Global Market Commentary – November 2024

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

No End To US Exceptionalism

- Stock markets (MSCI World Index) jumped 4.75% in November and have now gained 21.75% in 2024

- Bond markets (Bloomberg Global Aggregate Index) remained broadly flat, for the month and the year

- US stocks continue to dominate the rest of the world

Key Theme

The re-election of Donald Trump to the US Presidency has caused another large rise in US stocks, which were already doing very well. Indeed, his “America first” ideology is reflected in the way US stocks have outperformed others recently. In 2024, the MSCI USA index has risen by 28% while the rest of the world (MSCI World ex-USA) has only gained 8%. Some analysts say US companies are simply the best around and always will be. On the flip side, high valuations do exist and this may limit the scope for such remarkable returns in the future.

UK

Many commentators contrast the pro-business political backdrop in the US to the more gloomy tone taken by the UK’s new government. This is despite the UK having a smaller budget deficit and lower debt-to-GDP ratio than across the pond.1 Confidence and sentiment are key ingredients for economic growth. Since the summer, most indicators of UK business activity have turned down, with manufacturing now in outright contraction and services at roughly the break-even mark.2,3 Surveys cite “subdued customer demand” and “worsening domestic business conditions… in the wake of the Autumn budget”.4 It is therefore no surprise that UK stocks are also flat to down since the summer, after a strong period at the beginning of the year.

United States

US stocks have risen so much that they now make up almost 75% of the MSCI World index.5 This compares to little over 30% in the late-1980s.6 Since the presidential election Tesla shares have risen 37% on the back of Elon Musk’s close association with the Trump campaign. However, Google shares have struggled to make any headway, as regulators might force the sale of its Chrome browser to improve competition.7 Amazon also faces regulatory challenges from the EU.8 In fact, one of the main risks facing US stocks is that the “Magnificent 7” tech companies have now grown so large that they block market competition and will need to be broken up. However, such drastic change is unlikely to happen overnight.

One of the main expectations is that Trump’s presidency will be good for US industries and smaller businesses, due to protectionist trade tariffs. The Russell 2000 index of US small cap stocks has gained almost 8% in less than one month, since the election.

Europe

France provides another example that the political environment can have a significant influence on stock market returns. President Macron called a snap election on 9 June which returned a chaotic hung parliament. Since then the French CAC 40 stock index has lost 9%. With the German government also facing collapse9 and economic data remaining weak across the eurozone, European investors have placed more money in the American market recently.10 European stocks have underperformed US stocks in eight of the last ten years, and 2024 is on course to see the widest margin of US outperformance since the 1980s.11 There are concerns that Trump’s trade tariffs may hurt Europe more than other regions.

Asia & Emerging Markets

Chinese stocks spiked higher in late September as the local government announced financial stimulus measures. Meanwhile, China is one of the main targets for Trump’s tariffs. These are two competing forces and investors cannot quite decide which will prevail, with both the Shanghai Composite and Hang Seng indices trading in a wide sideways range over recent weeks. The movement in the US dollar may prove key: it has strengthened considerably, but Trump has often called for a weaker dollar to support US exports.12

Bonds

Government bond yields have finally settled down, at least for now. The annualised yield on a 10-year UK Gilt moved as high as 4.60% shortly after the Autumn budget, but now stands at 4.25%. These yields are closely tied to mortgage rates and they set the cost of borrowing across the economy: lower is better, to grease the wheels of the financial system. The Bank of England should continue cutting interest rates in the new year.

Points of Interest

The returns from US stocks pale in comparison to those of Argentina, which have more than doubled in value year-to-date, in sterling terms. Much of the success has been put down to the radical economic policies of President Javier Milei. This includes reducing taxes, cutting government spending by 30% and creating a Ministry of Deregulation.13 This has brought short-term pain to many, but investors believe there will be long-term gains.

Summary

The last decade has been dominated by US stocks. In that time, they have quadrupled while the rest of the world has doubled. With the US having a stellar year in 2024, the trend of outperformance seemingly has no end in sight. The largest technology companies in the world are well entrenched, and they now aim to prolong their success on the back of the artificial intelligence revolution.

Can the rest of the world keep up? We shall have to wait and see. But for the next four years at least, it appears the political environment in America may be friendlier to financial markets than the regimes in Europe and the UK. Recent history tells us that policy matters and makes a significant difference to investment returns. After all, taxes reduce profits, and profits drive shareholder returns.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found here or provided on request

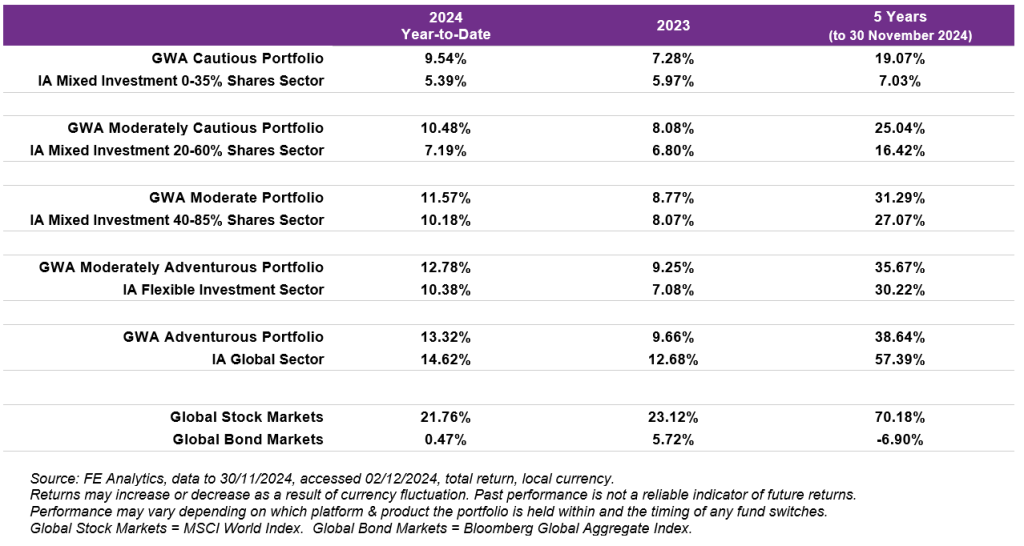

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

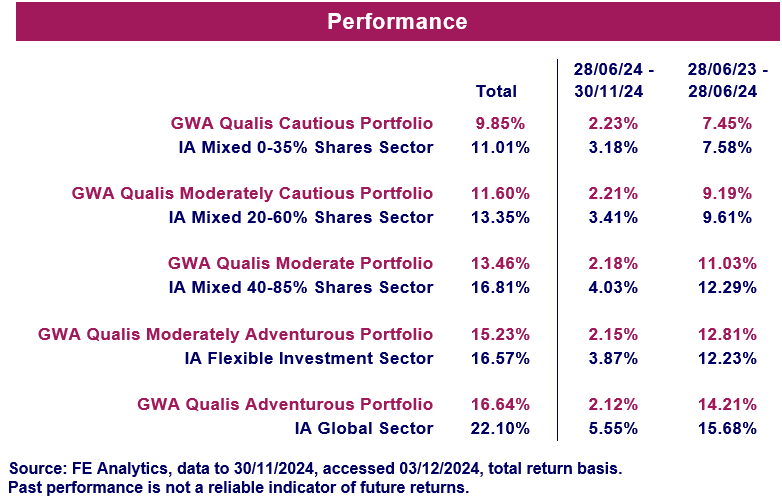

MGTS Qualis Funds

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia. The fund recently increased it exposure to US mid and small caps.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk