MGTS Qualis Defensive: 2025 Performance Review — Resilience by Design

2025 was another reminder that defensive investing isn’t about avoiding risk altogether, it’s about choosing the right risks and combining them in a way that delivers a smoother investor journey.

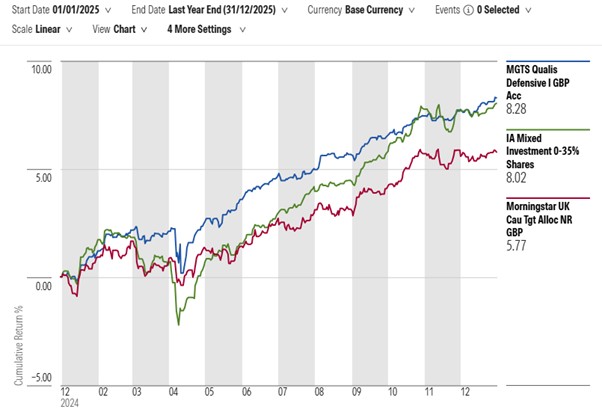

Against a backdrop of shifting rate expectations, uneven inflation data and frequent market mood swings, MGTS Qualis Defensive returned +8.28% in 2025, outperforming its benchmark by +0.26%, while also delivering the lowest drawdown in its sector during a year that tested diversification.

Source: Morningstar – https://www.morningstar.com/

So what drove the outcome? In short: a strong contribution from credit, combined with a carefully selected blend of alternatives, and a deliberate approach to duration and government bond exposure.

1) Alternatives: “true diversifiers” that earned their keep

A key differentiator in 2025 was the positive impact of our alternative allocations, specifically the performance and balance of active managers selected to provide differentiated return streams versus traditional bonds.

Our holdings in strategies such as:

- Argonaut Absolute Return Fund

- YFS Kernow Equity Navigator Fund

helped strengthen the portfolio’s ability to deliver returns without relying purely on one macro outcome. In a year where correlations between asset classes shifted more than investors might like, this element of diversification mattered.

The goal here is simple: build a portfolio where not everything needs to be “right” at the same time. Alternatives can provide that different engine of returns, particularly valuable when markets are choppy and leadership rotates.

2) Credit: carry plus manager skill in a rate-sensitive year

Credit was another major contributor. Importantly, the emphasis wasn’t just on collecting yield, it was on allocating to managers with the flexibility to navigate changing conditions.

Holdings such as:

- Man Dynamic Income & Global Credit Value Funds

- Aegon Strategic Bond Fund

- Nomura Corporate Hybrid Bond Fund

helped capture income while remaining selective about where risk was being taken. In 2025, that combination of carry (income) and active decision-making proved effective, particularly as markets moved between “rates higher for longer” anxiety and periods of renewed optimism around disinflation.

3) Why we favoured strategic bond funds

We specifically preferred strategic bond strategies because of the quality of the managers and, crucially, their broad mandate.

A strategic bond manager isn’t locked into one part of the market. They can move across:

- investment grade credit

- high yield (selectively)

- securitised assets

- duration positioning

- and even cash, when appropriate

That flexibility matters when bond markets are being pulled in multiple directions and 2025 had plenty of that. It allowed the portfolio to remain adaptive as the opportunity set changed through the year.

4) Government bonds: underweight due to fiscal uncertainty

We remained underweight government bonds, primarily reflecting ongoing fiscal uncertainty and the potential for volatility around sovereign yields. In an environment where government bond markets can become unstable quickly, particularly at longer maturities, we preferred to allocate risk elsewhere.

Our only government bond exposure was the iShares 3–7 Year US Treasury ETF, held in the sterling-hedged share class. This choice had two key benefits:

- Reduced currency volatility for sterling investors, particularly in a period of dollar weakness

- Maintained exposure to the longer-term relationship where dollar weakness often coincides with falling Treasury yields over time, supporting bond prices

In other words: we wanted the defensive properties of Treasuries, but in a more controlled, risk-aware way.

Looking ahead

Qualis Defensive is built around a simple principle: diversification must be real, not theoretical. In 2025, the blend of alternatives, flexible credit exposure, and cautious government bond positioning helped the portfolio deliver returns while keeping drawdowns low, exactly the outcome defensive investors’ value most.

Past performance is not a guide to future returns. The value of investments can fall as well as rise, and investors may not get back the amount invested.

Disclaimer –

This article does not constitute investment advice or an offer to sell or a solicitation of an offer to buy the products described within. You should consult your financial adviser before making any decisions.

Please note that any performance figures are provided for information purposes only and are not to a guide to future returns. The performance of your own investments may deviate due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing.

Important information –

As always with investments, your capital is at risk. The value of investments is not guaranteed and the income from them can fall as well as rise. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole consideration when selecting a product. The basis of taxation may also change from time to time. We have not considered the suitability of these investments against your individual objectives and risk tolerance. This article is intended for information purposes only.

The MGTS Qualis funds are operated by Margetts Fund Management Ltd (MGTS) the Authorised Corporate Director. GWA Asset Management Ltd (GWAAM) has been appointed as the Investment Manager, a wholly owned Greaves West & Ayre Group business. GWAAM is authorised and regulated by the Financial Conduct authority and is entered on the Financial Services Register https://register.fca.org.uk/ under FRN 960226

Margetts have full responsibility for the management and operation of the funds as the Authorised Corporate Director.

Margetts Fund Management Ltd is authorised and regulated by the Financial Conduct Authority no. 208565. More information about MGTS can be found by visiting their website – MGTS (mgtsfunds.com).