Global Markets Performance Update 2022 Quarter 3

The quarter started with the markets displaying some optimism amidst hopes that inflation was peaking. While this led to a solid rebound in July, any optimism was quickly eroded and shares and bonds turned lower in August and September. July’s rally was led by markets pricing-in interest rate cuts from the US Federal Reserve (Fed) in 2023. However, in August the Fed, and other central banks, reaffirmed their prioritisation of quelling inflation over supporting economic growth and made aggressive interest rate hikes that prompted a sharp sell-off in the second half of the quarter. Overall, global equities fell by -6.7% (MSCI World) and bonds -7.4% (Bloomberg Global Aggregate) in USD terms.

Overview

Markets gained in July as investors focussed on the possibility of interest rate cuts from the Fed in 2023 amidst concerns of slowing economic growth. However, the Fed reiterated its commitment to combating inflation – even at the expense of growth – in the Jackson Hole summit in August. This spooked investors, with the market moving to price-in a more aggressive series of rate hikes than had initially been envisaged. This sent shares and bonds sharply lower. Over the quarter, central banks hiked policy rates by 1.5% (Fed), 1.25% (European Central Bank) and 1.0% (Bank of England).

Economic data for the third quarter points towards a global growth slowdown, with the Purchasing Managers’ Index (PMI) for the Eurozone in September sitting at 48.1, the UK 48.4 and US 49.5. (A PMI level below 50 indicates contraction and above 50 growth). This contributed to concerns of global recession. In fact, GDP data indicates that the US economy is already in a technical recession.

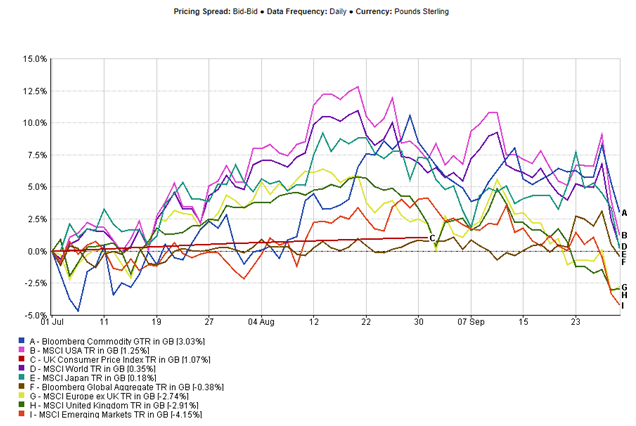

Overview of Regional and Asset Class Performance in Q3

Source: FE Analytics (01/07/22 – 30/09/22).

Past performance is not a guide of future returns. Figures are quoted in GBP terms.

United States

US equities fell in Q3 as the economy entered technical recession and consumer confidence dropped close to its lowest level in decades. However, other sources of data pointed towards economic resilience, particularly within the labour market. The communication sector was among the weakest sectors over the quarter, whilst the energy sector proved durable.

Europe

Eurozone shares fell further in Q3 against a backdrop dominated by rising inflation, the ongoing energy crisis and resultant fears of prolonged recession. All sectors posted negative returns over the quarter with particularly steep falls posted in communication, healthcare and real estate.

Annual inflation for the bloc was estimated at 10.0% in September*, a 0.9% increase from August. Soaring energy costs proved the primary contributor to inflation in the region. Nord Stream 1, the main source of gas supply from Russia to Europe, closed for much of the quarter which exacerbated worries about energy shortages in the winter. The euro fell to a 20-year low against the US dollar.

*Source: Eurostat

UK

UK equities fell in Q3. Liz Truss’s election as the new Prime Minister and the fiscal package proposed by her government was poorly received by the markets, sending Sterling to record lows against the US dollar.

Large cap energy companies and consumer staples outperformed, aided by the reputation for the resilience of these sectors in an environment characterised by high inflation and slowing growth. The strong dollar was also a positive, given that these companies garner a large portion of their revenue overseas. In contrast, domestically focussed companies suffered widely due to concerns that rising energy costs and climbing interest rates would lead to reduced spending capacity.

Global Bonds

As a result of persistent inflation and central bank policy rate hikes, bond markets remained volatile throughout Q3.

Over the quarter, the Fed increased the federal funds rate by 75 basis points to 3.0-3.25% which saw the US 10-year treasury yield rise to 3.83%, and the 2-year to 4.23%. UK gilt yields also jumped, led by expectation of further rate hikes and a lack of confidence in the government’s mooted fiscal policies. The UK 10-year gilt yield moved from 2.20% to 4.15%.

Government bond yields were higher over the quarter, and credit spreads wider. The credit spread represents the difference in yield between fixed interest securities of a similar maturity profile, but different creditworthiness of issuer. In this instance, credit spreads widened amidst concerns that the economic growth prospects may ail further as a consequence of inhospitable monetary policy.

Commodities

Declining energy, industrial metal and precious metal prices sent broad commodity indices lower over the quarter. Due to lower oil prices, energy was the weakest component. Industrial metals, copper, aluminium and nickel prices all weakened and gold and silver both fell within precious metals. Within agriculture, higher prices for wheat and corn helped to offset price falls for cotton, sugar, and coffee.

Summary

In summary, the story for Q3 was similar to the first half of the year: against a backdrop of slowing global growth, stubbornly high inflation rates, rising interest rates and growing geo-political tensions, markets performed poorly. As we move into Q4, the global economy is still facing many challenges and there is pessimism around. However, labour markets remain robust and it is a possibility that the markets have already factored in the ‘bad news’. Uncertainty is a permanent feature of investing but we understand there are risks and we are firmly committed to helping our clients focus on their long term goals.

Please note that the content of this review should not be considered investment advice or any form of recommendation. If you require investment advice, please do not hesitate to get in touch with a member of our qualified team.