Global Market Commentary – 2 February 2024

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team. This article was written on 2 February 2024.

A Steady Start to 2024 –

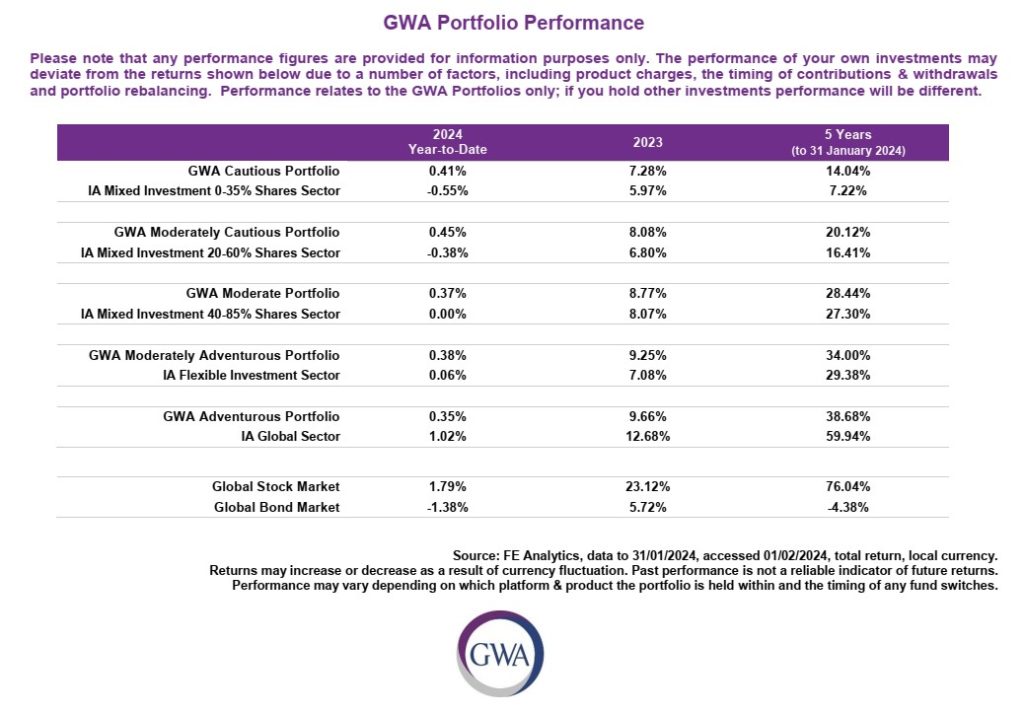

- The global stock market (MSCI World Index) began 2024 with a 1.8% gain in January

- The bond market (Bloomberg Global Aggregate Index) declined 1.4%

Key Themes

In recent days investors’ focus has turned to questioning the prior assumption that central banks will begin cutting interest rates in early spring. The US Federal Reserve Governor said rate cuts in March should be considered unlikely and it will remain ‘data dependent’ thereafter1. The Bank of England Governor also showed little desire to cut rates when he spoke on 1 February2. Inflation has moderated over the past six months but remains a concern and investors are watching for any uptick in unemployment while interest rates remain high. Further afield, weakness in China should not be overlooked.

UK

A relatively quiet period for UK stocks ended with the FTSE 100 declining slightly in January (-1.3%). Mid and small-cap stocks had similar returns. There has been some good news, however: British stalwarts Rolls Royce and Marks & Spencer have risen 185% and 70% respectively over the past year, on the back of promising turnaround plans from new management teams. We can only hope the rest of the market will eventually follow.

United States

The ‘Magnificent 7’ technology companies have been reminded that share prices don’t rise in a straight line, despite their dominant business models. Google’s share price declined 7% after disclosing slightly weaker than expected advertising revenue from its search engine, while Microsoft shares declined 3% after forecasting higher development costs for its artificial intelligence technology3.

Elsewhere, the US regional banking crisis reared its head again. New York Community Bancorp shares dropped by 38% on 31 January after disclosing losses from assets that it bought from the now-defunct Signature Bank4. Shockwaves were even felt in Japan the next day, when Tokyo-based Auzora bank declined 20% due to its own US commercial property losses5. Despite all that, the S&P 500 closed January 1.6% higher.

Europe

The European economy remains weak, but that hasn’t stopped its stock markets progressing in recent months. The Euro Stoxx 50 rose 2.9% in January and some of Europe’s largest companies have real momentum behind them. Denmark’s Novo Nordisk has quadrupled in five years, with speculation that it could someday reach a valuation as high as $1trillion through its weight loss drugs Wegovy and Ozempic6. Elsewhere, French luxury brands conglomerate LVMH (Louis Vuitton) and Dutch semiconductor equipment manufacturer ASML have also had strong gains. All three are now among the top 25 stocks in the world by market valuation7. The UK’s largest companies, Shell and AstraZeneca, sit outside the top 50.

Asia & Emerging Markets

We need to talk about China. The world’s second-largest economy and global manufacturing engine is experiencing a prolonged economic contraction. The property giant, China Evergrande Group, was ordered into liquidation on 29 January with $300bn worth of liabilities8 and the country’s top 10 housing developers have lost 84% of their market value since 20209.

With the property and financial sectors becoming central to the domestic economy in recent years10,11, systemic risk is real and has led people to discuss parallels with the Great Financial Crisis of 2008-09 or the Japanese deflationary spiral of the 1990s12. The Shanghai Stock Exchange began the year with a 6.4% decline in January, despite talk of stimulus measures.

Partly as a result of this Chinese malaise, the value of India’s stock market has exceeded Hong Kong’s for the first time ever13. The MSCI India index returned 2.2% this month, higher than most other emerging markets which averaged a decline of 1.8% (excluding China).

Bonds

UK government bonds experienced a selloff, as the headline 10-year gilt yield rose from 3.4% to 4.0%. The yield has now settled back a little, to 3.8%. Bond prices decline as their yields rise, so the average gilt investor would have lost 2.2% in January. Bond markets are very sensitive to inflation and interest rates and did not take well to the slightly hotter UK inflation data on 17 January14. In contrast, sterling high yield bonds – those issued by riskier companies, with less interest rate sensitivity – did fine and returned 1.6% on average.

Points of Interest

The world’s first Bitcoin ETFs were launched in the United States on 11 January. In a classic ‘buy the rumour, sell the news’ event, the price of Bitcoin duly declined by more than 15% in the two weeks that followed15. It has now recovered around half of those losses, to stand at $42,750 per coin.

Tesla founder Elon Musk was told by a judge that he would have to go without his proposed $56billion pay package, as it was ‘unfathomable’16. With Tesla shares down 25% this year, many investors will agree. The company itself is valued at $600billion.

Summary

The year has begun on a tentative footing following the excesses of November and December, when asset prices galloped higher. Investors have paused to reflect on the ‘wall of worry’ that is said to accompany most bull markets. Optimism has been scaled back, which is no bad thing: after all, if everything is priced to perfection then the only way is down.

As with most risky endeavours it is prudent to proceed with caution and investors are beginning to remember that in their January sobriety. So long as such risks are identified and managed, the way ahead can be rewarding. The Chinese economy, US regional banks, high interest rates and the threat of rising unemployment have all been signposted yet markets hope to prosper, regardless. 2024 is also likely to contain different surprises; let’s wait and see.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found here, or provided on request.

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

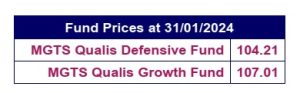

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commodities and alternative assets. Recently, the fund has been focused on opportunities in corporate bonds.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has an overweight position in Japan and has been increasing its allocation to smaller companies in the UK and US.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk

This article was written on: 2 February 2024.

To see sources from this article click here