Global Market Commentary – August

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Markets Survive Japanese Scare

- Stock markets (MSCI World Index) gained 3.4% in August and have risen 16.9% in 2024

- Bond markets (Bloomberg Global Aggregate Index) gained 2.1% in August and have risen 1.8% in 2024

Key Themes

August began with a “flash crash” in Japanese stocks which declined 20% in the course of three trading days, following sharp movements in foreign exchange rates. However, the drama appears to have disappeared as quickly as it occurred, with stocks grinding higher for the remainder of the month. Closer to home, the Bank of England has made its first interest rate cut, while the Americans are expected to follow shortly. Stocks have had excellent gains in the past year and investors hope that lower interest rates will allow that to continue, while also giving government bonds a much needed boost.

UK

One of the most notable trends of recent weeks has been steady strength in sterling, with the pound having a good month against the dollar in August. It has now gained 8% versus USD since January 2023 and 5% versus the Euro. This benefits importers at the expense of exporters, and may draw the attention of holidaymakers looking ahead to 2025 deals. At 1.31/USD, there is plenty of headroom before sterling would recover its pre-Brexit level above 1.50.

This year has been good for the FTSE Small Cap index (+15%), as well as the FTSE 100 (+11.5%). In the real economy, recent GDP growth and surveys of business activity have been very strong,1,2 with all signs suggesting the UK is on an improving path relative to the stagnation of late 2022 & 2023.

United States

The focus of US investors turned to quarterly results from computer chip manufacturer, NVIDIA. The company has carved out a niche as the go-to supplier for the artificial intelligence industry and has supplanted Apple and Tesla as the most widely owned stock by retail investors.3 Despite strong results, the stock price declined in the days afterwards and some may question whether the previous high on 20 June may mark the top of this particular bubble. The stock has risen 25-fold over five years.

In broader terms, US stocks had a solid month, with the S&P 500 rising 3.8% in August to now stand at a 19% gain for 2024. Financial markets currently forecast that the Federal Reserve will cut interest from 5.25% to as low as 3.25% by mid-2025,4 and the Bank of England tends to mirror the Fed.

Europe

Europe’s Stoxx 50 index beat most others in August, with a return of 4.1%. However, this masks a mixed picture in the Eurozone economy. Overall growth is positive with a strong boost from the Paris Olympics, but the German economy reported an unexpected contraction and manufacturing remains subdued.5,6 Policymakers remain concerned about the economy and are likely to continue with the interest rate cuts which began in June.

Asia & Emerging Markets

From January 2021 to June 2024 the Japanese yen lost one-third of its value versus the US dollar, as higher interest rates in the west jarred with the continuation of zero interest rate policy by the Bank of Japan. When Japan then announced only its second interest rate rise in 17 years7 and the US signalled its intention to cut rates, a slew of major investors suddenly feared they would be caught offside in their “short Yen” trades, leading to a panic which caused Japanese stocks to suffer their worst day (-12%) since 1987.8 After the panic came the calm, with the TOPIX stock index regaining most of its losses by month end.

Elsewhere in Asia, the Chinese economy remains weak, in contrast to India which continues to go from strength to strength. The MSCI India stock index is up a whopping 62% in eighteen months, far outstripping the MSCI Emerging Markets index which has remained lukewarm at best.

Bonds

Interest rate cuts should be good news for government bonds, which have now experienced four years of relatively poor returns. The annualised yield-to-maturity on 10-year UK gilts currently stands at 4.1%, down from a peak of 4.7% last year. As yields decline, investors benefit from an increase in capital value. Corporate bonds remain well bid, despite the spike in volatility which permeated through financial markets at the start of August.

Points of Interest

Brent crude oil has declined from $92 to $77 per barrel since April (-16%), despite increased tensions in the middle east, with petrol station noticeboards already returning to the mid-130s in certain locations. The price weakness is due to poor Chinese demand and the OPEC cartel reluctantly lifting its supply constraints, due to internal pressures.9,10 Meanwhile, US presidential candidate Donald Trump has promised to ramp up US oil production, if elected.11

Summary

Amidst talk of economic growth and asset market returns, one of the most relevant factors this month has been the absence of any discussion about inflation. Financial markets can turn their attention very swiftly from one thing to another, and the latest inflation data is now seemingly less important than at any time during the past three years. Headline inflation is back towards target in the UK, US and Europe, therefore asset prices will now react more acutely to the rate of decline in interest rates, as well as any indications of economic weakness due to rates being kept too high, for too long. If a “soft landing” is achieved, the outlook for stocks and bonds remains positive.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found Sources List – September 2024

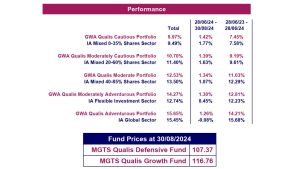

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

Source: FE Analytics, data to 30/08/2024, accessed 02/09/2024, total return, local currency. Returns may increase or decrease as a result of currency fluctuation. Past performance is not a reliable indicator of future returns.

Performance may vary depending on which platform & product the portfolio is held within and the timing of any fund switches.

Qualis Update

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest.

If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Japan.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk