Global Market Commentary – February 2025

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

Reassessing Value

- Stock markets (MSCI World Index) declined 1.0% in February, but remain up 1.5% year-to-date

- Bond markets (Bloomberg Global Aggregate Index) are up 2.2% this year

- Value stocks have outperformed growth stocks in recent weeks

Key Themes

2025 has been a mixed year, so far. The winners of 2023 and 2024 are not currently faring so well, with US stocks lagging behind Europe and the UK as the “Magnificent 7” technology companies decline in value.1 Inflation may be increasing again and the path for interest rate cuts remains uncertain. Tariffs and geopolitical developments are causing concern. Amidst such a backdrop, the market is favouring more conservative stocks with high dividend yields, attractive share buybacks and low price-to-earnings ratios, where they can be found.

UK

The FTSE 100 has continued its good run and has now gained 8% year-to-date. With a high proportion of its companies residing in the financial, energy and industrial sectors, the index has benefitted from investors rotating into value stocks from more expensive growth stocks.

It hasn’t all been plain sailing, however. Travel companies had been doing well since last summer due to strong demand for overseas holidays – with British Airways stock more than doubling in that time. But a poor trading update from Jet2 on 19 February appears to have put a dent in the post-pandemic recovery. The company cited pressure on customers’ discretionary income, an increase in late bookings and higher hotel prices as factors that could impact profit margins in the year ahead.2 Jet2 stock fell 10% on the day, with others such as On the Beach (-6%) and EasyJet (-4%) declining in sympathy.

United States

February was another busy month in the US stock market, headlined by the latest results from the world’s most valuable computer chip maker, NVIDIA. Its stock has risen more than 1,000% since late-2022 to reach a similar valuation to Apple, due to a leading position in the artificial intelligence industry. On 26 February NVIDIA announced revenue had more than doubled from the year before, with a strong forward outlook.3 The stock nevertheless declined 8% and now sits more than 20% below its all-time high.

It is not difficult to find data comparing current US valuations to the dot-com boom of the late 1990s,4,5 and in that context it may not be surprising that some high-flying stocks are having their wings clipped. Tesla declined 27% in February, Google was down 16% and Amazon dropped 10%. All told, the Nasdaq technology index has underperformed most others recently and is down 5% so far this year.

Europe

European stocks continue to lead developed markets this year, with a gain of almost 12% for the EuroStoxx 50 index so far. Spain and Germany have been standout performers, with the IBEX and DAX up 15% each. Meanwhile, March began with a sharp rally for defence stocks, following pan-European talks on Ukraine.6 German armoured vehicle maker Rheinmetall gained 14% in one day, with UK firms such as BAE Systems (+13%) and Rolls Royce (+5%) also benefitting from a potential ramp-up in defence spending.

The biggest winner from the latest developments has been the Russian stock market, however. The RTS index jumped 20% in February, with the rouble also advancing 10% for a total gain of more than 30% in dollar terms.

Asia & Emerging Markets

The Chinese stock market continues its recovery, and in this case it is the technology companies that are leading. The e-commerce giant Alibaba has gained 60% this year, with Temu’s owner PDD Holdings up 18% and other tech firms achieving double digit gains. Japan has been broadly flat, while there has been a recent bout of profit-taking in Indian stocks.

Bonds

Government bonds seemingly cannot decide which direction they want to move in. Over the past three months, the annualised yield on a 10-year US treasury bond has gone from 4.1% to 4.8% and back to 4.1% again. As the global standard for a “risk free rate”, such instability has led to different theories about what is driving the price. Concerns about government debt levels have quietened a little, for now, with focus shifting to the possibility of a tariff-induced global economic slowdown.7 That could lead to more interest rate cuts than expected and a classic flight to safety trade, into bonds.

Points of Interest

Cryptocurrencies seem to have broken lower, from their recent range. After spending 14 weeks between $92,000 – $107,000 per coin, Bitcoin has declined to $83,000 at the time of writing. Even Trump’s announcement of a US strategic crypto reserve8 could do nothing to stem the losses.

Value stocks have comfortably outperformed growth stocks this year. The MSCI World Value Index has gained 5.5%, compared to a 2.3% decline for the growth index. The selloff in US tech stocks and cryptocurrencies could suggest investors are finally taking stock of high valuations and speculative frenzy, after a two-year “risk-on” period where growth beat value by the widest margin in 25 years.

Summary

Stocks continue to climb their proverbial wall of worry, with the new US administration providing no shortage of headlines to react to. As we begin March, stock markets are taking fright at US tariffs being enforced on Canada and Mexico, while developments in Ukraine remain highly uncertain. No wonder government bonds are attracting a bid. Meanwhile, perhaps surprisingly, the FTSE 100 quietly makes all-time highs, perhaps showing that diversification – and traditional valuation metrics – remain key to long-term success.

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

Sources may be found online here, or provided on request.

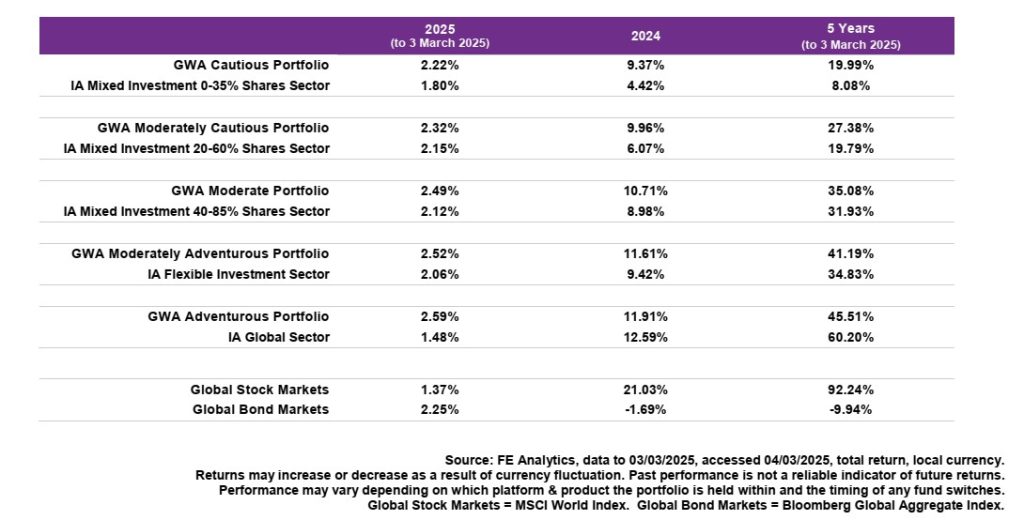

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

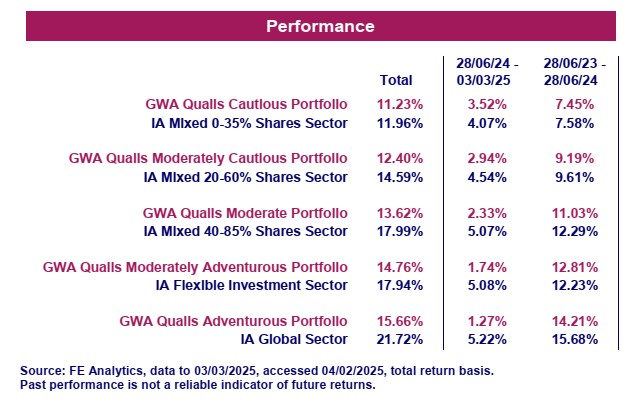

The MGTS Qualis Funds launched in June 2023 and are managed by our wholly owned subsidiary GWA Asset Management Ltd

Fund Positioning –

The MGTS Qualis Defensive Fund is diversified globally and invests mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in alternative assets, such as property.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund invests primarily in the UK, US, Europe and Asia. The fund recently increased it exposure to US mid and small caps.

For further information including the latest Fund Factsheets, please visit qualisfunds.co.uk