Global Market Commentary June 2023

Please note that the content of this review should not be considered as investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.

A New Bull Market?

- The global stock market (MSCI World Index) rose 4.7% in June and is now up 15.1% this year

- The bond market (Bloomberg Global Aggregate Index) declined 0.2% in June but has risen 3.0% this year

- The UK has been left behind as the Bank of England struggles to tame high inflation

Key Themes

The first half of 2023 has flown past with a number of stock markets recovering strongly following a poor 2022. The US and Japan have led the way, aided by an artificial intelligence investment boom and new regulation aimed at improving shareholder returns, respectively. Investors remain focused on inflation and central bank interest rate movements and any markets that show improvements in those measures are being rewarded with strong inflows of capital.

UK

While many overseas stock markets have surged higher, UK stocks have struggled due to stubbornly high inflation and a flatlining economy. Core inflation has increased to 7.1% – the highest figure since 1992 – at a time when core inflation in Europe and America is now declining. Headline inflation is 8.7% and higher than any other G7 economy, while real GDP growth fluctuates around 0%. As a result, UK stocks lagged their overseas counterparts with a half-year return of only 3.2% for the FTSE 100 index, far behind the global average. Mid-sized companies fared worse, remaining flat over six months, while the AIM All-Share Index declined 8.5% amid dismal conditions for small-cap growth investors.

United States

In our January review, we said ‘in the five previous instances where US stocks rose 5% or more in January following a negative prior year, the average full-year return has been a barnstorming 29%’. At the half-year mark, the S&P 500 has now risen 16.6%. Will the trend continue to year-end, or will the lagged effect of interest rate hikes finally hit the US consumer and bring about the recession that many economists have predicted? New unemployment claims just experienced the biggest drop in 20 months, first-quarter GDP growth was revised upwards from 1.3% to 2.0% and inflation has fallen to the lowest figure in two years, at 4.0%. The US stock market thinks it has its answer: a ‘goldilocks’ economy, meaning risk appetite can return. All in stark contrast to the UK. The Nasdaq index has already returned 32.3% in H1 alone, as tech stocks lead the way.

Europe

Germany tipped into recession, but nonetheless its DAX stock market index climbed 1.9% in June to end the first half up 6.6% and near to its all-time high, on hopes that Chinese stimulus will boost export demand. Italy, Spain & France all fared better, with half-year returns of 22.3%, 19.3% & 17.4% respectively. Global manufacturing remains in contraction, in contrast to an expanding services sector, which favours peripheral Europe.

Japan

Japanese stocks have attracted global attention, with the TOPIX index rising 6.6% in June to finish H1 up 22.4%. This comes on the back of a fresh initiative from the Tokyo Stock Exchange, to make its companies more competitive and investor-friendly. Japan contains a large number of old-fashioned conglomerates which hold shares in each other, reward conservative management decisions and hoard a large amount of assets such as property and cash. The new reforms are aimed at unravelling those cross-shareholdings and releasing value from disposable assets, in order to return more money to investors and create leaner, more competitive businesses. Overseas investors are certainly taking note.

Emerging Markets

China makes up 30% of the MSCI Emerging Markets Index but is holding it back in terms of returns. The Shanghai Composite is down 5.4% this year and has remained flat since 2017. In contrast, other emerging markets such as Mexico, Brazil, Vietnam and India have returned 2%-6% this year and between 20%-100% since 2017. Those economies are attempting to move onwards despite Chinese demand faltering. A weak US dollar has helped.

Bonds

UK government bond yields have moved markedly higher since mid-May, in response to high inflation. The benchmark 10-year gilt yield now stands at 4.4% – the same level which created headlines last September following the mini-budget. UK, US & EU yield curves have remained inverted for the past year, with short-term yields higher than long-term yields. This is traditionally a strong recession indicator, albeit often quite far in advance.

Points of Interest

The Bank of England attempted to reclaim its credibility by raising interest rates by 0.5% on 22 June, to a 15-year high of 5.0%. This pushed many new mortgage rates towards 6.0%. Despite this, average house-price-to-salary multiples remain high by historical standards. Stocks related to the UK housing market, such as estate agents and housebuilders, ended the month with their share prices heading south at a rate of knots, signalling trouble ahead.

Artificial Intelligence threatens to become the next great investment bubble, following in the footsteps of railroads (1840s) and the internet (1995-2000). Many analysts forecast that its impact on the real economy could be even greater than the industrial revolution. The excitement created by ChatGPT has led to massive gains for AI-related technology stocks in the US, such as Nvidia and Microsoft, with the former quickly becoming the latest $1trillion company by market valuation. Excluding technology stocks, the S&P 500 is only flat for the year.

Summary

Markets are once again becoming ‘bifurcated’, to borrow a term which was very popular in financial markets throughout 2021. This time around, we are seeing certain countries leap forwards based on local factors and their exposure to new technology. Another term from the past – stagflation – threatens to become more relevant here in the UK. Hopefully, we may start to see prices coming down on supermarket shelves and energy bills, allowing the UK stock market to join in the global rally. For now however, geographic diversification is key

Note: Past Performance Is Not A Reliable Indicator Of Future Performance

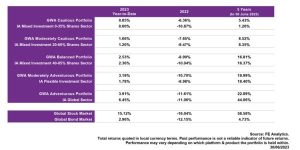

GWA Portfolio Performance

Please note that any performance figures are provided for information purposes only. The performance of your own investments may deviate from the returns shown below due to a number of factors, including product charges, the timing of contributions & withdrawals and portfolio rebalancing. Performance relates to the GWA Portfolios only; if you hold other investments performance will be different.

MGTS Qualis Funds

Please note that this should not be considered as investment advice or any form of recommendation or inducement to invest. If you require investment advice, please contact your financial adviser.

We are pleased to report the successful launch of the MGTS Qualis Funds on 19 June 2023.

The funds are managed by our wholly owned subsidiary, GWA Asset Management Ltd.

Fund Positioning

The MGTS Qualis Defensive Fund is diversified globally and is currently invested mainly in fixed income funds, which hold government bonds and corporate bonds. The fund also invests in commercial property, commodities, alternative assets and cash. The fund does not hold any equities. The fund is currently focused on keeping interest rate risk to a minimum, in the face of high inflation and rising interest rates.

The MGTS Qualis Growth Fund invests solely in equities and is focused upon geographic diversification. The fund has overweight positions in Japan and the US. The fund is underweight UK equities, reducing home bias. The fund also has a material position in semiconductor stocks, which have benefitted from the artificial intelligence investment theme.