Global Market Commentary – April 2024

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Interest Rate Dilemma

• The global stock market (MSCI World Index) is up 9.0% since New Year

• The bond market (Bloomberg Global Aggregate Index) has declined by 2.7% over the same period

• GDP growth forecasts are improving and inflation remains above target, despite high interest rates

Key Themes

At the end of 2023, investors expected the US and UK central banks to reduce interest rates by 1.50 -1.75 percentage points in 2024.1 A fortnight after the spring equinox, those expectations have reduced to only 0.25 – 0.75 percentage points2 and some are now questioning whether we will see any rate cuts at all. Headline inflation remains stubbornly above 3.0% on both sides of the Atlantic, with few signs that it will reduce to the 2.0% target. The stock market has shrugged this off so far, but government bonds are beginning to show strain in light of the possibility that interest rates remain higher for longer.

UK

UK stocks have picked up recently, with the FTSE 100 and FTSE 250 indices producing higher returns than most other developed markets in March, at 4.8% and 4.5% respectively. The FTSE 100 broke the 8,000 barrier for the first time ever on 2 April, albeit only briefly. The mid-cap FTSE 250, which is said to be more closely tied to the domestic economy, remains 19% below its previous high from July 2021. Economic growth remains weak in the UK and markets are currently pricing in a rate cut at the Bank of England’s 1 August meeting, with a broadly 50:50 chance of a cut being announced during the 20 June meeting.3

United States

The S&P 500 stock market index has gained 9.4% year-to-date, which is extremely strong, and British investors are now chasing US stocks to a record extent. In the last four months, Brits invested more money in North American equity funds than during the previous nine years combined (£6.69bn v £6.38bn). Meanwhile, cash has been extracted from domestic UK equity funds for 34 months in a row, with March recording the worst month for withdrawals (-£823m) in over a year.5

The US Federal Reserve do seem keen to cut interest rates from 5.33% at some point this year.6 The average US mortgage rate is close to 7%, so homebuyers would celebrate,7 and many claim that cuts would need to begin soon to avoid the appearance of interference in the November 2024 Presidential election. But with very strong GDP growth, near-record low unemployment and above-target inflation, the justification for cuts is not immediately apparent.

Europe

The European Central Bank is now receiving the right kind of data to support an interest rate cut. Eurozone inflation dropped by more than expected in March, to 2.4%, while economic growth remains anaemic.8 However, the ECB and Bank of England may be cautious about cutting rates before the US does, for fear of damaging the Euro and the Pound, versus the Dollar. On the stock market front, the Euro Stoxx 50 gained 4.3% in March and has risen 11% since the beginning of the year, helped by strong growth from some of Europe’s largest companies.

Asia & Emerging Markets

The Japanese stock market remains buoyant, with the Topix surging 15% in local currency terms year-to-date. The Bank of Japan have raised interest rates for the first time since 2007, but they still stand at only 0.0%-0.1%. This puts continued pressure on the Yen, which has lost more than 30% of its value since 2020 versus higher-yielding currencies in the West.9 Chinese stocks are attempting to stabilise following many months of losses, while the MSCI Emerging Markets index is ticking along reasonably with a 4.8% gain for 2024.

Bonds

After declining rapidly from October through December, government bond yields have climbed slowly higher in 2024 as the ‘last mile’ of the inflation fight proves more difficult than imagined. The headline UK Gilt yield has risen from 3.56% to 4.14% this year, while the equivalent US Treasury yield now stands at 4.59%. As the market price of a bond moves in the opposite direction to its income yield, this has created negative total returns so far in 2024.

Points of Interest

Last month we mentioned Gold had finally broken the $2,100 per ounce barrier and asked if further gains were to come. The world’s oldest inflationary hedge has now pushed on to $2,340. Meanwhile, Brent Crude Oil has gained 17.5% since the start of February, with Copper rising 15%. Both are sensitive to economic demand and may be responding to forecasts for an improvement in global economic growth for the remainder of 2024.10 Needless to say, higher growth and higher commodity prices tend to put upwards pressure on inflation, rather than downwards pressure.

Summary

We have talked a lot about interest rates – they matter so much because financial markets love them to be low. Stocks and bonds are priced more highly, it is easier for companies and individuals to borrow to invest… and maturing debt is easier to roll-over into new debt. With over $10trillion of corporate debt maturing by the end of 2026 around the world,11 that last point is important.

The main market assumption at the start of a new year often proves to be misguided in hindsight. Investors thought 2022 would be good,12 but it produced the worst bond market decline in over a century13 along with significant losses for stocks. At the beginning of 2023, investors feared a recession and more bad returns.14 Instead, the US economy boomed and the global stock market gained 23%.

This January, investors believed that central banks would cut interest rates a number of times in 2024, helping to extend the 2023 rally. Returns have been good in the first quarter, but that interest rate assumption is now being severely tested. It will be interesting to see how the markets react.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance. Sources can be found here – Sources List – 9 April 2024

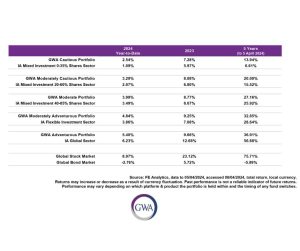

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

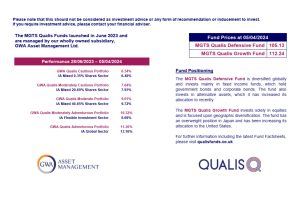

MGTS Qualis Funds