Employers’ National Insurance Contributions (NICs)

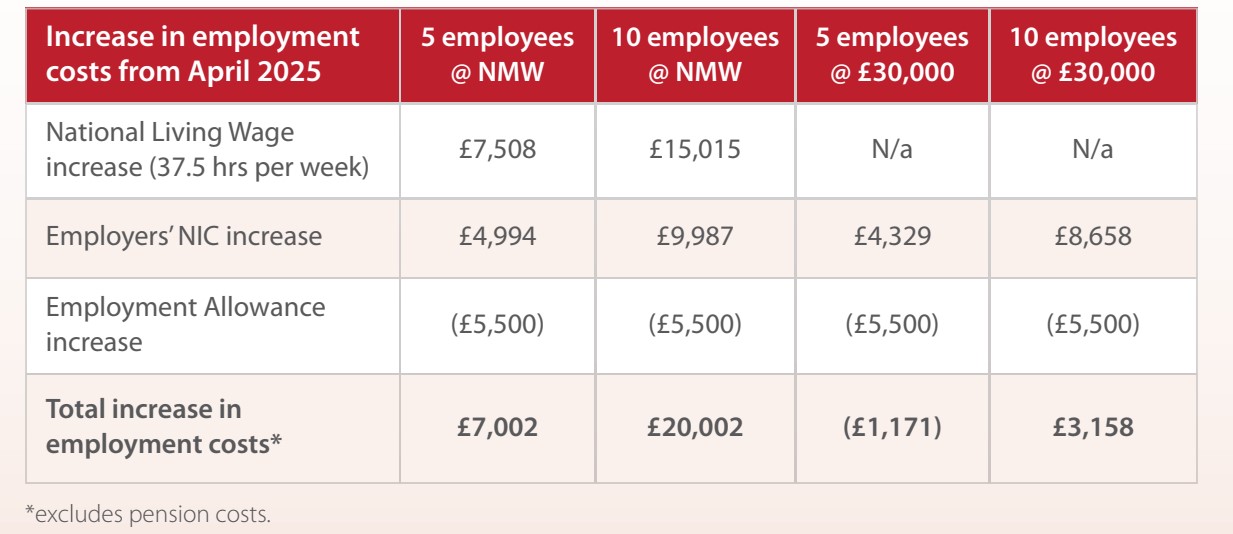

The biggest revenue raiser in the Budget was the changes to NICs. The increase in Employers’ NICs (increasing from 13.8% to 15% from April 2025) grabbed many of the headlines. What has been largely overlooked is the reduction in “Secondary Threshold” from £9,100 to £5,000. Allied to the increase in the National Living Wage, the changes will particularly affect those in the care, retail, hospitality and cleaning/maintenance sectors.

Whilst the increase in the NIC Employment Allowance (from £5,000 to £10,500) will partly offset some of the increased NIC costs, these changes will impact on some sectors more than others.

These changes will apply from April 2025, which is four short months away. All employers will be affected in one way or another. Understanding the impact on your own position is crucial to managing your costs effectively.