Global Market Commentary – 4 September 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written 4 September 2025.

Fiscal Policy Comes Into Focus

- Stock markets (MSCI World Index) have gained 10% this year

- Bond markets (Bloomberg Global Aggregate Index) have gained almost 7%

Key Themes

August followed a familiar path with stocks rising for the fourth month in a row. A number of factors are supporting the market, including interest rate cuts from the US and UK, a massive increase in US fiscal stimulus through President Trump’s “big, beautiful bill” and a significant decline in the value of the US dollar, which eases credit conditions for borrowers in emerging markets. Saying that, the UK budget deficit is drawing attention again and this could put a dent in investors’ enthusiasm by the time the Autumn Statement hits in the dark days of late November.

UK

The FTSE 100 continued its strong summer with a gain of 1.2% in August. Old stalwarts such as Rolls Royce, BT, Prudential and British Airways have all gained 15% or more in the past 3 months and between 50%-133% over 1 year, to remind us that some elephants do indeed gallop. When returns are good and valuations are cheap it attracts attention, and American investors have duly invested more money in the UK than any other country since April.1

The news isn’t all rosy, however. After selling off its high street stores for a paltry sum, WH Smith shares declined by 40% on 21 August on reports of accounting misstatements in its American business.2 The onus is now firmly on its more lucrative airport outlets to lift the share price back to previous levels.

United States

Results from AI computer chip maker NVIDIA showed the world’s most valuable company increased its revenue by 56% year-on-year.3 That may sound impressive, but the share price was actually down the next day – a reflection of the sky-high expectations surrounding the ongoing AI investment boom. The Nasdaq 100 technology index has risen by a whopping 42% since its intra-day low on 7 April, reaching new all-time highs, but there have been signs of exhaustion in recent weeks with gains being harder to come by.

Europe

The French government faces collapse with its Prime Minister being subject to a no confidence vote, due to difficulties passing an acceptable plan to improve a budget deficit which stands at 5.8% of GDP – almost double the EU’s 3% limit (and worse than the UK’s 4.8%).4 The cost of French government debt is now threatening to become higher than Italy’s for the first time since the Euro was created in 1999.5 It is perhaps no surprise that French stocks have lagged other European stocks this year, with a return of 7% for the CAC 40 index compared to 18% for the German DAX and 25% for the Italian MIB. Prime Minister Giorgia Meloni has managed to cut the Italian deficit in half since taking over three years ago and local stocks and bonds are responding very favourably.

Asia & Emerging Markets

Japanese inflation is now higher than US inflation for the first time in 48 years.6 This has caused its government bond yields and interest rates to surge higher, which echoes the experience of western economies in 2022. However, this does mean nominal GDP growth has accelerated towards 4% having averaged just 1.5% since 1981.7 Net net, the local stock market has achieved record highs while merger & acquisition activity has boomed.8

Elsewhere, Chinese stocks continue to make strong gains as the country recovers from the bursting of its property bubble in 2023-24. The MSCI China index has returned 18% in 3 months, helped by Alibaba rising 19% in one day on the announcement of its own AI chip.9

Bonds

After spending most of 2025 in a sideways range, 30-year Gilt yields spiked higher to reach almost 5.75% on 3 September. The increase in borrowing costs has sent alarm bells ringing in the Treasury, as the government looks towards 26 November knowing that it must raise even more money to achieve its aim of a balanced budget. Speculation is beginning to increase about the tax-raising measures that could be enacted, while the Chancellor will hope for yields to settle down again to alleviate the pressure. Favourable inflation data would be very welcome, albeit unlikely.

Points of Interest

The UK is experiencing a millionaire exodus as a result of Labour’s policies. According to one projection, the country will lose 16,500 millionaires this year – more than double any other country in the world. China sits in second place at an estimated 7,800 losses, while the UAE, US and Italy are projected to gain the most. Millionaire migration is said to be at record levels globally as the wealthiest individuals become more willing to relocate.10

Summary

Stocks have marched steadily higher throughout the summer and as things stand, 2025 could go down in the record books as a strong year. This marks a stark reversal to the feeling back in April, during the worst of Trump’s tariff announcements. Having moved so far and so fast it would not be surprising if markets now experience a dip, and for those who believe in seasonal patterns September is historically the worst month of the year.11 However, the mid-term outlook remains positive as recession risk is currently low with the services sector remaining particularly strong.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online here, or provided on request

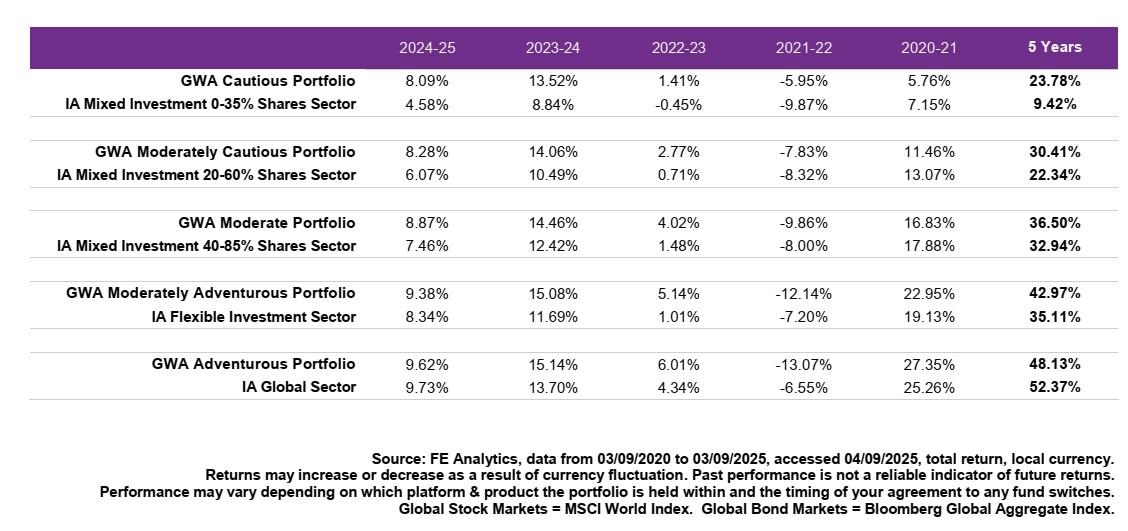

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

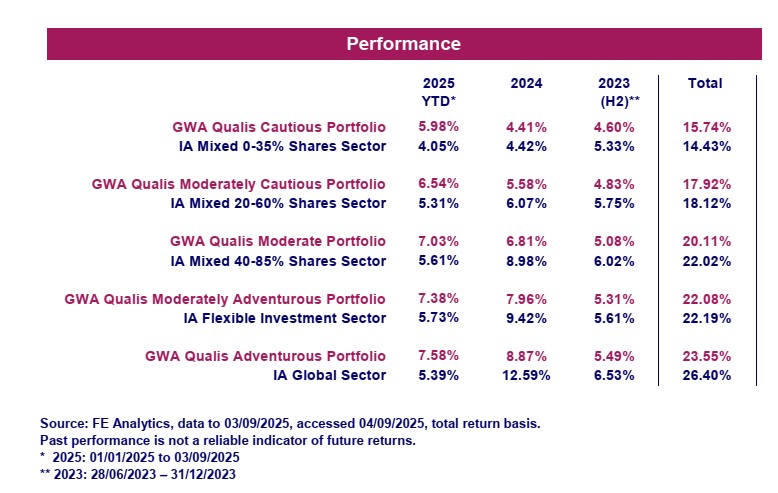

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

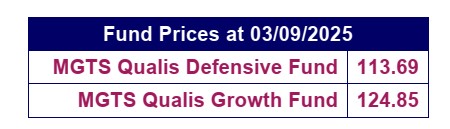

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk