Scotland vs England – A Taxpayer Comparison

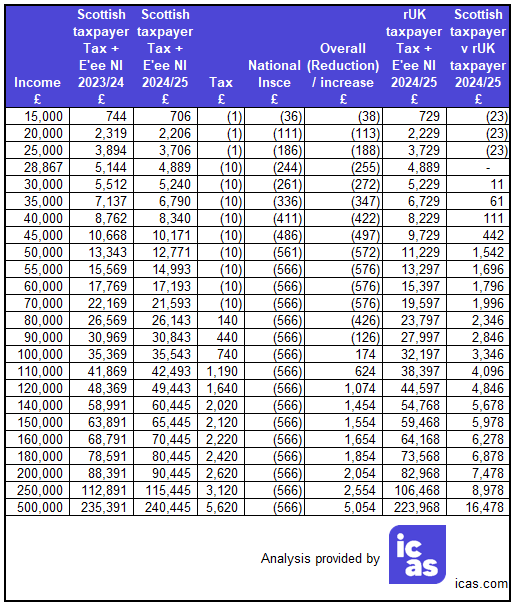

The Institute of Charted Accountants Scotland (ICAS) has made an interesting and very useful comparison of the 2023/24 Scottish Tax Rates against those announced in the Scottish Budget of 19 December 2023, for 2024/25.

ICAS have also looked at the differences between a Scottish taxpayer and the rest of the UK. Even at modest income levels (£50,000), there is at least a £1,500 differential.

An employee in Scotland earning £110,000 will take home less than someone in England, who earns £100,000. One way or another, that £10,000 differential is purely tax. In addition, for employees, the marginal rate of 69.5% extends all the way from £100,000 to £125,140.

Source: ICAS