Global Markets Performance Update – 2021 Quarter 4

The final quarter of 2021 continued to provide plenty of challenges for governments, businesses, consumers and investors alike.

Initial optimism around growth in economic activity was counterbalanced by the rapid spread of the Omicron Covid-19 variant. Flash Purchasing Managers’ indices in the UK, Eurozone and US all fell, indicating slowing in the service sector. However, despite rising input prices and supply constraints, manufacturing remained buoyant.

The US Consumer Price Index (CPI) spiked to 6.8% in November; CPI increased to 5.1% in the UK. Unemployment fell to 4.2% in both countries.

In the US, the Federal Open Market Committee voted to accelerate asset purchase tapering; this is expected to run from January to March 2022. Also in the US, President Biden signed the Infrastructure Investment and Jobs Act. This long-awaited bill provides for $550 billion of additional spending on transportation, power infrastructure, broadband and the environment.

In the UK, record job vacancies led to concern of increased wage demands fuelling inflation: The Bank of England responded by increasing the base interest rate to 0.25%.

Elsewhere, the European Central Bank confirmed it will disband its dedicated emergency asset purchase programme in March, but ruled out an interest rate hike in 2022. An unreliable supply of Russian gas led to a sharp spike in gas and electricity prices across Europe, which added to inflationary pressures. Increasing interest rates and stubborn inflation remain headwinds for bond markets.

Overview:

- developed market shares ended the year strongly, as investors focused on economic resilience and earnings growth

- sovereign debt outperformed credit, with markets beginning to price-in interest rate hikes in the US

- overall, investors placed greater weight on the prospect of further earnings growth in 2022 than they did risk factors.

Regional Overview

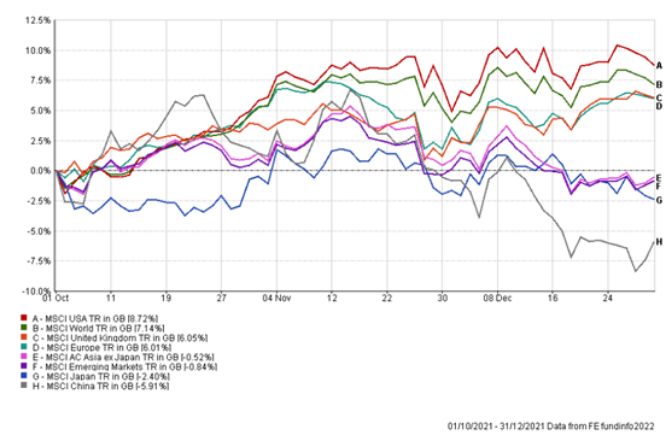

Source: FE Analytics (01/10/21 – 31/12/21).

Past performance is not a guide of future returns. Figures are quoted in GBP terms.

United States: US equities gained 8.7% over the quarter in GBP terms. Rising infection rates and asset tapering sparked investor concern in November but this largely subsided by the end of the quarter, with data suggesting continued robustness in the economy and earnings growth. Tech was the best sector, with chipmakers gaining strongly.

UK: UK companies also rose over the quarter with encouraging early data regarding the threat of Omicron moving a number of economically sensitive sectors upwards.

Europe: Eurozone shares gained over the quarter, strong profits, and economic resilience outweighing investor concern over increasing infection rates. Some countries introduced restrictions that, predictably, hit the travel and hospitality sectors. Again, investors drew a degree of comfort in early positive Omicron data indicating a lower risk of severe illness.

Asia: The Japanese markets ended the quarter -2.40% down (GBP terms). Following the general election in October, attention moved to a stimulus package that could include direct cash handouts to households in an attempt to increase domestic consumption. Covid-19 infection rates in Japan remain remarkably low. Inflation moved into positive territory in December but remains muted compared to most developed nations. Industrial production experienced strong growth as automobile manufacturing recovered from semiconductor shortages.

China also finished the quarter down owing to the persistent concerns regarding slowing growth and rising Covid-19 cases. Taiwan outperformed, aided by tech stocks.

Emerging Markets: Emerging markets ended the quarter down, US dollar strength being a key headwind.

In Brazil, inflationary pressures caused the central bank to unanimously vote to raise the benchmark interest rate to 9.25%, the seventh time policymakers increased the rate within a year.

Russian geopolitical tensions increased as military presence on the Ukrainian border stepped up.

Bonds

Bond markets were choppy in the quarter, led by central bank policy shifts and persistent inflation. Credit markets lagged sovereign. US high yield debt was the standout performer, supported by strong balances sheets and earnings data.

Commodities

Industrial metals were the strongest performer as the economic recovery gained traction. Within energy, the sharp drop in the price of natural gas was largely offset by higher gasoline and crude oil prices.

Summary

In summary, despite the rapid spread of the new Omicron variant, the final quarter of 2021 was a positive one for those investors with well-diversified portfolios.

As we move into 2022, the threat of emerging new Covid-19 variants alongside other financial concerns such supply bottlenecks, rising inflation and interest likely means further challenges for the global economy. However, uncertainty is always a component of investing and there are still plenty of reasons for optimism. A balance of assets alongside a clear focus on long term goals should continue to serve investors well.

GWA Portfolio Returns

Our results for the rolling 12 months to quarter 4 end are as follows:

| Investment Association Mixed Investment 0-35% Shares Sector | 2.84% |

| GWA Cautious | 4.16% |

| Investment Association Mixed Investment 20-60% Shares Sector | 7.20% |

| GWA Moderately Cautious | 6.84% |

| Investment Association Mixed Investment 40-85% Shares Sector | 10.94% |

| GWA Balanced | 8.35% |

| Investment Association Flexible Investment Sector | 11.30% |

| GWA Moderately Adventurous | 11.21% |

| Investment Association Global Shares Sector | 17.68% |

| GWA Adventurous | 13.31% |

Source: FE Analytics (31/12/20 – 31/12/21).

Past performance is not a guide of future returns. Portfolio returns are quoted net of fund management costs but gross of adviser and platform/custody charge. Figures are quoted in GBP terms.

Please note that the content of this review should not be considered investment advice or any form of recommendation.

If you require investment advice, please do not hesitate to get in touch with one of our Wealth Management team.