Market Commentary: 9 February 2026

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Stocks Rise Despite Software Struggles

- The MSCI World Index of developed market stocks has gained 2% so far this year.

- Bonds have also made slight gains.

- There are major rotations taking place in several markets, creating a bumpy ride.

Key Themes

Stocks started the year with gusto and many of the world’s major indexes gained between 2% and 6% within the first fortnight. However, since then the American market has been particularly weak and there have been signs of profit taking in certain areas. Software stocks are under pressure due to a theory that Artificial Intelligence (AI) could destroy their competitive advantages.1 Meanwhile, gold and silver have declined from their all-time highs.

UK

The UK stock market has been an area of relative strength since the middle of last year. With budget anxiety in the rear-view mirror and both the manufacturing and services sectors showing solid growth, 2,3 the FTSE has started to attract money from overseas investors, helped by its status as a “value” market.

However, the software sector has been hit very hard. In only three months, Autotrader (-39%), Rightmove (-32%), Experian (-25%), Sage (-20%) and Money Supermarket (-15%) have all declined drastically, as some investors bet that their business models will become obsolete with further advancements in AI. During the same period, the FTSE All Share has risen by 6%.

United States

The US has long been home to many of the best “software as a service” companies and its stock market is feeling the strain, although it has been counterbalanced somewhat by the semiconductor and hardware stocks that are seen as major beneficiaries of the AI buildout. Adobe, Salesforce and Booking.com have experienced double-digit declines, while Intel and SanDisk have made major gains.

Google & Amazon just announced plans to spend roughly $200 billion each this year, in an attempt to remain at the forefront of AI technology – a total that is similar to the GDP of Portugal.4,5 Investors are beginning to baulk at such costs and Amazon lost 10% in after-hours trading. Despite all the turbulence, the S&P 500 remains within 3% of its all-time high.

Europe

European stocks continue to move steadily higher, with the Spanish IBEX Index being one of the strongest performers in recent months. Southern Europe has benefitted from the European Central Bank setting a low interest rate of only 2% since last June. The pound lost some ground to the euro last week after the Bank of England held our own rates at 3.75%.

Asia & Emerging Markets

This is where the real action has been, of late. Over 6 months the Japan Topix Index and MSCI Emerging Markets Index have gained 26% and 23% respectively, in local currency. Brazil’s market is up 13% this year alone. Emerging markets lagged developed markets by a wide margin from 2021 to the middle of last year – making almost no gains during that time – but they have now come to life, helped by a weak dollar and broadening growth.6

Bonds

The yield on a 10-year UK gilt sits at 4.5% and has remained between 4.3% and 4.8% for a year now. Boring bond markets are healthy bond markets, and this is an attractive rate of income for investors looking to diversify their portfolios using a “safe haven” asset, in case of a stock market selloff. Eurozone bond yields are much lower and the government would be happy if gilt yields moved in their direction, to ease the interest burden.

Points of Interest

It has been a rollercoaster couple of weeks in the commodity and cryptocurrency markets. After gaining 200% in five months, Silver lost one-third of its value in a single day on 30 January and has remained extremely volatile since then, with daily moves of more than 10% in either direction.

Bitcoin also experienced severe declines – at one stage last week it had lost 50% of its value from its peak on 6 October. Both assets have been the subject of a “currency debasement” trade, but that appears to have lost steam.7 When the crowd rushes to the exit at the same time, large declines can be seen.

Summary

There is a saying among investors that “the year goes as January goes”, referring to the tendency for a strong January to be followed by a strong year overall.8 This suggests good news for the UK, Europe and Asia, which all experienced good gains. However, there have also been areas of weakness and the US has lagged behind other regions.

2026 may be a year that rewards investors who create proper diversification within their portfolios, rather than concentrating their bets in specific sectors or regions. Overall market conditions remain good, but there are some riptides lurking under the surface, and they could catch out anyone who leaves themselves unguarded.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online here, or provided on request.

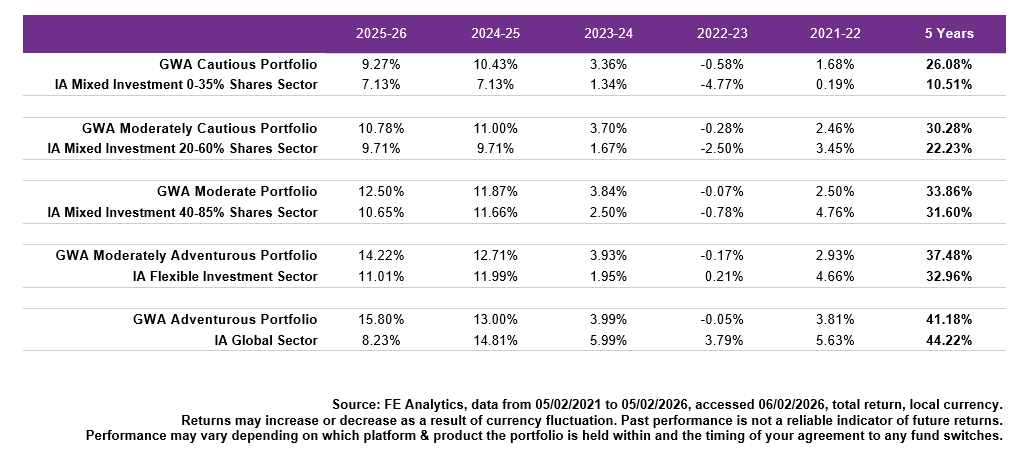

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

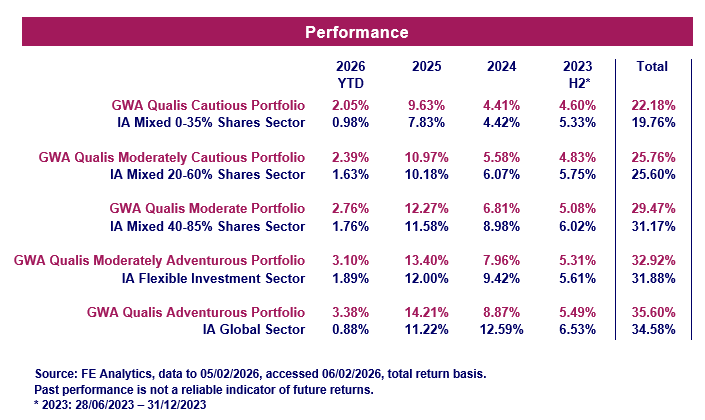

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in other assets, such as property and infrastructure.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has a broad range of investments across the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk