2020 Letting Relief Changes – What You Need to Know

In an earlier blog post from Summer 2019, we highlighted that the Capital Gains Tax (CGT) reporting window on residential property was changing.

As part of the ongoing HM Revenue & Customs (HMRC) focus on individuals that own multiple dwellings, we now want to draw your attention to changes related to the final period of ownership and stricter conditions for Letting Relief.

Under current legislation, HMRC allow for the final 18 months of a dwelling’s ownership to be exempt from CGT if at any point in the property’s ownership it has been your Principal Private Residence (PPR). However, draft legislation now reduces this from 18 months to nine months on any sales made on or after 6 April 2020.

In addition, the previously advantageous Letting Relief is also under review. From next April, HMRC propose that this will only be available to property where landlords reside with a lodger rather than a property that was previously their PPR.

This relief is currently worth the lower of:-

• £40,000 (£80,000 where civil partners and spouses own a property jointly)

• the gain remaining after PPR relief has been applied

• the gain arising during the actual let period.

With this in mind, if you are currently considering disposing of a property that would qualify for these reliefs the timing of that disposal is now crucial.

To show how these changes impact on the sale of a residential property qualifying for these reliefs we have provided the following examples. For the purposes of this, we have assumed that the annual exemption, tax rates and tax bands remain the same in the year ended 5 April 2021 as they are in 2020.

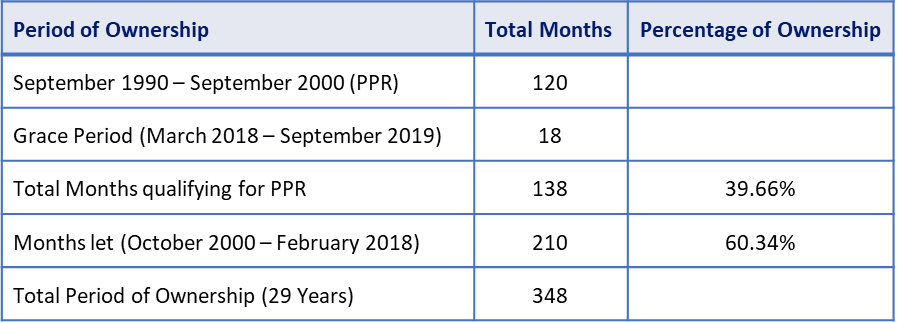

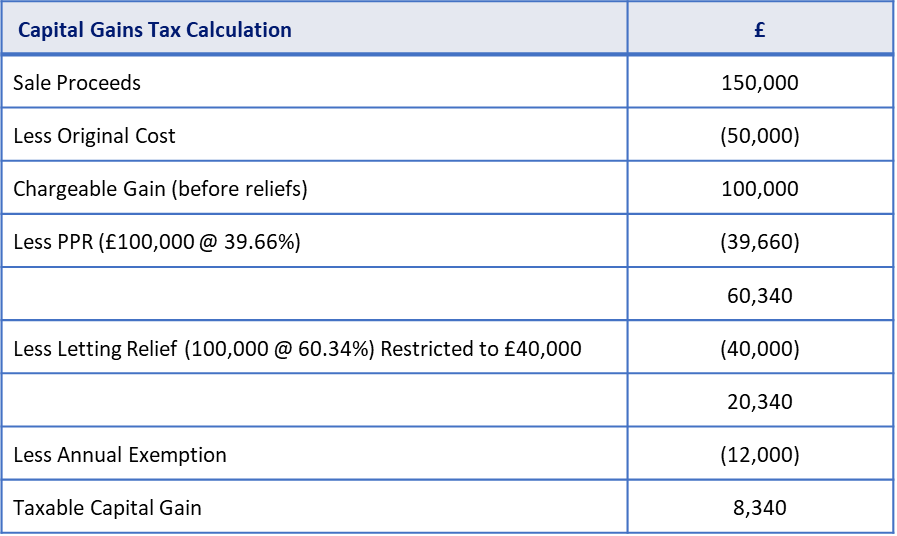

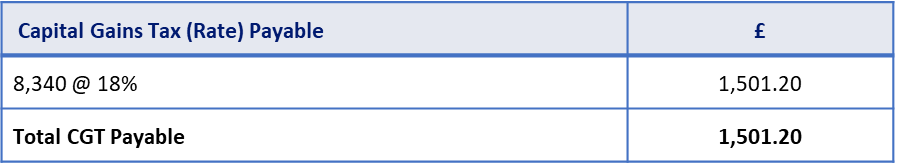

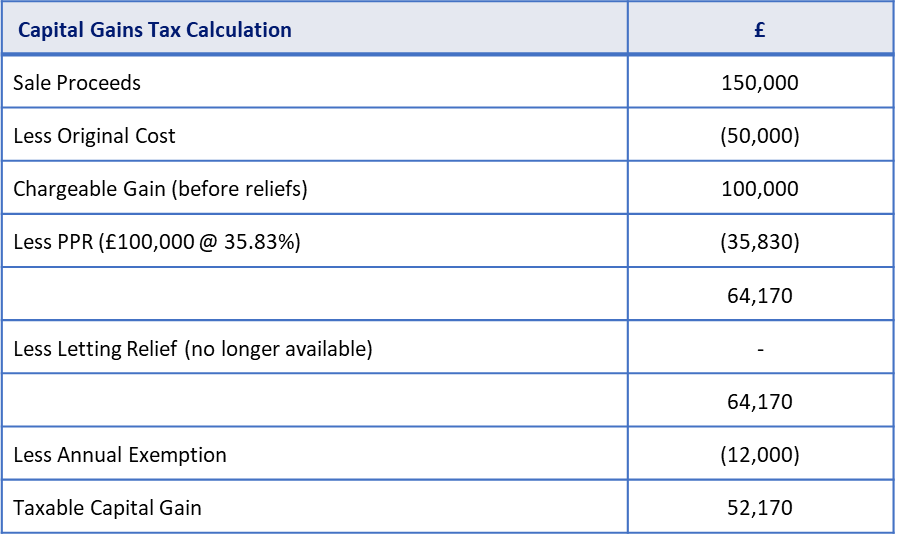

Mr Smith purchased his first home in September 1990 for £50,000. He lived in the property for 10 years before purchasing another house which he moved into in September 2000. He decided to let his initial property on the open market. In September 2019, he sold this initial property for £150,000. Mr Smith is a Basic Rate taxpayer; his gross income is £28,000. Therefore, his remaining basic rate band is £9,500.

If the property sold in September 2019

The Taxable Capital gain remains within Mr Smith’s basic rate band and is therefore taxable at 18%. A CGT liability totalling £1,501.20 will become due for payment by 31 January 2021.

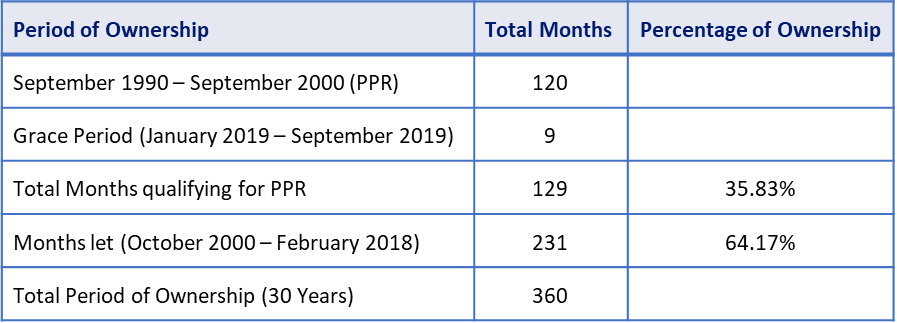

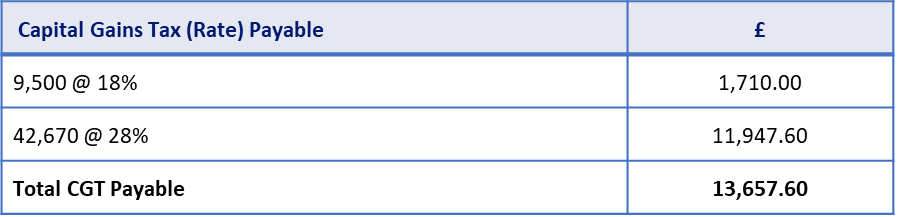

If Mr Smith delayed disposing of the property for one year

In accordance with the other proposed changes this amount would be reportable 30 days after disposal, when a payment on account of the above would also become due. The final amount would require to be confirmed and paid by no later than 31 January 2022.

As you can see from the above example, a one year time delay on the disposal of the property could cost Mr Smith an additional £12,156.40 in CGT.

There are a number of ways that the above CGT could be reduced, it is however important that you discuss any potential property sales in advance to ensure that CGT liabilities are reduced as far as possible.

If you have any questions or concerns about these changes, we would encourage you to contact us for clarification or further guidance and we can then review your individual requirements.

Please note that the calculations provided above are for illustrative purposes only, and cannot be relied upon to work out any tax that might become payable in your own circumstances.