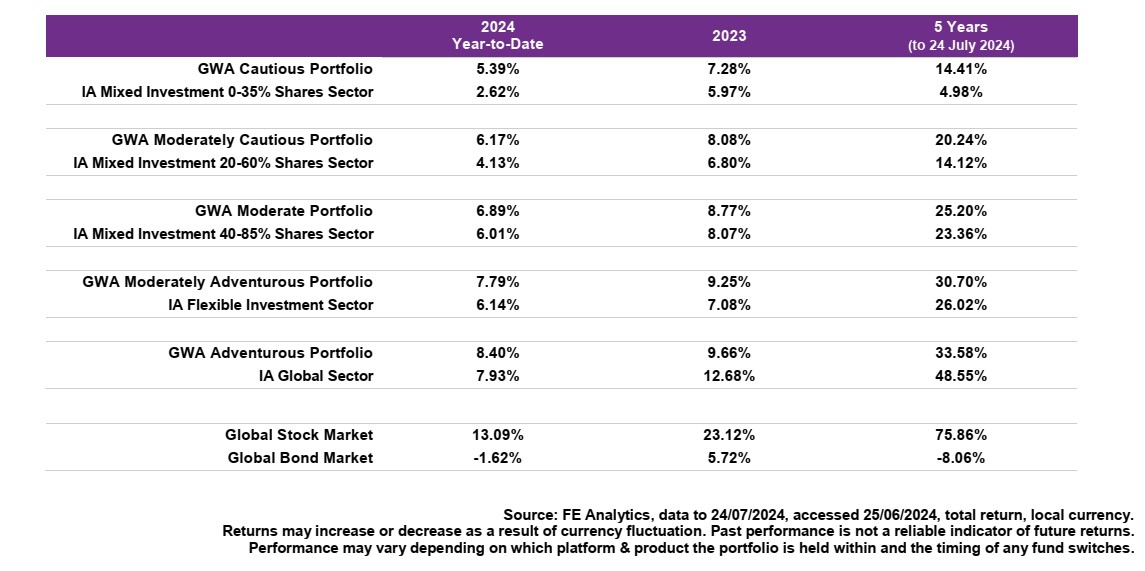

- The global stock market (MSCI World Index) has gained 13.1% so far in 2024

- The bond market (Bloomberg Global Aggregate Index) has declined by 1.6%

- Interest rate cuts are now imminent, as new governments are installed in many jurisdictions

Key Themes

2024 has been a very good year for investors so far, with stock markets in the UK, US and Europe all reaching record highs. Signs of weakness have emerged in recent weeks, as companies report their latest earnings: valuations in the US are high and some profit taking has occurred. The UK stock market appears cheaper, with an improving economy to boot. Many investors believe inflation is finally under control.

UK

The UK election concluded at the beginning of July with a new Labour government. Markets are fairly sanguine about the result, with the UK now seen as having a far stronger and more fiscally prudent government than other developed markets, such as France and the US. Some hope this will lead to foreign investors increasing their investment in UK stocks, which have been shunned since the Brexit vote in 2016.1, 2 In a boost to the London Stock Exchange, French TV business Canal+ has announced plans to list its shares in the UK rather than its home market.3

The FTSE 100 is up almost 8% year-to-date, while mid and small cap stocks have had strong returns. However, the higher-risk AIM All-Share Index is at the same level as 12 March 2020, midway through the Covid crash, and would need to rise 70% to regain its all-time high from September 2021.

United States

US stocks have experienced upheaval in response to poor quarterly earnings reports and the changing odds of a Trump presidency. A September interest rate cut is now considered a certainty and investors expect three 0.25pp cuts by year end.4 Lower interest rates and a Trump victory in November’s election are viewed as beneficial for small cap stocks versus large cap stocks:5 the Russell 2000 outperformed the S&P 500 by 10% over the week to 16 July, which is the widest margin since records began in 1986.6

Meanwhile, Nike dropped 20% for its worst-ever daily decline.7 It warned sales will fall due to weak Chinese demand and increased competition from newer brands such as Alo and Hoka. US “earnings season” has got off to a poor start: Tesla and Google also fell 12% and 5% respectively on 24 July upon weak results, causing the S&P 500 and Nasdaq to have their worst day in more than 18 months.8

Europe

The French election ended in deadlock and put investors on a defensive footing, as political instability is unlikely to provide a remedy for the nation’s poor public finances. France’s budget deficit and debt-to-GDP ratio are worse than the UK’s, while the risk premium attached to French debt recently hit a 12-year high, in comparison to German debt.9 France’s CAC 40 stock index has lost 6% over three months, in sterling terms.

Asia & Emerging Markets

Emerging market stocks have lost some of their prior gains in recent weeks, weighed down by a very weak Chinese economy and a decline in commodity prices. For example, the price of oil (brent crude) has dropped by 12% since mid-April, from $92 to $81 per barrel. Brazil has a large oil industry and its Ibovespa stock market index has fallen to the bottom of the emerging market leaderboard, losing almost 20% year-to-date in sterling terms. The MSCI Emerging Markets Index has gained 6% over the same period.

Bonds

Government bond yields remain relatively rangebound, with the annualised yield-to-maturity on 10-year UK gilts standing at 4.15%. Corporate bonds continue to fare well, with the high-yield “junk” bonds of risker UK companies returning almost 15% in the past year.10 With UK & US central banks set to reduce interest rates from 5.25% this autumn, it remains to be seen whether long-dated bond yields will decline in response to that, or if such a move has already been priced in. When yields reduce, it creates capital gains for bond investors through an increase in market prices.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Points of Interest

Shipping Rates are spiking back towards the peak levels of late 2021 when trade reopened from the Covid pandemic. The cost of shipping a container from Shanghai to Rotterdam has risen more than sixfold in the past year, from $1,292 to $8,267.11 Reasons include a rebound in western demand for physical goods and ongoing disruption to the key Red Sea route due to conflict in the Middle East. Such cost increases present a challenge for several UK retailers and may lead to further price inflation.

UK Defined Benefit (DB) Pension Schemes have benefitted from rising bond yields in recent years, after a decade of zero interest rate policy. Recent data shows more schemes are in surplus and deficit recovery contributions have reduced to such an extent that, for the first time ever, the largest UK companies are now paying more into their defined contribution (DC) schemes than their DB schemes.12

Summary

We mentioned last month that the summer months often bring a pullback in stock markets. Whatever the cause of these seasonal effects – weather, holidays and election cycles are often suggested – 2024 appears to be following the familiar pattern. UK and European stocks are below their peaks from mid-May, while the US has had a sharp reversal. Looking forward, support is on the horizon, in the form of interest rate cuts on both sides of the Atlantic.

Sources may be found online at, Sources-List-26-July-2024-002.pdf or provided on request.

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

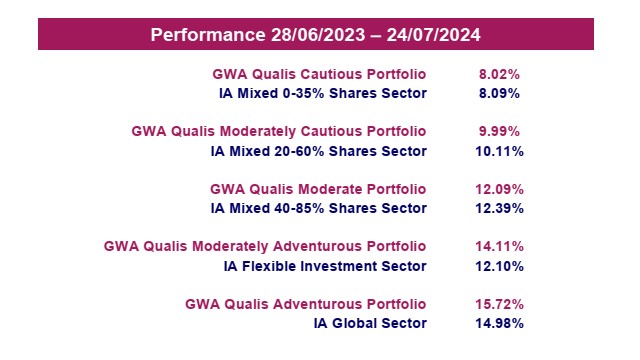

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis finds launched on June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has recently increased its allocation to smaller companies in the UK, Europe and US.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk