Global Market Commentary – 11 November 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Stocks Stumble After US Shutdown

- Stock markets have gained 15% this year (MSCI World Index).

- Bond markets have gained 7.5% this year (Bloomberg Global Aggregate Index).

Key Themes

News that the US government shutdown is nearing an end has caused stocks to rally early this week. With government services being curtailed since 1 October – the longest shutdown in history – markets had started to decline due to the economic losses which were being incurred.1 Investors have also questioned the high valuations placed on certain stocks in the artificial intelligence (AI) industry, with signs of profit-taking in some names. However, on a global level the recent price action appears to be little more than a small dip in a broader bull market.

UK

Focus is firmly on the Autumn Budget of 26 November, with speculation swirling about the tax rises that could be announced. This appears to be having a negative impact on mid- and small-cap stocks, which are domestically-oriented. They have made no gains for the past three months despite the FTSE 100 rising by 7% over that period, in line with its international peers.

There has at least been some good news ahead of the budget, with UK retail sales unexpectedly reaching a 3-year high and CPI inflation being lower than predicted, at 3.8% rather than 4%.2 The Bank of England chose not to cut interest rates but is expected to do so at its next meeting on 18 December.

United States

It was “earnings season” in the States once again, bringing a flurry of financial results from the world’s biggest companies. As usual, there were some clear winners and losers: Google and Amazon rose on strong earnings and cloud computing growth, but Microsoft and Tesla disappointed slightly.

There are emerging signs that investors are placing more scrutiny on AI spending. Facebook’s shares are down 15% since announcing its AI costs will increase again next year, while giving few details about the extra profits this will generate.3 In contrast, Apple is sticking firmly to its knitting: the new iPhone 17 has achieved strong sales, outselling the previous model, and this was a big reason for the improvement in UK retail sales mentioned earlier.4 Its share price has ticked steadily higher in recent months, to new all-time highs. US stocks have now risen for 6 months in a row, which is a very rare feat.

Europe

European stocks have been a little subdued since the summer, after a strong first half fuelled by increased defence spending and interest rate cuts. Adidas shares declined again and have now lost 1/3rd of their value this year, with the company’s US sales declining by 5% amid heavy discounting in the key training shoe market.5 On a more upbeat tone, Volvo shares had their best-ever day (+40%) as a cost-cutting program and strong demand for the updated XC60 model created a marked improvement in profits.6

Asia & Emerging Markets

Amid all the action, it is arguably the Far East that has fared best in recent months. The FTSE Korea index has surged, with Samsung being a major beneficiary of the huge demand for AI computer chips. Its shares are up 87% this year. Meanwhile, the Japanese & Chinese stock markets have marched consistently higher, helped by expectations of increased government spending in both nations.

Bonds

The Chancellor will be relieved to see that gilt yields have declined in the past month, with the 10-year yield moving from 4.7% to 4.4%. With the cost of borrowing being lower it should create some wiggle room within the budget – up to £5bn worth, by one estimate.7 If gilt yields reduced further it would certainly help, but inflation probably needs to decline materially for that to happen. Elsewhere, there have been corporate bankruptcies and rising repossession rates in the US car loan market, creating some talk about cracks appearing in their apparently strong economy.8

Points of Interest

High-profile US congresswoman Nancy Pelosi has said she will retire after next year’s mid-term elections. Her spectacular investment returns are just as notable as her four decades in office. “The Pelosi Portfolio”, as it has become known, has increased in value from around $785,000 in 1987 to $133million today – a market-beating return of 16,900% which shows the power of compounding (averaging 14.5% per year).9 Her success is built on high-growth technology stocks. It has also created public pushback against congressional stock trading, with conflicts of interest being a concern.

Summary

Another month, another gain for stock markets. It can’t continue like this forever and there are clear signs of profit-taking in some of the most popular trades. This feels like a test to see whether a renewed bout of “buy-the-dip” behaviour will drive stocks to fresh highs once the US government re-opens. The UK remains weighed down by the upcoming budget and a clear trend can only be determined after that date. But overall, this is still a bull market in stocks across the globe, while interest rate cuts should persist well into 2026 to support other assets such as bonds and property. Investors can continue to dance, until the music clearly stops.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online here, or provided on request.

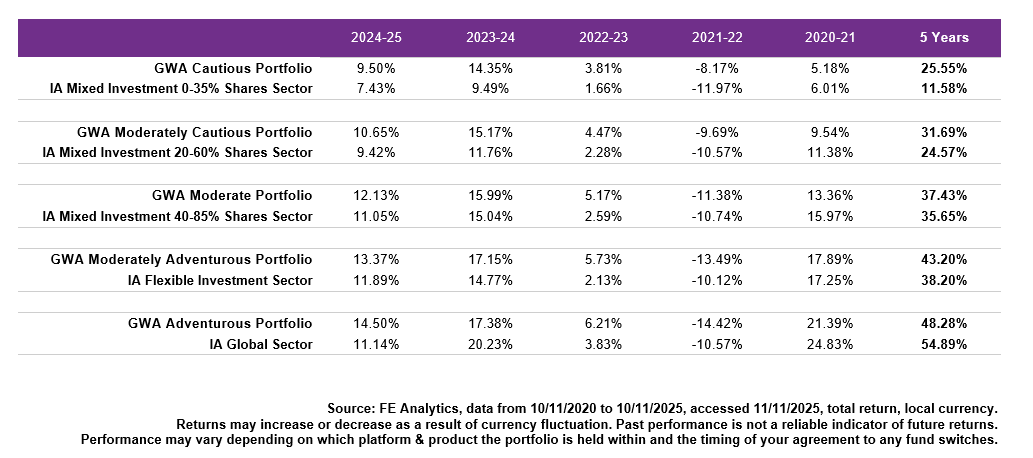

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

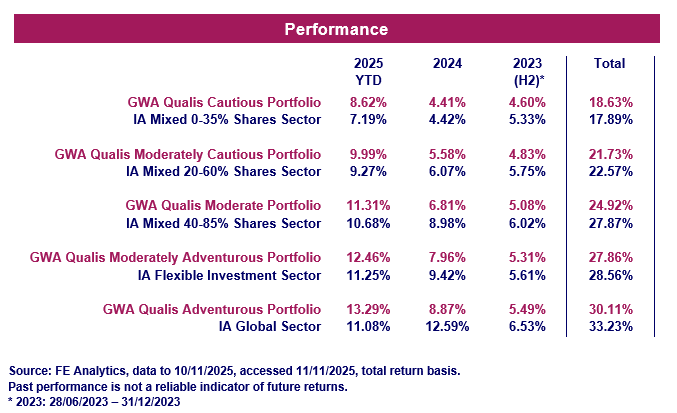

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk.