Global Market Commentary – 7 October 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Echoes of the 90s

- Stock markets have made strong gains this year.

- Bond markets have also risen.

- Currency movements have been sharp at times, with the US Dollar declining significantly.

Key Themes

Stocks are at record highs and have now risen for five months in a row. Such a hot streak is quite rare, happening only 11 times since 2009.1 An artificial intelligence (AI) investment boom is at the heart of the rally. This has caused some people to say there are similarities to the historically strong, internet-fuelled gains of the 1995-2000 period. Whether we do sit in that type of cycle remains to be seen. However, there is no arguing that stocks have fantastic momentum at the moment, with gains being made across the globe.

UK

September really was a strong month, with the FTSE 100 gaining 3.5% and the FTSE Small Cap index rising 4.5%. The mining sector is now leading, having more than doubled in value since the start of the year. This follows a strong rise in the price of precious metals such as gold and silver, and industrial metals such as copper. One large-cap copper miner, Antofagasta, has risen almost 50% since 1 August on global supply concerns.

In other news, B&Q and Screwfix owner Kingfisher plc had its biggest one-day gain since 1986 (+18%) when it reported an unexpected uptick in demand. Its sales rose 3.9% over six months.2 The firm has struggled to grow its profits in recent years, but the latest results offer some hope.

United States

From 1995 to 2000 the S&P 500 index of US stocks rose in an almost perfect uptrend at a rate of 28% per year, until the “dot-com bubble” eventually burst. Since January 2023 the index has risen at a rate of 24% per year, hindered only by the April tariff tantrum, amid a potential AI bubble. Both periods had huge capital investment into new technology, offering a step-change in productivity. Are we only mid-way through a similar 5-year boom? Will the technology create enough benefit to make the record spending worthwhile? The story is still to reach its conclusion. Whatever the ending, it will likely go down as one of the most notable periods in market history. AI spending is expected to reach $1.5 trillion in 2025.3

Europe

Last month we mentioned that the French government was facing collapse. It did collapse, and the new Prime Minister has already resigned just weeks into the job. The French financial markets have not reacted well, with stocks declining and government borrowing costs rising.4 European stocks have had high returns this year, but this presents a fresh challenge in one of the region’s biggest markets. The European Central Bank has already reduced interest rates to 2.0%, providing the bulk of its stimulus, and is unlikely to cut rates again any time soon.5

Asia & Emerging Markets

In a stark contrast to France, Japan’s stock market gained almost 5% yesterday on news that Sanae Takaichi is due to become the country’s first female Prime Minister. Likened to Margaret Thatcher in both the historic precedent and her style, Takaichi is expected to focus on deregulation and stimulating the economy.6 The stock market gains did come at the cost of some currency weakness however, with the Yen down 2%.

Elsewhere, China has roared back to life with a gain of almost 40% for Hong Kong’s Hang Seng index so far this year. This has helped the MSCI Emerging Markets index to climb by 26% in the same period.

Bonds

The cost of UK government borrowing remains a concern, reaching its highest level since 2008. The 10-year borrowing rate (4.7%) is higher than other developed nations such as the US (4.1%) and Germany (2.7%). Even Greece can borrow more cheaply at only 3.4%, given its close links to the EU. With debt interest payments costing almost as much as defence and education combined,7 any further increase in gilt yields would be difficult to stomach.

Points of Interest

Gold has now doubled in value in only two years, gaining far more than the Nasdaq technology index during that period. Its price has breached $3,900 per ounce for the first time ever. Central banks from all around the world have been big buyers, increasing their reserves from record low levels.8 Many investors have also bought gold as a long-term store of value, as the global money supply increases and debt levels expand.

Summary

We are in the middle of a classic bull market. Stocks are creating new all-time highs on a monthly basis, across the globe. Nominal growth rates are quite high, when combining inflation with real GDP growth. As central banks cut interest rates and governments inject money through fiscal deficits, the party continues for now. Of course, there will be one or two bumps along the way and future events remain unknowable, but from a global perspective “risk-on” conditions are firmly in the ascendancy.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online here, or provided on request.

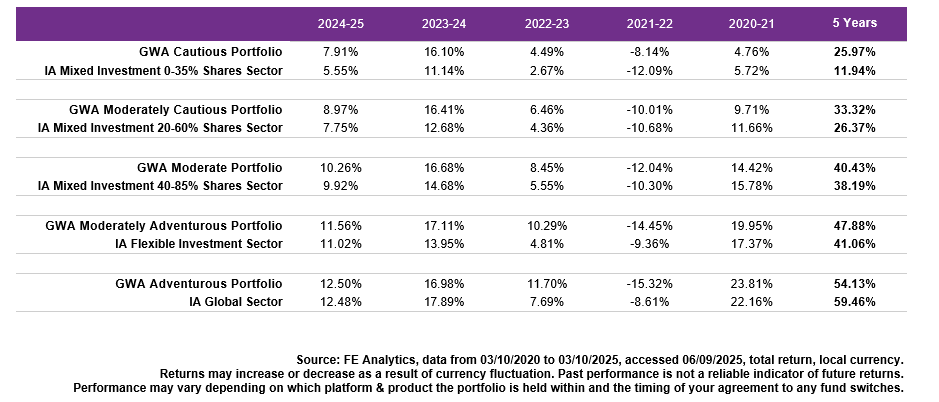

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

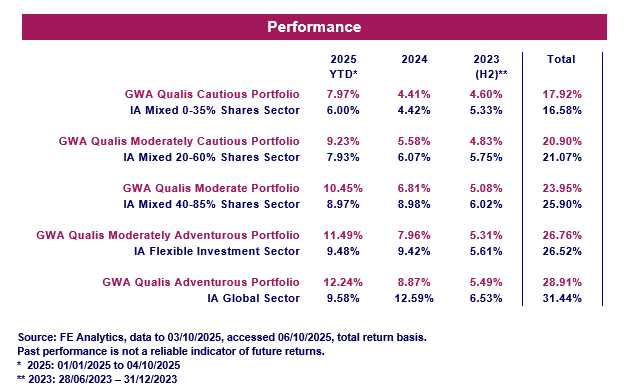

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk.